For context, let’s consider a passive market-weighted equity ETF which must allocate progressively larger pools of its funds into – as you would imagine – the largest companies in the universe.

In the S&P 500, for example, Microsoft, Apple and Amazon rank high among the best- performing companies in recent memory and hold market leadership positions in several categories.

As investors reward such qualities, these companies have “earned” the right to be some of the index’s largest members.

Alternatively, the way a company becomes a bigger part of a fixed income index is by issuing more debt.

Holders of a passive fixed income ETF that tracks an underlying bond index therefore end up receiving a growing share of debt issued by companies that are most aggressive in levering up their balance sheet.

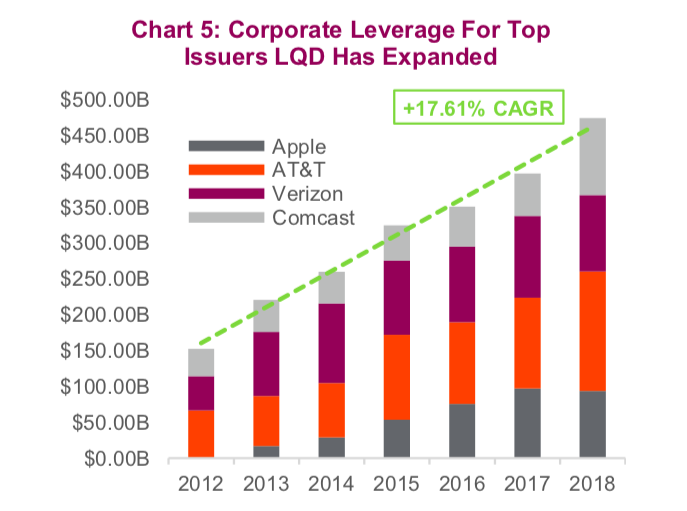

To illustrate this point, consider that the top four ex-financial firms in the U.S. Investment Grade Bond Index have increased debt by 2.11x over the past seven years and now account for over 10% of the index (Chart 5 below). Suddenly, bonds aren’t that boring anymore.

Another major difference between most fixed income ETFs and the bonds held therein is that a holder of an ETF does not get any money back until they liquidate their position. If one were to buy a basket – or ladder – of bonds from a variety of issuers, they would receive the entire principal plus interest earned upon each security’s maturity.

With a traditional ETF, profits only pay out interest after expenses. However, the investor must nonetheless ride the wave of volatility caused by changes in bond yields, convexity and credit spreads. The financial jargon is probably as clear as a muddy puddle for some, so consider an example.

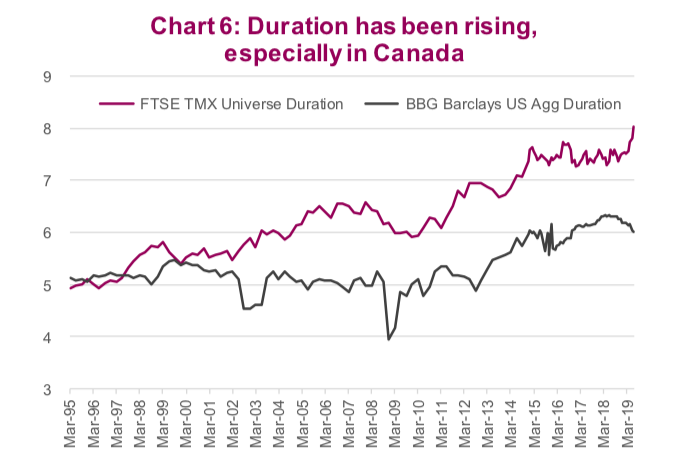

Say you are an older investor with $2 million to buy a retirement home in five years. You can tolerate medium risk and decide to put half in stocks and half in bonds. You can make it easy and buy a million dollars of ZAG, the largest Canadian fixed income ETF, for a cost of just 9 basis points. Or you can buy a basket of bonds that mature in five years. In five years from now, say bond yields rise 2%, the price of ZAG may drop around 16% based on its duration of 8 years (Chart 6 below).

The price of the ETF could fall further if credit spreads move higher. Conversely, the individual bond investor will simply recoup their million dollars. Both still earn interest along the way.

If you or your clients do not have a liquidity need at a specific date, a ladder strategy can have a similar outcome, generating income for the investor every time a bond matures, to be reinvested in another longer-dated bond. The finance world is constantly evolving, and one recent development in the ETF space has sought to replicate some of these benefits: Target maturity bond ETFs hold a basket of bonds that mature in the same year. Once the bonds in the fund mature, the fund is closed, and the investor is paid out.

Like passive fixed income ETFs, direct bond investing has its own limitations. It usually only makes sense for mass affluent investors who plan on holding the bonds to maturity. Why? Because some bonds tend to have mark ups and wide bid/ask spreads. This is more jargon, but the point is that fees increase the smaller the purchase and the more frequently the asset is traded. Additionally, certain bonds outside of money market, government and high-rated investment-grade paper offer poor liquidity; unlike stocks, some of these bonds only trade weekly or monthly.

Both traditional bonds and passive ETFs have their unique pros and cons. If you’re planning for a long-term commitment or have a specific goal in mind, buying individual bonds provides the highest level of safety for your principal and the ability to weather changes in the interest rate environment. Alternatively, ETFs provide an extremely liquid and cost-efficient way to benefit from the portfolio diversification that bonds deliver. ETFs also allow you to easily add to your investments or tactically change duration and alter credit exposure. Investors have individual goals and objectives, and it’s important to carefully establish those specific objectives in order to develop an optimal solution.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.