The major U.S. stock market indexes traded lower last week against a backdrop of rising interest rates. The S&P 500 Index (INDEXSP:.INX) lost 0.7% last week while small- cap indices fell more than 1.0%.

The economic data in early October, including the latest numbers from the Institute of Supply Management (ISM), showed renewed strength in manufacturing and non-manufacturing activity last month. Friday’s September Employment Report was weaker than expected but vibrant enough to keep open the potential for a 25 basis point rate hike this year. The fed funds futures market discounts the probability of a November federal reserve interest rate hike but puts the odds of a December interest rate hike at 66%. Stocks are likely to remain range bound with the risk to 2120 and reward to 2190 using the S&P 500 Index.

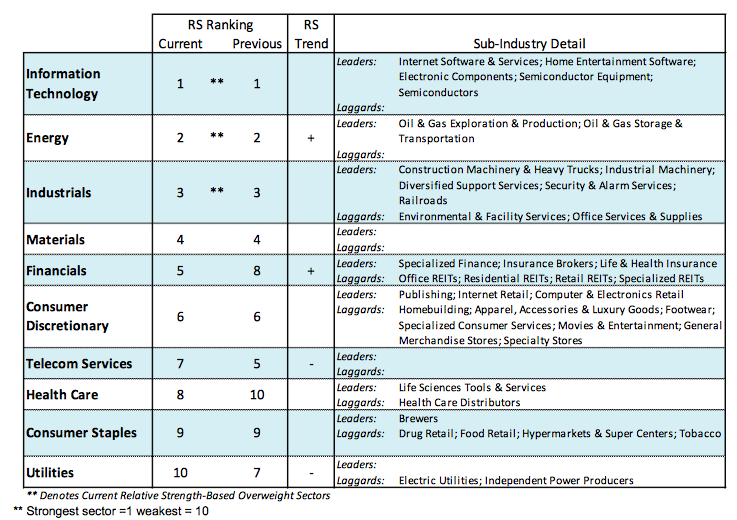

The prospect of a December interest rate hike (and higher interest rates, in general) is reflected by the shift in leadership in the equity markets. Defensive sectors like gold, real estate and utilities have given way to the technology, energy, materials, and industrial sectors that are more closely tied to the performance of the economy. The financial sector moved into the top five in relative strength. A strong financial sector has leading and bullish implications for the stock market longer term.

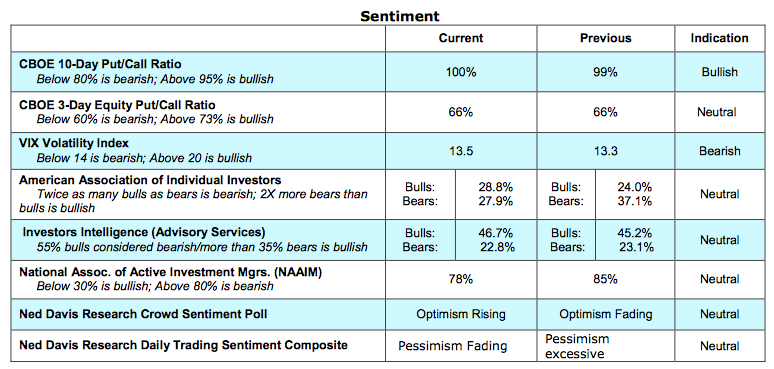

The technical indicators are a mirror image of the mixed trading by the popular averages the past three weeks and offer little evidence of the next important move for stocks. Measures of investor sentiment indicate a deep seated complacency. The CBOE Volatility Index (VIX) is trading at the low end of its recent range of 12 to 18. This is an indication that despite a host of negative news events and the uncertainty over the November election, investors see little to fear in the fourth quarter. Low levels of cash by mutual fund managers and near record margin debt are also indicators of investor complacency. The best rallies the past three years have occurred with investor pessimism widespread and deeply seated. When rates are rising, as has been the case the past two weeks, a larger contingency of bears is required to trigger contrary opinion buy signals and fewer bulls to suggest a near-term peak. It should be noted that we are just a month away from entering the strongest seasonal period for stocks from November to April.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.