It seems the European Central Bank (ECB) has taken a page from the Fed’s stimulus book. The highly anticipated announcement of European QE came at a great time for European equities, triggering a breakout and new leg higher in the German DAX rally. But the rally has been very steep, heightening the risk of a pullback.

Consider this: the German DAX rally has gained over 20 percent in 2015 and over 40 percent off the October 2014 lows. Check out the chart below – it looks like the DAX is taking an elevator up a high rise. But when markets rally this far, this fast, it’s a good idea to make sure you tighten up your risk management. As well, the DAX is running into a key Fibonacci extension level (resistance), while putting in a bearish weekly wick (thus far). And I believe this situation should be monitored in the days ahead.

German DAX Rally – Risk On… About to be Risk Off?

Also read: German DAX Powers Over 12000: Is European QE Working For All?

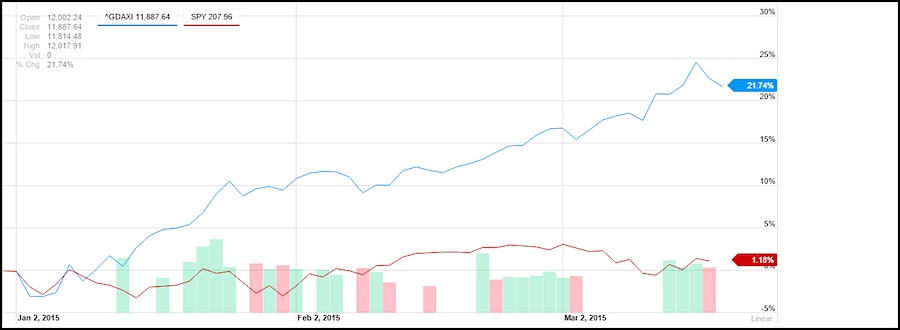

Below is another chart showing the performance disparity between the German DAX vs S&P 500 (through 3/17). This spread is running so wide that logic would say that we are nearing a period of mean reversion and relative underperformance for the DAX. One caveat, though: markets aren’t always logical!

German DAX vs S&P 500 – The Tortoise & The Hare?

European equities have lead global markets higher in 2015, so I believe it’s important for investors to monitor how the German DAX handles the 12000ish resistance level. Thanks for reading.

Follow Chris on Twitter: @KimbleCharting

Author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.