May was an eventful month, as moderate oil prices and continued US Dollar strength took their toll around the world. Crude oil exporters such as Venezuela, Saudi Arabia, Nigeria, the United Arab Emirates, have devalued their currencies or are concerned that they must. Other nations below the radar are also facing currency pressure from continued Dollar strength – Armenia, Azerbaijan, and Vietnam to name a few. And then we have Brexit on the horizon… the US Dollar has since declined but the currency markets are jittery.

News headlines of course are concerned with bigger themes – concerns about Brexit and data from China. But the Fed and Brexit are likely weighing on market minds.

Stocks & Bonds

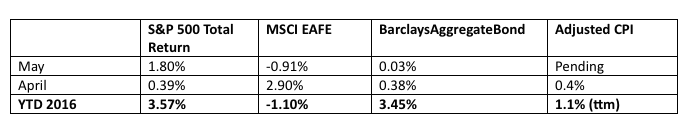

The S&P 500 Index continued to climb higher in May, approaching its all-time high set in the spring of 2015. European equities underperformed with Brexit concerns, and bonds continued to benefit from safe-haven demand. You will note I have changed CPI measurement from unadjusted to adjusted numbers for better relevance. By the numbers:

Commodities & Currencies

Crude Oil prices continued to rebound, fueled by unrest in Nigeria that sent that country’s production to its lowest point in years. In addition, an epic wildfire in Canada severely impact oil-sands output. Crude oil prices rose almost 5.2% for the month, and are up nearly 19% year-to-date. Market participants started to worry about the Fed tightening, causing the dollar to strengthen in May. For the month the dollar index gained about 3%, cutting its losses for the year to about minus 3%. June may bring another story; and Brexit will likely play a role.

Economy

ISM Manufacturing PMI in May came in at 51.3, a second month of growth after 5 straight months of contraction. The non-manufacturing, or services, index showed a reading of 52.9 in May, 2.8 percentage points lower than the April reading of 55.7. A cursory glance through ISM data shows that employment is weak, and international trade is weak or flat. Most other categories show continued, if mild, growth. The Commerce Department released its second estimate of GDP for the 1st quarter of 2016, which showed the economy expanding at an annual rate of 0.8%, up from its initial estimate of 0.5% growth. Residential construction and relative growth of exports over imports both contributed to the upward revision. Existing-home sales in April 2016 were 6.0% higher than in April 2015, and the median sale price increased 6.3% from $218,700 to $232,500. Distressed sales (foreclosures and short-sales) were 7% of the market in April, down from 8% in March and 10% a year ago.

Commentary

The presidential race is coming up more often as a conversation piece, which provides an opportunity to talk about investing and politics. First let’s review recent history. President Obama’s first inauguration was January 20th, 2009. On that day, the S&P 500 closed at 805.22 and the SPDR Gold Trust (ticker: GLD) closed at $84.52 per share. Fears abounded that a Democrat as president, especially one whose rhetoric sounded dangerously populist, would lead to runaway federal debt and inflation.

Since then, inflation has averaged 1.4% annually. Twice, Social Security has skipped a cost-of-living-adjustment because inflation was too low to warrant one. GLD has risen 37.32% (as of May 31st) for an annual gross return of about 4.5%. That equals about a 3% annual compound return after inflation. On the other hand, the S&P 500 closed at 2,096.95 on May 31st, an increase of 160% from President Obama’s 2009 inauguration day. That represents about a 14% annual compound return, or 12.5% after inflation.

A few lessons can be gleaned here. First, you can cherry pick data to tell any story you want to tell. If we had bought or sold stocks or gold a few years earlier or later, we can change the story. Second, in regards to politicians, don’t believe the hype. And with campaigns in full glory, there is a lot of hype. We do not yet have a written and credible economic plan issued by either party’s frontrunner and presumed candidate. And when we do, we still only have 1/3 of a plan – the other 2/3 decided by the House and Senate.

Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- www.federalreserve.org – historical data on 10-year Treasury note

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.