The 2013 consolidation is over: or so it seems.

The 2013 consolidation is over: or so it seems.

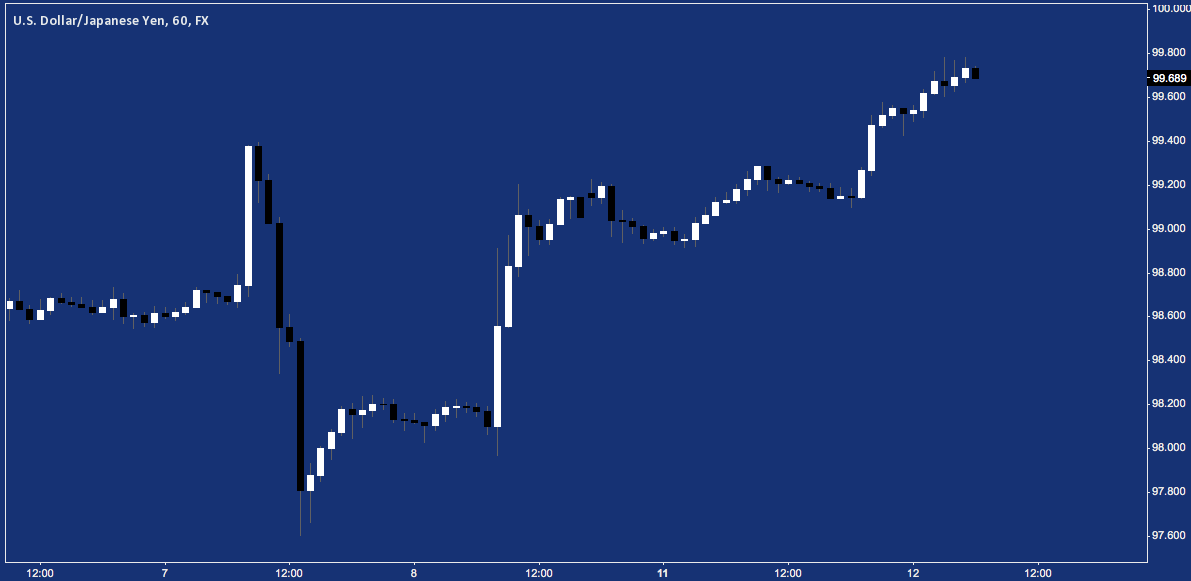

US Dollar/Japanese Yen (USD/JPY) broke higher immediately after Tokyo’s session opened last night, with the Yen selling off hard to continue Friday’s reflexive rally and quickly dispatching the 99.41 high put in last Thursday.

USD/JPY Breakout – 1-Hour: Establishes a Higher High over Last Thursday’s 99.40 Cap (click image to zoom)

This represents another higher high in the (still corrective) rising trend off the 10/24 bottom near .97.

It also marks the moment of the long-awaited USD/JPY breakout from the currency pair’s symmetrical triangle, begun in April.

USD/JPY Breakout – Weekly: Symmetrical Triangle Resolves Upward (click image to zoom)

The triangle break may denote significant weakness ahead for the Yen, and corresponding strength for the Greenback. Horizontal resistance given off by the triangle’s lower highs is noted:

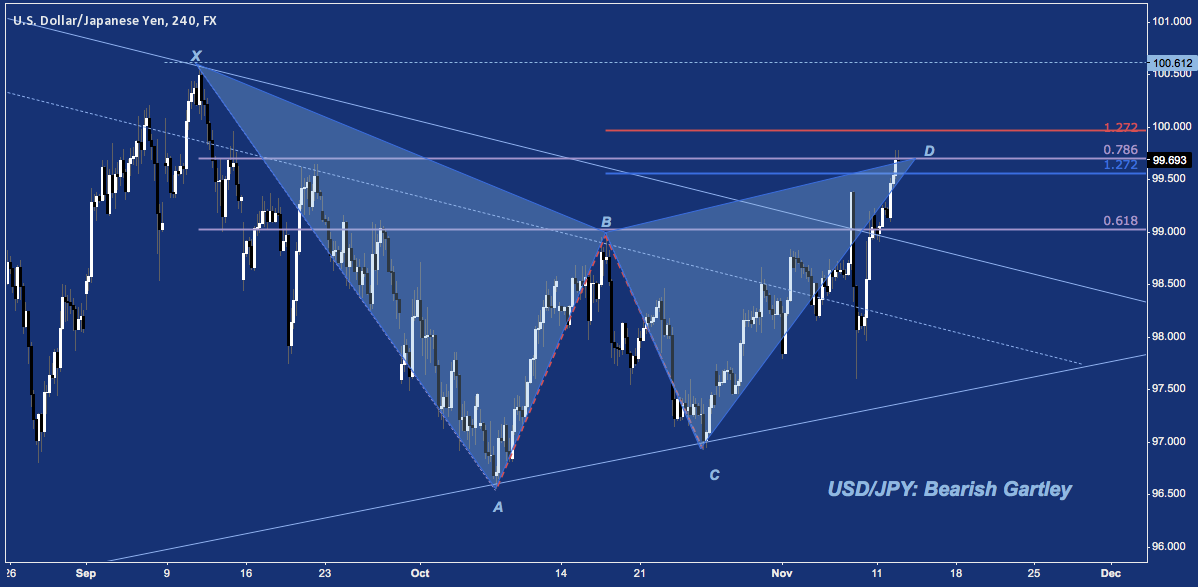

Not so fast, though. While the breakout receives the benefit of the doubt, USD/JPY formed a Bearish Gartley harmonic pattern over the last 10 weeks that is now posing resistance around the 78.6% retracement of line XA between 99.55-100.

USD/JPY Breakout – 4-Hour: Bearish Gartley with Potential Reversal Zone (PRZ) at 99.55-100 (click image to zoom)

If the Yen gets a foothold and pushes to resolve this pattern downward, USD/JPY may end up back inside the symmetrical triangle, signaling a failed breakout with bearish implications. This is the pattern to keep an eye on to see if last night’s break sticks, setting the stage for a major potential move higher in USD/JPY.

Twitter: @andrewunknown and @seeitmarket

Author holds no positions in the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.