Whether it’s “3 steps and a stumble” or just the fact that the Federal Reserve is thinking and talking about going from QE to QT, there is a growing sense that ‘policy normalization’ is increasing downside risk for the S&P 500 (INDEXSP:.INX).

But as I talked about previously, the Fed Funds Sweet Spot Indicator is still saying conditions are broadly supportive for the S&P 500.

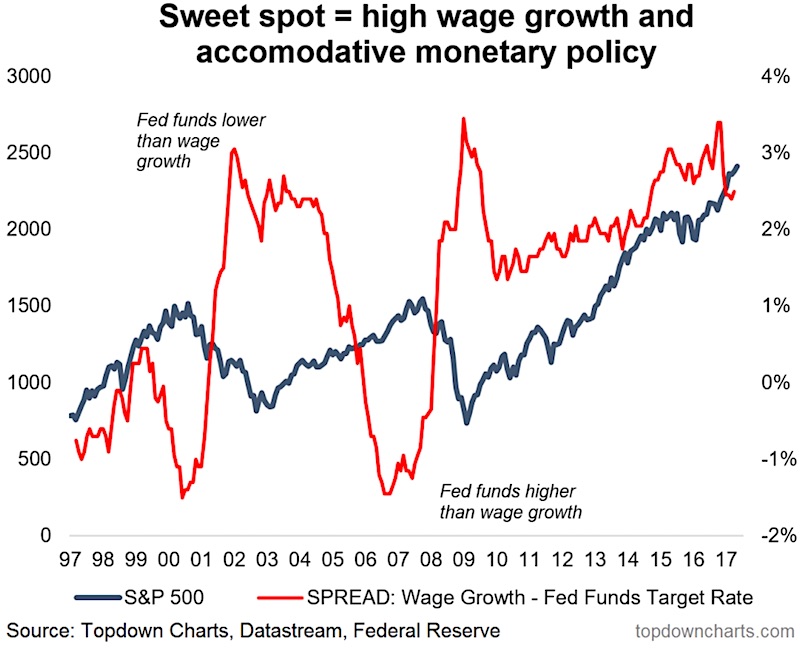

Let’s revisit the indicator and check out the chart.

Fed Funds Indicator: Stock Market Still Holding In “Sweet Spot”

As a reminder the indicator is the spread between wage growth (Atlanta Fed wage growth tracker) and the fed funds target rate. This chart was featured in a broader discussion about Fed rate hike risks and policy normalization in the latest weekly report.

The rule of thumb is the higher the indicator the more supportive for markets.

ALSO READ: The Great Capitulation Into U.S. Equities

A high reading basically says either or a combination of wage growth is strong or interest rates are really low. In the former case it reflects a strong economy, in the latter case it reflects monetary policy stimulus. As an example, the indicator was at its highest points at both the major market bottoms in 2003 and 2009.

A low reading says either or a combination of wage growth is weakening or interest rates are starting to get quite high. Both are bad signs for confidence and economic conditions, which ultimately will get reflected in stock prices.

The fact that the indicator was at high readings during the 2015-16 market turmoil was probably a key factor in explaining why the correction didn’t turn into a bear market.

To sum up, the indicator is still in the sweet spot of decent wage growth and still low interest rates. Until interest rates head materially higher and/or wage growth rolls over, this indicator will continue to signal low risk of a bear market as a result of traditional business cycle drivers.

Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.