With a glance at today’s geopolitical newsflow – whether Ukraine’s troubles with Gazprom or ISIL’s occupation of oil refineries in northern Iraq as it solidifies it’s hold there – you’d be forgive for concluding energy prices must be shooting through the roof across global markets. And along with it’s counterparts in the Energy complex WTI Crude Oil (CL) did experience a significant spike last week as the Shi’ite extremist faction’s encroachment rapidly progressed toward Baghdad. But all things considered market tone and price action remain subdued.

With a glance at today’s geopolitical newsflow – whether Ukraine’s troubles with Gazprom or ISIL’s occupation of oil refineries in northern Iraq as it solidifies it’s hold there – you’d be forgive for concluding energy prices must be shooting through the roof across global markets. And along with it’s counterparts in the Energy complex WTI Crude Oil (CL) did experience a significant spike last week as the Shi’ite extremist faction’s encroachment rapidly progressed toward Baghdad. But all things considered market tone and price action remain subdued.

A technical look at Crude, however, suggests the quiescent environment may soon give way to a major directional move.

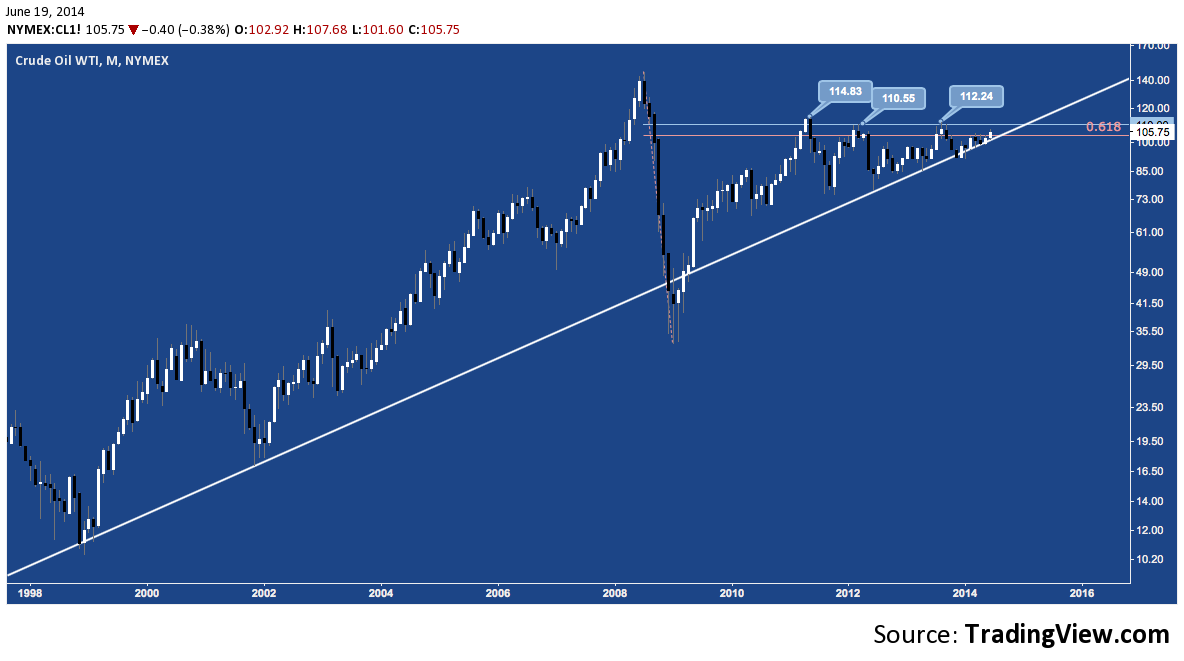

After establishing a major higher high in late 2001 – in the relative calm following 09/11, following the Afghanistan invasion but before Iraq – Crude satisfied the criteria for what has become a secular uptrend. And with the narrow exception of pricing in “Financial Armageddon”, Crude has now held this line for over 12 years. Following 2009’s bottom, a major snapback rally ensued recovering over 70% of 2008’s losses before entering the consolidation around the 61.8% retracement of that year’s range we find Crude in today:

Crude Oil – Monthly: Secular Uptrend Intact Since 2001 (click image to zoom)

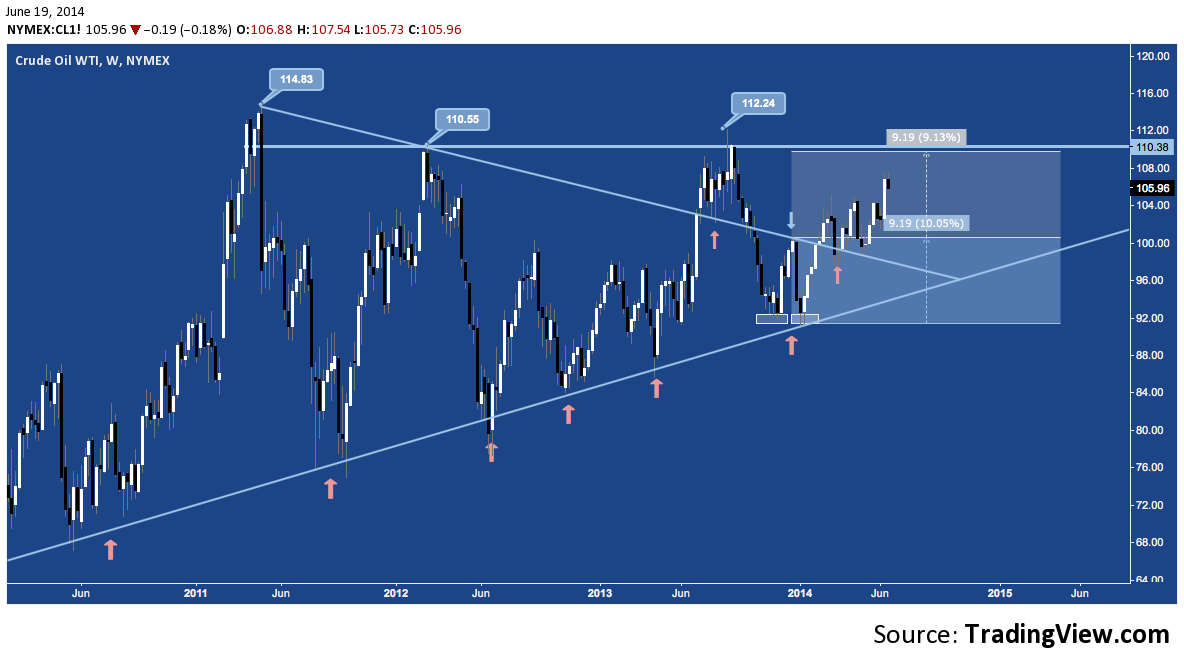

Late 2013/Early 2014 brought the latest in a long series of tests at this rising trend line near $90. A clean double bottom developed off this test suggesting a measured move to $110. The pattern broke out in mid-February, but entered a 3 month congestion that is finally resolving higher with the renewed unrest in Iraq in early June. This objective near $110 coincides with a powerful resistance level that has proven the upper boundary of Crude’s prolonged consolidation since early 2012. This latest oscillation from $110 to rising trendline and back comes near the apex of a 3-year Ascending Triangle pattern that ultimately suggests a measured move to ~$140, a stone’s (over)throw from July 2008’s all-time high at $147.27.

Crude Oil – Weekly: Double Bottom Measured Move to $110 Underway (click image to zoom)

Another encounter with $110 seems likely: at least, the path of least resistance points there with no major technical impediments to prevent it from occurring. The real technical dilemma occurs at that level. Like today, late 2013 appeared to have the requisite momentum to definitively break $110; but was viciously sold off, losing nearly 20% over a 12 week period in Q4.

Another encounter with $110 seems likely: at least, the path of least resistance points there with no major technical impediments to prevent it from occurring. The real technical dilemma occurs at that level. Like today, late 2013 appeared to have the requisite momentum to definitively break $110; but was viciously sold off, losing nearly 20% over a 12 week period in Q4.

Is the current environment much different? In Late 2012/Early 2013, a consolidation with higher lows developed, ultimately breaking out near $98 and just tagging it’s measured move target near $111 before late 2013’s drop. Last week’s pop created a breakout from a similar consolidation (March-June’s Ascending Triangle) between $97-$105 that suggests a move to $112-$113 is in the cards, bringing Crude back into contention with early 2011’s $114.83 peak for new recovery era-highs.

A number of studies are supportive of this move and further strength in WTI Crude Oil. For example, after a bearish-to-neutral configuration from Q4 2013-Q2 2014, Ichimoku Kinko Hyo is now suggesting a firmly bullish environment as it’s longer-term average (Kijun-Sen, in red below) peaks back above the cloud (a dynamic representation of price equilibrium). It’s important to note this week has forfeited 1/3 of last week’s advance with distribution back into the 105s, but until 104 is broken this is considered a constructive pullback before prices move higher.

Crude Oil – Weekly: Ichimoku Turns Bullish Again (click image to zoom)

Reverting to a Monthly chart for a harmonic look, 2011-2014’s structure continues to support the construction of a Bearish Butterfly pattern with a Potential Reversal Zone (PRX) that coincides tightly with the ascending triangle that has emerged over that period. The CD leg of this Butterfly is unusual and perhaps suspect because of it’s stubborn sideways trajectory, but given a) the durability of the secular rising trend line beneath and b) proximity to the optimum breakout window for this Ascending Triangle, an upside resolution toward $140 is favored.

Crude Oil – Monthly: Harmonic/Classic Patterns Point to ~$140 (click image to zoom)

What emerges is 1) a short-term bullish thesis looking for $110, 2) a medium-term bullish thesis looking for $140, and 3) a longer-term bearish thesis that sees the possibility of prices turning over near $140 if/when the Butterfly PRZ/Ascending Triangle measured move target are achieved there. Whatever the geopolitical context, keeping an open mind that isn’t beholden to inherently immediate-term newsflow is essential. A consultation of multiple time frames and tools like this one aids in development of a balanced set of theses on a stock or asset class: a critical tool to remaining objective and flexible in your trades. Just be prepared for something that be new and even uncomfortable: simultaneously holding bearish and bullish points of view.