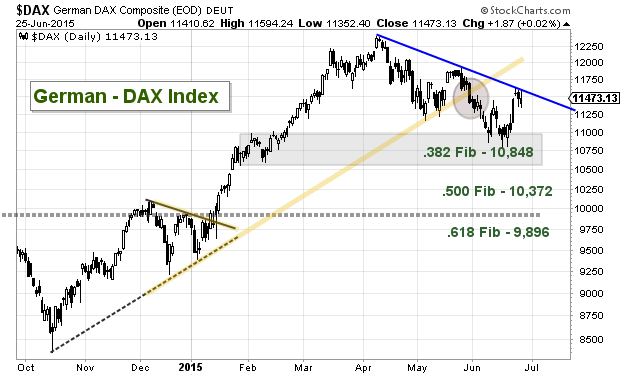

The German DAX correction started in early April and accelerated into June. Blame it on valuations, the rebound in the Euro, or Greece, but technicals play a role too. Like clockwork, German stocks found support at its .382 Fibonacci support level. And since then, the German DAX has been rallying.

But the rebound rally is about to get tested.

In the chart below, you can see three technical events that have/are playing out. First, the Index broke its uptrend line. That confirmed the move lower. Second, the German DAX correction found support at the .382 Fibonacci retracement level. And third, it is now testing its downtrend line resistance. A sustained break above this level would neutralize the bears and could set up for a retest of the April highs. But on the flip side, a failure to break and hold above this trend line would indicate that German stocks are still weak and that the correction lows may be in line for a retest.

German DAX Index – Daily Chart

I’ll be watching this into next week. Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.