Stock Market Futures Considerations For November 22, 2017

The S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) are digesting gains from the latest rally higher on Wednesday morning. A successful consolidation may allow the bulls to march a bit higher into end of week. Check out my futures trading commentary and key price levels below.

Note that you can access today’s economic calendar with a full rundown of releases.

S&P 500 Futures

New highs and a hold of higher lows push us into breakout territory (under some negative divergence). Straddle buyers from Monday are pleased as its price has expanded outside of the range of motion predicted. With volume light and participants thinking of other things here in the US, anything goes. For me, it’s a bullish move with a sharp eye kept on support. Failed support would be a signal that this bounce is going to begin a retest. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2600.5

- Selling pressure intraday will likely strengthen with a failed retest of 2594.5

- Resistance sits near 2599.75 to 2604.25, with 2611.5 and 2614.5 above that.

- Support holds between 2594.5 and 2589.75, with 2584.25 and 2578.5 below that.

NASDAQ Futures

The NQ_F continued to rise into new highs as traders hold this chart steady. Buyers have more control below 6354, and range expansion shows higher moves ahead as likely today. Performers continue to be bought so watch support levels to find buyers. Failed support will be very important to watch – and failure will find lower support and define a new range. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6389.75

- Selling pressure intraday will likely strengthen with a failed retest of 6375

- Resistance sits near 6385.75 to 6389.5 with 6402.5 and 6431.75 above that.

- Support holds between 6375.5 and 6354.75, with 6345.75 and 6324.75 below that.

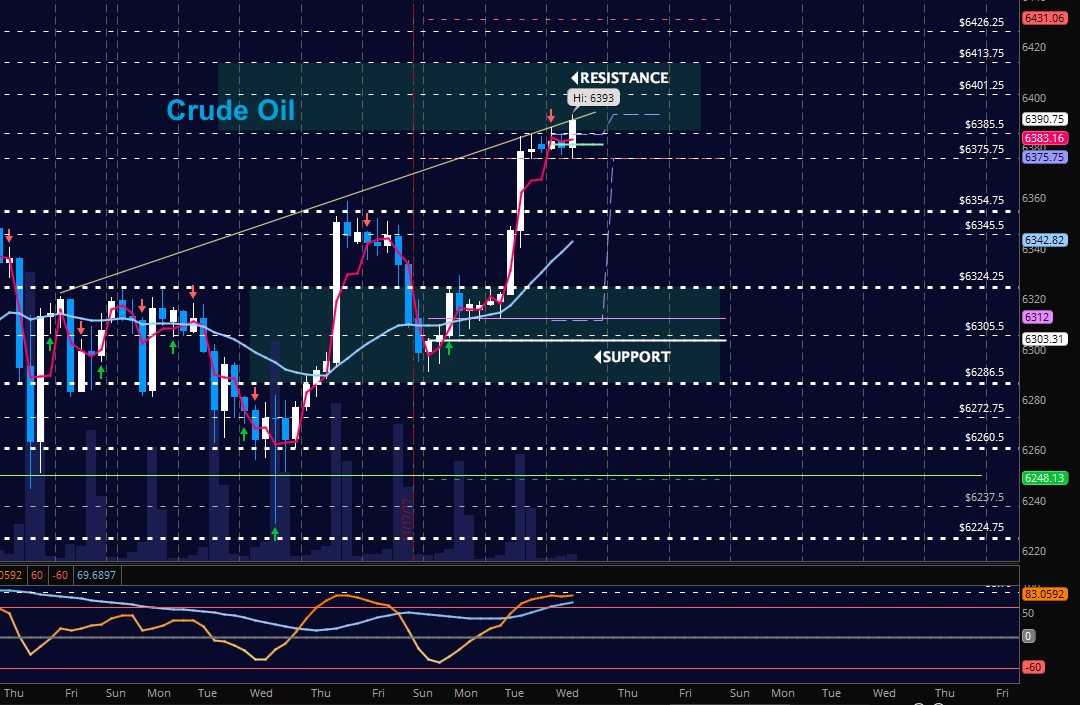

WTI Crude Oil

Oil holds higher highs this morning along with higher lows and testing key resistance. Key resistance remains near 57.98 as momentum shifts higher. Support holds near 57.03. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 58.07

- Selling pressure intraday will strengthen with a failed retest of 57.03

- Resistance sits near 57.94 to 58.04, with 58.23 and 58.73 above that.

- Support holds between 57.6 to 57.34, with 57.04 and 56.67 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.