I have been alarmed by the speed and daring of the recent Russian takeover of the eastern portion of Ukraine. Our country’s reaction to this aggressive move by the Russians will not involve bombers and missiles, however, and that has implications for anyone with money to invest. Let me explain:

I have been alarmed by the speed and daring of the recent Russian takeover of the eastern portion of Ukraine. Our country’s reaction to this aggressive move by the Russians will not involve bombers and missiles, however, and that has implications for anyone with money to invest. Let me explain:

The U.S. government has set into motion an attack of “financial warfare” on Russia, involving a new type of manipulation of markets and businesses. This cyber-warfare has become a sophisticated tool in our foreign policy mix, according to a recent Newsweek cover story.

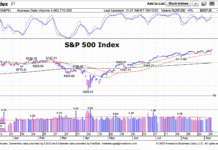

This ability to crash markets and sink stock values with a few clicks of a button is further evidence that the markets around the world are susceptible to far more volatility than ever before, a point that I have repeatedly made in my writings and counsel to clients.

However, the U.S. could be especially vulnerable to a counterattack from Russia if our current sanctions against that country have a powerful effect. Russia and other countries have the same manipulative capabilities, as the article alluded to; and they could choose to try and attack the U.S. without firing a single shot.

I often encounter clients that are concerned about the gold standard and our national debt. These are legitimate concerns, but they are already factored into the stock market. What I need to do as a good professional money manager is to identify the risks not factored into the markets. The threat of cyber and/or financial warfare is this kind of risk.

It may very well be likely that financial warfare played a significant role in the financial crisis and resulting stock market crash in 2008. I believe it will likely play a role in the next big crash as well. You can see that in such a potentially hostile political and financial climate, old investment strategies such as “Set and Forget” will become more obsolete than ever before.

For that reason, I advise all of my clients to entrust their money to managers who know how to jump immediately out of a given stock market and thus avoid potentially huge losses, which could result almost instantaneously if a nation such as Russia sought to respond in-kind to the U.S. blacklisting many Russian businesses.

Given that the Chinese government and Russia publicly stated more than a decade ago that they wanted to pursue financial warfare, any retiree’s investment money must be as nimble as a deer these days, not entrusted and forgotten about. More than ever, you should always know exactly what is happening with your money.

The statement in the Newsweek article that the U.S. Treasury is “at the center of our national security” simply confirms that market movements as a result of financial warfare are a matter of when, not if. Plan accordingly.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.