Stock Market Futures Trading Considerations For November 8, 2017

The S&P 500 (INDEXSP:.INX) is trading mixed in Wednesday morning trade. The markets are digesting gains of the past several days and look a bit toppy short-term. However, as long the price action makes higher lows, the trend is up. Important trading levels and futures market commentary can be found below.

Check out today’s economic calendar with a full rundown of releases.

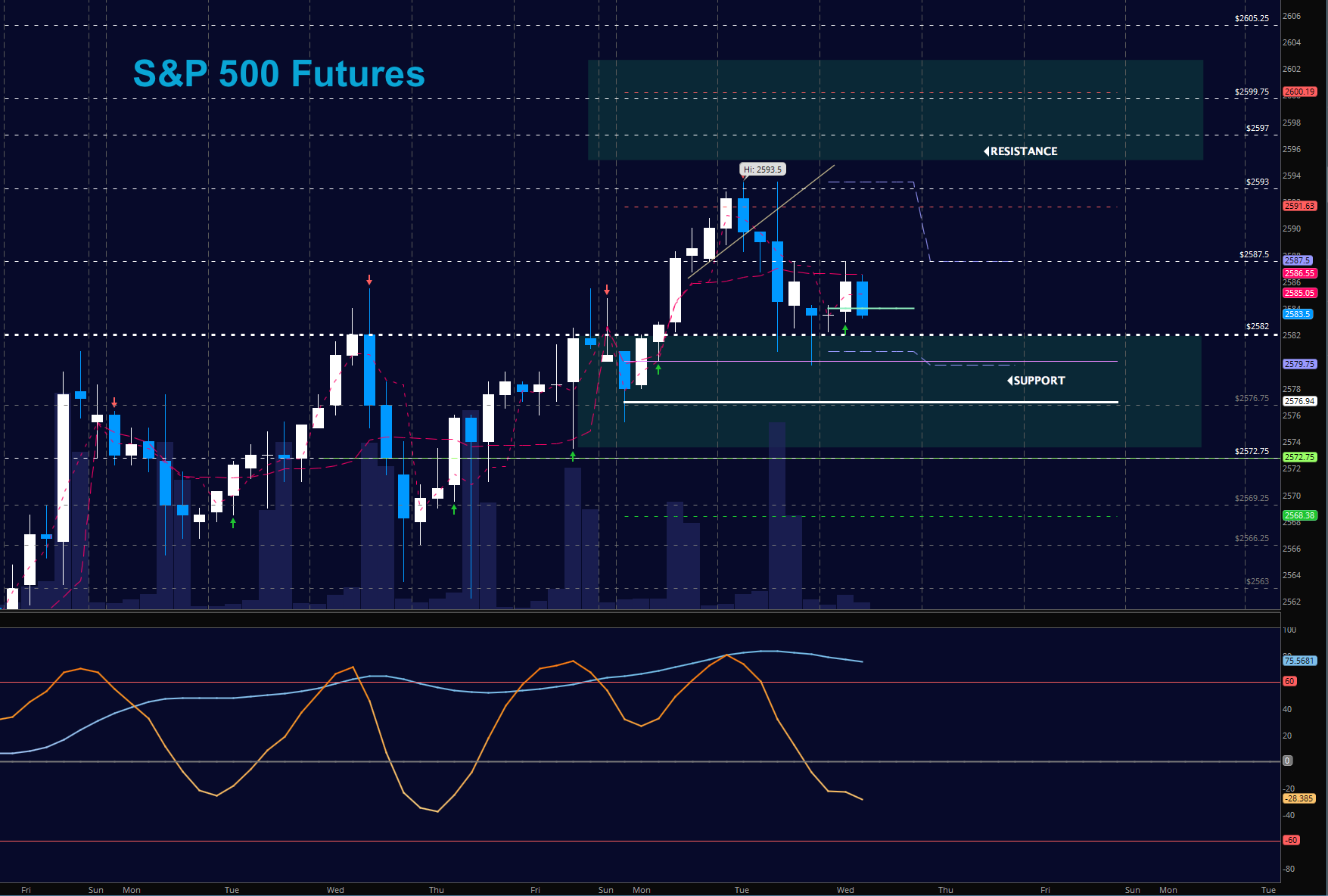

S&P 500 Futures

HIGHER LOWS hold as we step into midweek. Markets still remain bullish with the greatest opportunities lying at the tests of support for long entries, but we will be watching the levels near 2591.75 – above there, we are set to retest old highs and continue the grind upward. The failure to recapture this level is likely to telegraph a test of deeper support. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2591.75

- Selling pressure intraday will likely strengthen with a failed retest of 2579.5

- Resistance sits near 2587.75 to 2593.5, with 2597.75 and 2600.5 above that.

- Support holds between 2581.5 and 2576.75, with 2574 and 2568.5 below that.

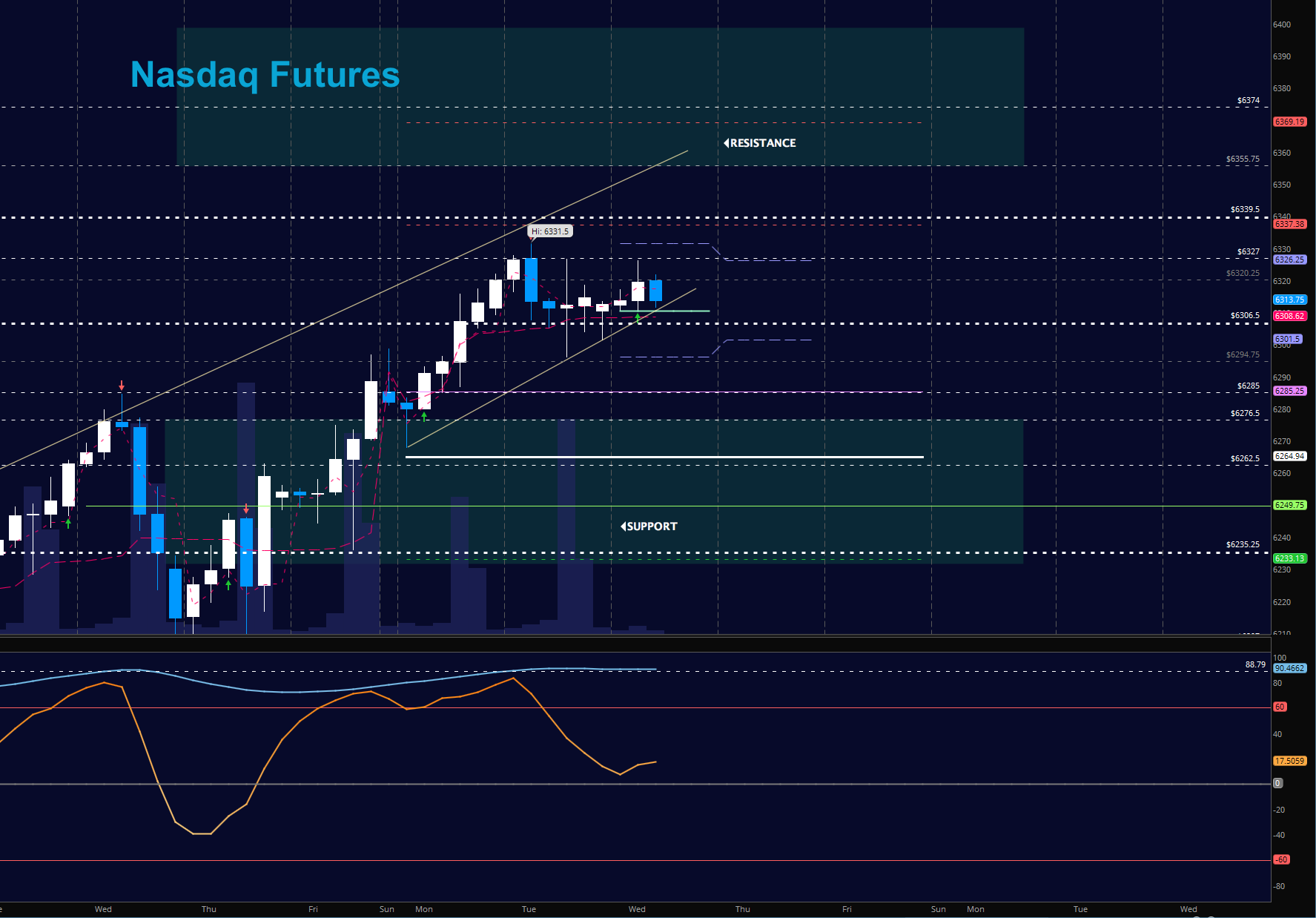

NASDAQ Futures

The NQ held HIGHER LOWS for another day and is now testing an important region of resistance intraday near 6324. As long as we hold 6305.75, buyers will continue to hold strong and bullish patterns continue. HIGHS are not likely to hold without a fade first so don’t chase longs outside resistance- catch them off support. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6327

- Selling pressure intraday will likely strengthen with a failed retest of 6301.5

- Resistance sits near 6322.75 to 6327 with 6337.5 and 6355.75 above that.

- Support holds between 6310.5 and 6296.5, with 6285.75 and 6264.5 below that.

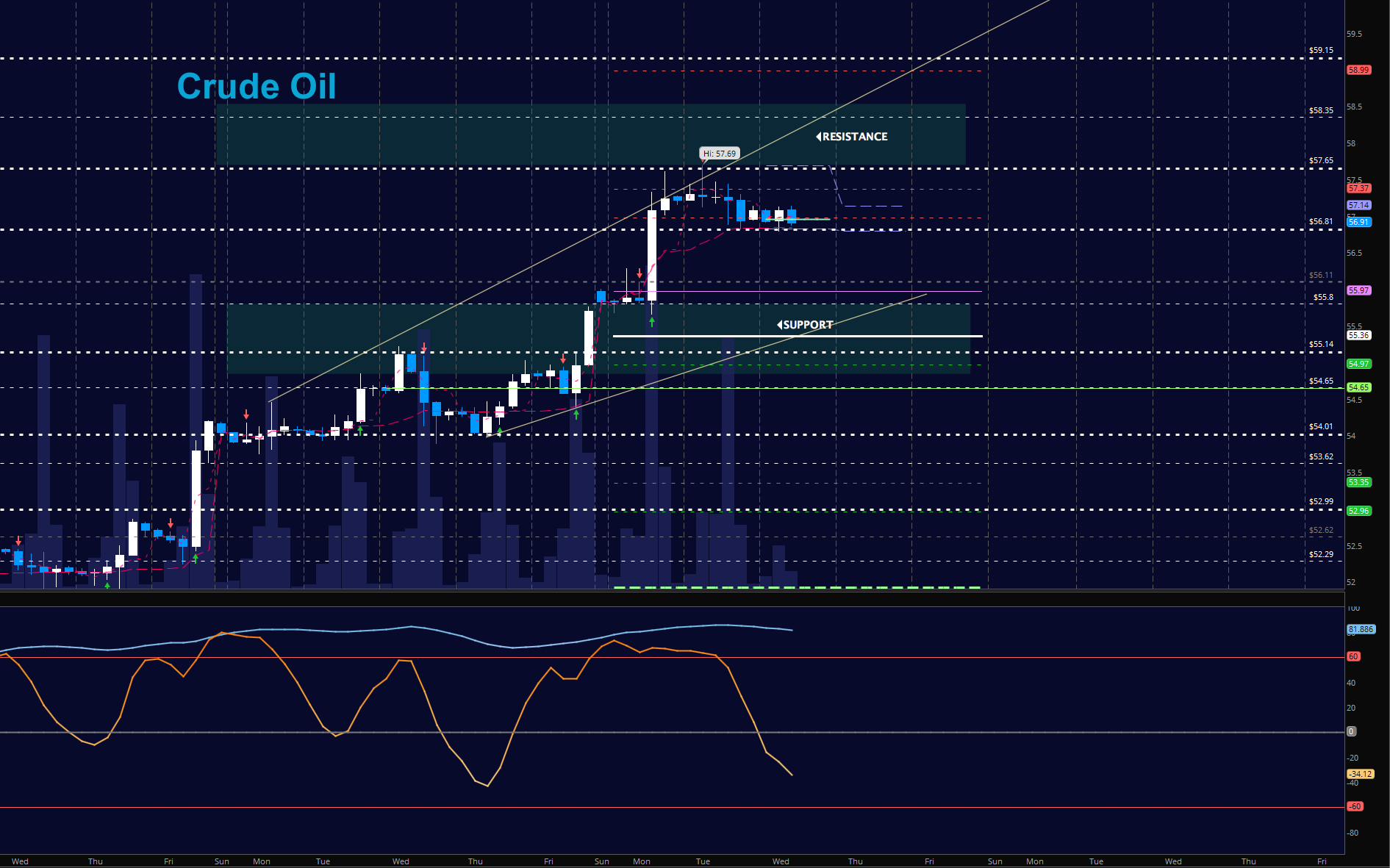

WTI Crude Oil

API report showed smaller than expected draw – but a draw nevertheless of inventories and EIA report is ahead this morning. Oil holds weaker bullish formations and holds a rangebound region around .60 wide. Momentum is bullish allowing pullbacks into support to be key buy zones still – near 56.8. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 57.39

- Selling pressure intraday will strengthen with a failed retest of 56.8

- Resistance sits near 57.37 to 57.7, with 58.35 and 58.95 above that.

- Support holds between 56.8 to 56.3, with 55.9 and 55.36 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.