On Wednesday morning, Investors will be greeted by 2nd quarter GDP data. As of right now, it is not a matter of whether there was Q2 GDP growth, but how much. And this has put the Fed (and economists and investors) in a bit of a pickle. Perhaps this is why the capital markets are acting up of late…

On Wednesday morning, Investors will be greeted by 2nd quarter GDP data. As of right now, it is not a matter of whether there was Q2 GDP growth, but how much. And this has put the Fed (and economists and investors) in a bit of a pickle. Perhaps this is why the capital markets are acting up of late…

Yesterday, fellow contributor Andrew Kassen and I talked about the upcoming Q2 GDP numbers and what they might mean. During that conversation, we talked about the big drop in Q1 and how often those big drops are accompanied by a recession (whether real time or through revision). For reference, check out his recent GDP post. But what I found particularly interesting about our conversation was the topic of where we are at in the economic cycle and what that may mean for the Fed sitting on a 0.00% to 0.25% interest rate policy.

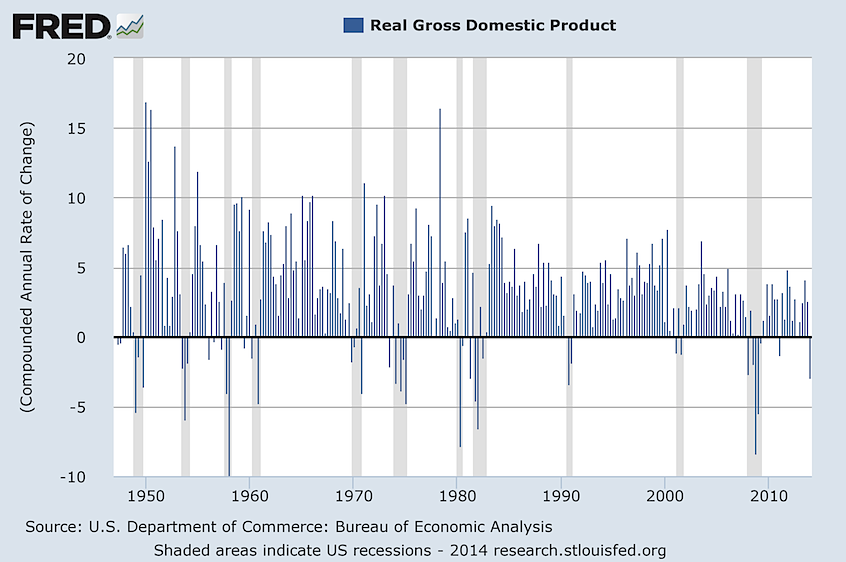

In short, they don’t have much margin for economic error 5 years into this cycle, sitting on a zero rate policy. Below is a FRED Chart of Real GDP (compounded annual rate of change):

I would like to think that at some point the Fed wants/needs rates to be higher. Why? Because they need a cushion. When was the last time that we went into the latter half of an economic cycle with rates at 0.00% to 0.25%? Or into a recession already in a low rate environment? Ideally, central banks need levers to pull, if even for psychological purposes. And considering that The Fed blew all their stimulative bullets on the financial crisis, they are slowly (trying) to put some of them back in the chamber.

BUT, will they get that opportunity? And what would another disappointing quarter do to Fed expectations and their plans?

A quick scan of 2nd quarter GDP growth expectations indicates a range of roughly 2.6% to 3.4%, with Reuters poll of economists coming in at 3.0%. And its worth noting that several economists have downgraded the Q2 GDP number recently (due to the durable goods report). That said, I will be curious to see how the Fed spins Wednesday’s release:

- If the GDP number disappoints… Will they talk about the soft economy? Say rates need to stay at 0.00%? Or more likely, will they focus on growth and the uptick going into 2H (where expectations are pretty firm), keeping a rate hike on the horizon for early next year.

- If the GDP number exceeds expectations… will they embrace it? Or try to talk it down?

How the Fed reacts to this number may offer investors and economists alike insights into what they are hoping to accomplish over the next year.

What do you think the Q2 GDP number will be and how will the market and Fed react?

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.