As was widely expected, the Federal Reserve raised the Fed Funds rate by a quarter of a percentage point last week, up to a range of 0.5% to 0.75%. This was a unanimous decision, as the growing chorus of dissenters from previous meetings finally got the interest rate hike they were looking for. In her post-meeting press conference, Janet Yellen acknowledged that this interest rate hike reflects the resiliency of and the Fed’s confidence in the economy.

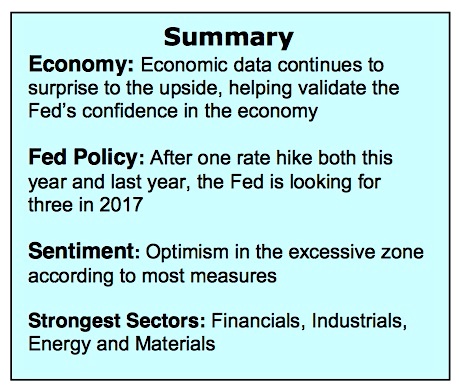

After single quarter-points hikes in both 2015 and 2016, the Federal Reserve now expects to raises rates three times (by a total of three-quarters of a point) in 2017. Will this have an effect on equities and the S&P 500 (INDEXSP:.INX) into 2017?

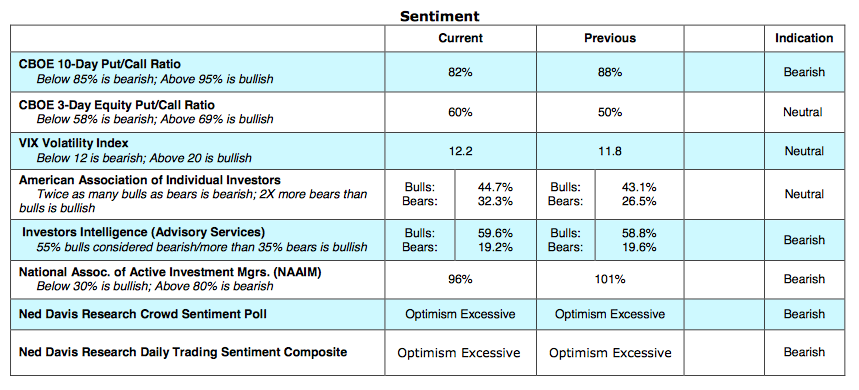

For the first time in several years, the Fed’s projected path of interest rates has actually shifted slightly higher. This upward revision did come as something of a surprise and could be a welcome early indicator of upward revisions to growth more generally. It also served as a catalyst for an uptick in volatility (INDEXCBOE:VIX) in the financial markets. Some consolidation would be welcome after extended moves to the upside by both stocks and bond yields over the past month and a half, especially if it helps cool surging investor optimism. Given strong seasonal tailwinds and improving breadth any near-term weakness that does emerge is likely to be limited in degree and duration.

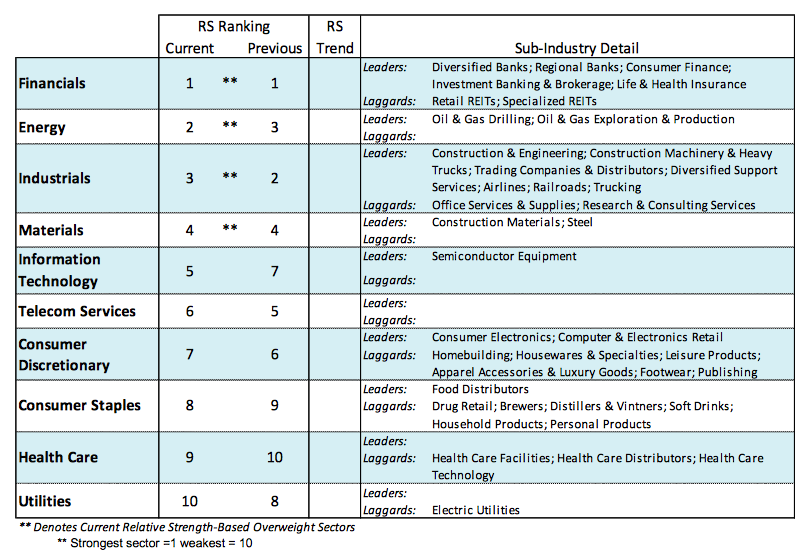

Looking forward, the path of interest rates is now moving higher and noise associated with specific Fed actions could begin to recede. That would be a good thing, as the market could more rightly focus on the news of emerging economic tailwinds, improving corporate fundamentals and potential policy reforms that could help spur a return of productivity growth (topics which we discuss in our 2017 Outlook: Focus on Fundamentals).

Happy holidays to you and yours! Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.