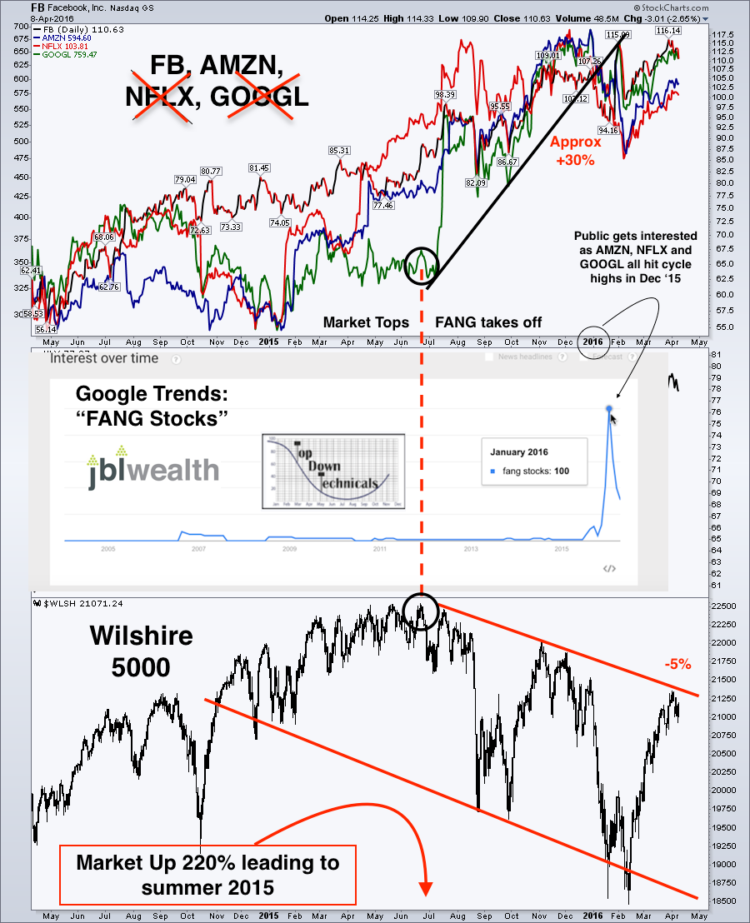

I have spent some time lately collaborating on a research project with Arun Chopra, a good friend who holds a CFA and CMT. Together, we have been blended fundamental indicators with technical indicators and key market themes to highlight opportunities in the market. Today, we’ll look at a chart of the FANG stocks (Facebook, Amazon, Netflix, Google) that shows why investors should remain cautious and focused here.

The FANG stocks are heavily followed and invested in. Check out the middle chart below – look at the spike in “FANG stocks” with Google trends.

As well, the stocks continued higher in spite of the broad market top last summer.

De-FANG’d: Family Feud?

Here are a few key bullets/takeaways about the FANG stocks chart below:

- There is a dangerous divergence that started in Summer 2015 to the broad market.

- Momentum FANG stocks ramp higher, while broad market tops and rolls over.

- Two of four FANGs (Netflix and Google) have disappointed 1Q16. Facebook and Amazon are on deck.

The broad market movement from here may well depend a good deal on the “FANG Family”. Will there be an earnings/guidance family feud? To be continued… $FB, $AMZN, $NFLX, $GOOGL

Thanks for reading and best of luck out there.

More from Jason & Arun: Chart Of The Day: Bear Market? Or Different This Time?

Twitter: @JBL73

The authors do not have a position in any of the mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.