There are a lot of different ways to examine a company using financial metrics: revenue growth, research & development, revenue per employee. But one in particular is so all encompassing, it might be the crown jewel: the amount of revenue a firm generates for every $1 in expense. And we will weigh this as we lay out our analysis of the best tech companies in the world.

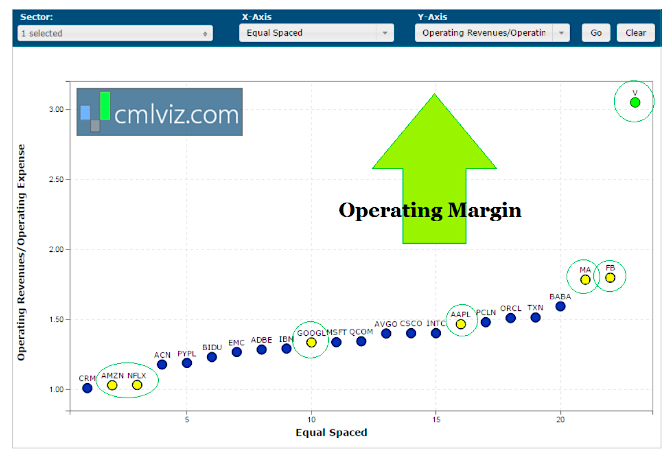

Operating Margin

We can measure the amount of revenue a firm generates for every $1 in operating expense it spends. This is the measure we’re after.

Let’s start by searching for the best tech companies that have market caps above $50 billion and we will rank them on a scatter plot by operating margin.

The operating margin for Visa (V) is absurd — the firm generates over $3 in revenue for every $1 in expense. A part of that is simply brilliant operations and a part is the industry. We can see that mastercard (MA) comes in at number three on this ranking.

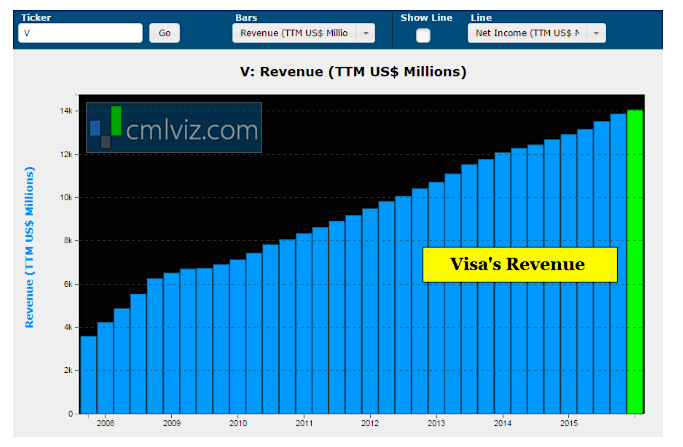

Here is Visa’s all-time revenue (TTM) chart:

But look at the other segments. We see Facebook’s astonishing margins, Alibaba (BABA) and then not too far down the line, we see Apple.

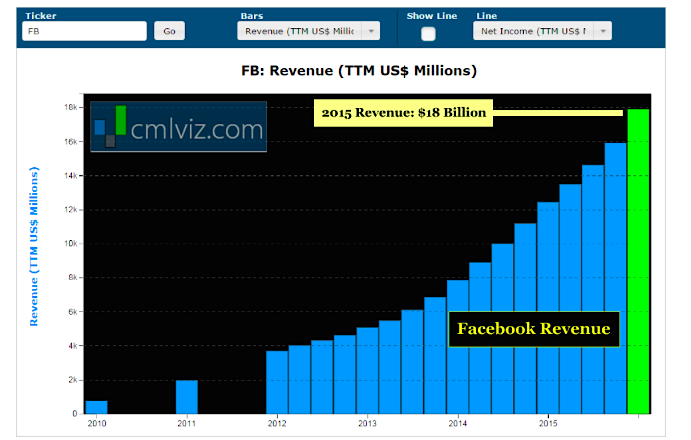

Here is Facebook’s all-time revenue chart:

It takes us quite some time to get to Google and then at the far end, just barely positive, we see Netflix (NFLX) and Amazon (AMZN).

Of all companies above $50 billion in the technology space, Salesforce (CRM) has the weakest operating margin — that’s a choice by the company to grow as quickly as possible, but it’s a choice we better be aware of.

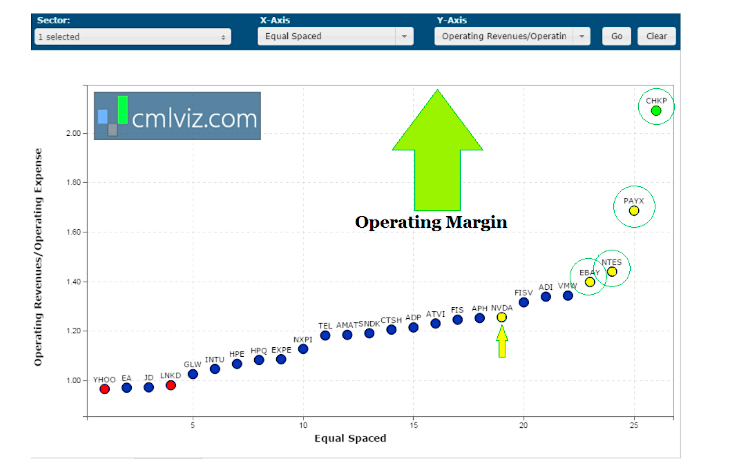

But of course, there’s an entire population of technology companies with smaller market caps. Let’s look at market caps above $15 billion and below $40 billion.

Cyber security marvel CHKP stands head and shoulders above the rest, generating more than $2 in revenue for every $1 in operating expense.

We also note how well EBAY is doing — the long (long) forgotten Internet giant. The first semi-conductor company is Nvidia (NVDA) — this is a crown jewel of technology’s future and in a capital intensive industry, the firm is still generating $1.30 in revenue for every $1 in expense. That’s remarkable.

Finally, we must note that LNKD, Chinese e-tailer JD, gaming company EA and Yahoo! all show less than $1 in revenue generated for every $1 in operating expense — not a good place to be for a long time.

The Next Huge Winners

Operating margin is a symptom not a cause.

True margins and profits, the kind that turn companies from small caps into mega caps, the kind that see stocks double, triple or even quadruple, that only occurs when two critical phenomena collide:

First, companies find themselves in exploding thematic shifts in technology — this is when we hear terms like “disruptive.” Second, these firms become the leaders in the already colossal forward momentum of these themes.

Further reading from Ophir: Tesla Looks To Supercharge Growth With Model 3

Read more from Ophir on CMLviz.com.

Twitter: @OphirGottlieb

Author has a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.