How Donald Trump’s protectionist trade policies (whether tariffs/border adjustment taxes) impact the US economy is really not well understood. And therefore they are hard to realistically value, especially since there is so much at stake and so many disparate stakeholders.

We can thus far assume this: Although the proposal for a ‘BAT/VAT’ system could be a big source of tax revenue, further helping to offset the cost of implementing large corporate tax cuts, the impact on certain industries (read: retail) would be crushing. We already have a ‘manufacturing jobs’ problem. This would only add to the exploding ‘services jobs’ problem, both exacerbated by the fact that these jobs have been displaced by technology, more than “off-shoring.”

So this is not going to be a slam-dunk, like the market seems to think/hope it will be. Social unrest at home not to mention our growing $20T government debt on top of growing personal debt on top of military posturing by Trump as he attempts to negotiate better trade deals, on top of Trump’s immigration policies indiscriminately ramping up terrorism. This is more like trying to make the basket blind-folded and shooting backwards. The Odds!

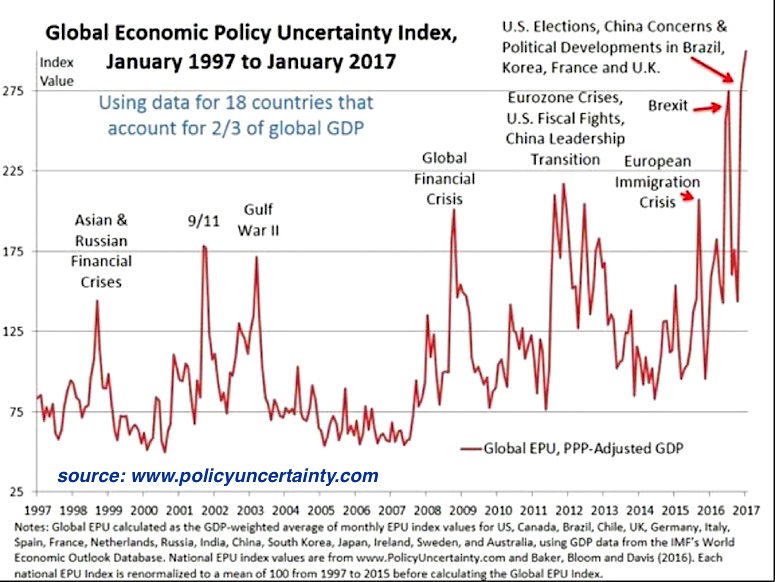

With the market Priced to Perfection, there is no room for FUD (Fear Uncertainty Doubt) let alone policy missteps. And yet, big shocks from policy uncertainty can occur and the amount of policy uncertainty can foreshadow big shocks.

Enter China

I can’t think of a better trigger for volatility than China.

Remember when they suddenly devalued the Yuan in August 2015 causing S&P 500 (NYSEARCA:SPY) to pullback 8% in rather short order? This was when we had good relations with them! More to the consequences: further devaluation of the Yuan as a ‘trade war’ reaction from China will only drive more Asian currency devaluations which then ramps up the US Dollar too much, too soon (2014 redux). The dollar rose 25% in 2014 and thank goodness we have been rangebound past two years for corporations and our economy to absorb the shock, but we can easily match that advance in similar short order if China’s feathers come off. And they are already running around like chickens.

Instead of antagonizing China and other trading partners, wouldn’t Washington be wiser if they acknowledged the problem that the US runs an enormous trade deficit because our whole economy depends on imports as we do not presently have the capacity to replace those imports with domestic goods. And what about the US Dollar, particularly when 93 per cent of US imports and more than 40 per cent of global trade is invoiced in US dollars (Megan Greene, chief economist at Manulife Asset Management, Financial Times column). In the ‘short term’, importers would pass the cost of the border tax on to US consumers, which undermines their ability to drive growth. But eventually, the dollar will appreciate significantly. And with nearly $10T of outstanding offshore debt denominated in dollars, that would make it that much harder to service. And wouldn’t you know, about 80% of China’s non-financial corporate debt is dollar-denominated.

Summarizing John Mauldin as he hits my major red hot buttons on the this topic of Foreign Trade, China and the US Dollar:

Emerging-market countries own massive amounts of dollar-denominated debt. A stronger dollar means they must somehow come up with more of their local currencies to repay their dollar debts. And they will have to do it fast, even as their exports are shrinking because US consumers are being encouraged to “buy American.” It gets worse. To whom is all that emerging-market debt owed? Primarily to Western banks and bondholders, who are often themselves excessively indebted.

Ambrose Evans-Pritchard of the London Telegraph … A dollar spike of anywhere near 20pc would send the Chinese Yuan smashing through multiple lines of psychological resistance. The People’s Bank (PBOC) is already intervening heavily to defend the line of seven Yuan to the dollar. Ferocious curbs would be needed to stop the Chinese middle classes funneling money out of the country if it crashed by a fifth.

Junheng Li from Warren Capital says the China’s exchange regime is more brittle than it looks. Official data overstates the PBOC’s fighting fund by $1 trillion, either because reserves are “encumbered” by forward dollar sales or because they must be held in reserve as a “fiscal backstop” for Chinese firms at risk of default on dollar debts. She expects the system to snap at any time, and without warning.

John sums it up nicely, “If our currency rises, the advantage that our exporters get from having to pay no income tax on their exports disappears at the border.”

Privilege Is Invisible To Those Who Have It

With the US dollar as the world’s reserve currency, we have very few foreign trade constraints. We already get to force other countries to accept payment in dollars. If we lose that…because Trump wants to do away with a trade deficit that kinda-sorta helps creates world-wide economic stability, then he will single-handedly destabilize our nation’s economy and currency. That’s not good for the markets. In fact, global recessions are made of this stuff. Credit implodes. Rest of World loses confidence in the US dollar as a store of value. And this quickly results in exactly what we all fear the most: exploding US interest rates and an economic crash. There is simply no other force that is more destructive to our nation and growth prospects than lack of confidence in our markets, our rule of law but most of all our currency.

So, best case we climb to SPX $2700-3100 EPS targets this year based on Potential growth and retrace our way back to Reality the following year. I do not see how the market can “Price for Perfection” a world where Trump can get support and put into practice protectionist fiscal policies without a global trade and currency war abroad at the same time his xenophobic immigration polices stir growing social unrest at home. He might have the audacity of hope to fight one of those wars, but both?

Friendly Sidebar: It’s easy to subscribe to my Free Fishing Stories/Blog for more insights like these. You are also invited to Come Fish With Me on any trading day!

Thanks for reading and Happy Trading.

Twitter: @SamanthaLaDuc

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.