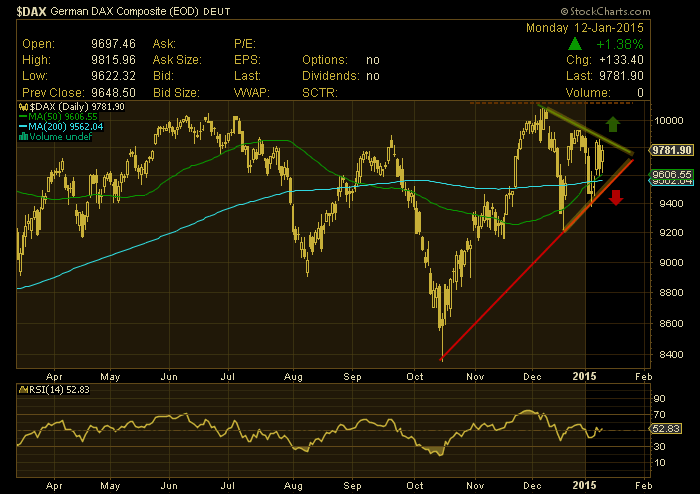

The German DAX Index closed today up 1.38% at 9781.90 on the heals of hopes for a new and improved economic stimulus out of the ECB (i.e bond buying). But perhaps the larger story for traders is the current symmetrical triangle that is forming on the German DAX. This is when the price action narrows producing an equidistant and equi-angled triangle pattern based on the daily highs and lows.

Often times, this pattern can form as indecision and/or anticipation builds. This makes sense and ties back to economic concerns that have contained Europe’s largest stock market index over the past 6 months (and seen the Euro fall precipitously). And adding to the tension, investors are expecting to hear back (an opinion) on a landmark legal opinion from the European Court of Justice. This will dictate if (and how) the ECB can perform its anticipated bond buying program.

Okay, so back to the symmetrical triangle pattern… Note that the pattern formed off a retest of the highs, adding to the importance of its resolution (near-term). How this triangle resolves may dictate the near term direction of European stocks. A close below the red support line would likely indicate a trip to back to the December lows, while a close above the downtrend line would signal that a retest of the highs is coming.

German DAX Index – Daily Chart

Note that investors can track and follow the German stock market through the iShares Germany ETF (EWG). Thanks for reading.

Follow Andy on Twitter: @andrewnyquist