Germany’s DAX Index (INDEXDB:DAX) is hitting a convergence of two major trendlines; its reaction here may set the tone for German stocks for some time.

In moving to new highs recently, the major U.S. stock market indices have benefited from a solid core of leadership sectors. In recent weeks even, new leaders have emerged to prop up the U.S. stock market, at least for the time being. The same strong leadership cannot be said for international market, however, where struggles have been more commonplace – even near-unanimous. One region that has particularly struggled (again) is Europe, whose largest markets have failed to lead any substantial or sustainable rally since their initial post-February bounce.

The continent’s economic stalwart, Germany, for example, has been held in check since its German DAX index put in a year-to-date high in late April. The index has been unable to surpass that level in the 15 weeks since. However, the German DAX, by our analysis, is presently hitting a significant chart juncture that may give it one more chance to lead the continent higher…or drag it down once again.

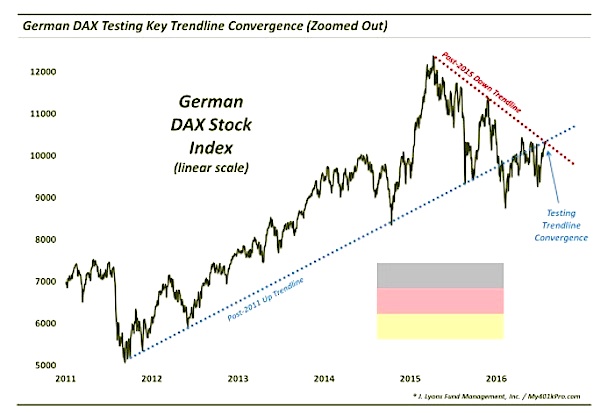

The juncture is the convergence of 2 important trendlines (on a linear scale). The first is an Up trendline stemming from the 2011 lows in the DAX and connecting the 2012, October 2014 and August-October lows. The DAX broke below the trendline early in the year and, other than the temporary spike back above it in April, it has struggled to reclaim it since. From a technical perspective, this trendline is seemingly the barrier that has kept the German DAX in check. The index is once again bumping the underside of the trendline presently, in what looks to be a key test for the DAX.

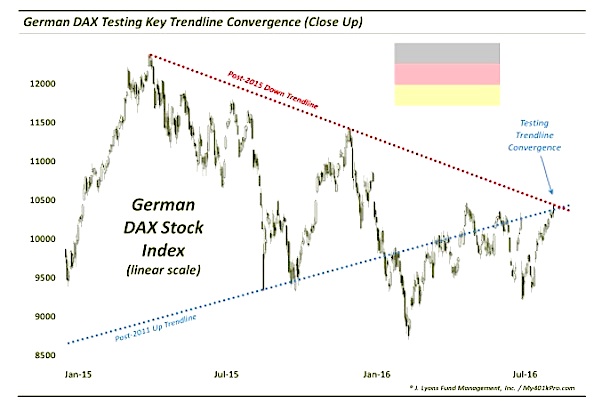

Making the test even more significant is the proximity of the post-2015 Down trendline connecting the April and November-December highs in the DAX. This trendline is nearly converging with the post-2011 Up trendline at the moment in what could be the most significant charting juncture for the German DAX index since the post-February rally began.

Here is a chart back to 2011, illustrating this key trendline convergence and its current proximity to the DAX.

Here’s a closer look, since the beginning of 2015.

As shown in the chart, the German DAX index actually hit the post-2015 Down trendline yesterday, bouncing off of it to close some 3% lower by today’s close. That would seem to validate the trendline’s relevance. That said, a 36-hour response hardly closes the book on this test. The DAX could very well have further opportunities to challenge the aforementioned convergence in the upcoming days and weeks.

We’ve mentioned before that folks who are knee deep in the markets every day have a tendency to place too much importance on too many trading junctures. There are really very few important inflection points in markets on an intermediate to long-term basis. Considering the significance of the 2 trendlines in play here, and their convergence, this feels like it may be a key inflection point for the German DAX. Its reaction to this area could set the direction for German stocks – as well as European stocks – for some time.

Thanks for reading.

Twitter: @JLyonsFundMgmt

Read more from Dana’s Tumblr Blog

Author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.