“I think we would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns.” – Jerome Powell 10/30/2019

The recent quote above from Federal Reserve Chairman Jerome Powell is powerful, to say the least.

I cannot remember a time in the last 30 years when a Federal Reserve Chairman has so clearly articulated such a strong desire for more inflation.

In particular, let’s dissect the bolded words in the quote for further clarification.

– “Really Significant”– Powell is not only saying that the Fed will allow a substantial boost to inflation but does one better by adding the word “really.”

– “Persistent”– Unlike the prior few Fed Chairman who claimed to be vigilant towards inflation, Powell is clearly telling us that he will not react to inflation that is not only a “really significant” leap from current levels, but a rate that lasts for a while.

– “Even Consider”– The language he uses here conveys the seriousness of the Fed’s commitment. The rise in inflation must not only be “really significant” but also “persistent.” Powell is saying both conditions must be met before they will even discuss rate hikes. A significant rise in inflation but one they do not deem to be persistent will not suffice. Nor would a persistent move in inflation but one they do not measure as significant. Both conditions must be present together based on his language.

I am stunned by the choice of words Powell used to describe the Federal Reserve’s view on inflation. We are even more shocked that the markets and the media are ignoring it. Maybe, they are failing to focus on the three bolded sections.

In fact, what they probably think they heard was:

I think we would need to see a move up in inflation before we consider raising rates to address inflation concerns.

Such a statement is more in line with traditional Fed-speak. The other alternative is that Powell has altered his language in so many different ways over the past year that nobody seems to be paying attention to his words anymore. If so, he has lost credibility.

This article presents Treasury Inflation-Protected Securities (TIPS) NYSEARCA: TIP as a hedge against Jerome Powell and the Fed getting what they want.

Inflation and Stable Prices – Apples and Oranges

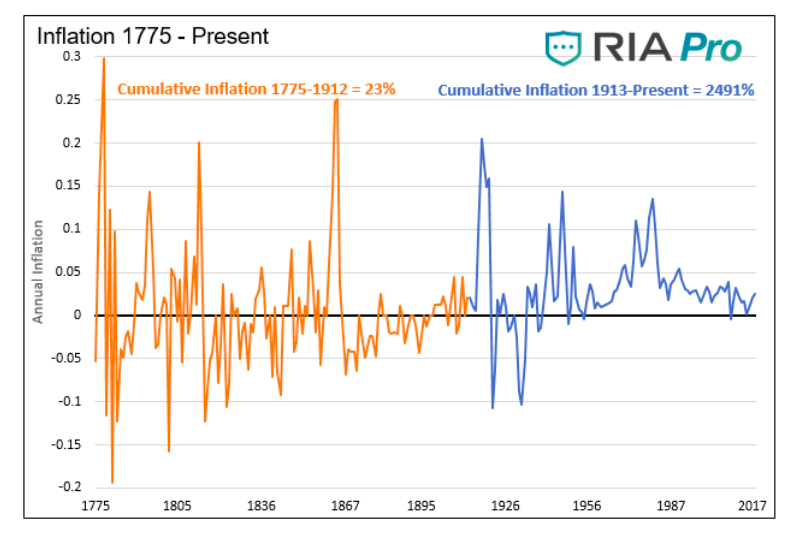

Before a discussion on using TIPS as a way to protect your investments from the deleterious effects of inflation, we need to examine how the Fed gauges inflation and debunk the narrative that terms inflation and price stability as one and the same. Price data going back about 250 years, as shown below, shows the stark difference between inflation and price stability.

Data Courtesy: Lawrence H. Officer and Samuel H. Williamson, ‘The Annual Consumer Price Index for the United States, 1774-Present

The orange line plots annual price changes before the Fed was established in 1913. As shown, prices were volatile year to year, but cumulative inflation over the entire 138 year period was negligible at 23% or .15% annualized. Dare we say prices were stable?

Compare that to the era after the Fed’s creation (represented by the blue line above). Annual inflation rates were less volatile but largely positive. The cumulative growth of prices has been an astonishing 2491% in the post-Fed area, which equates to 3.1% annually. There is nothing stable about such massive price inflation.

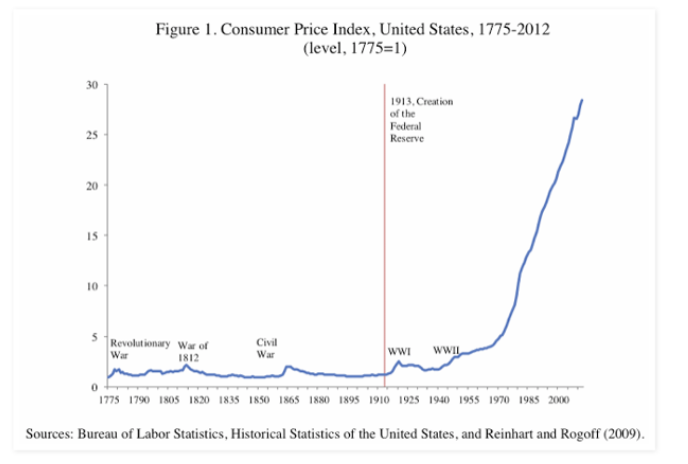

Here is another graph to shed more light on price stability.

Stable prices should be defined as prices that are constant. In other words, a dollar today can purchase the same basket of goods that it did yesterday. Inflation must be near zero over longer periods for this to occur.

The Federal Reserve’s definition of stable denotes a consistent rate of annual inflation. Based on their actions and words, they have little regard for the destruction of a dollar’s purchasing power caused by a steady inflation rate. The Fed benefits from this linguistic imprecision because it allows for economic expansion via the accumulation of debt while their Congressional mandates are achieved.

This is why the Fed wants to produce inflation. It reduces the amount of debt on an inflation-adjusted basis. The Fed wants inflation but disguises it under the banner of price stability.

With Federal deficits now topping $1 trillion and corporate debt and consumer debt and financial liabilities at all-time highs as a percentage of GDP, we must think about hedging our equity and fixed income portfolios in case the Fed gets more inflation than the 2% goal they consider stable.

Despite what the Federal Reserve leads us to believe, they have little control over the rate of inflation and do not know how to accurately measure it. As occurred 50 years ago, they can lose control of prices.

I urge you to focus on the forgotten leg of wealth, purchasing power. The opportunity costs of owning TIPS are minimal and the potential hedge value of TIPS tremendous. Change can happen in a hurry, and the only way to protect yourself or profit from it is to anticipate it.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.