As much as I admire F5 Networks (NASDAQ:FFIV) business and industry space, the pummeling to F5 Networks stock price after last night’s earnings report may not be enough to offer a “safe” entry.

Patience is key for FFIV bulls and I’ll attempt to show why in this brief research note.

F5 Networks (FFIV) Chart Review & Trading Thoughts

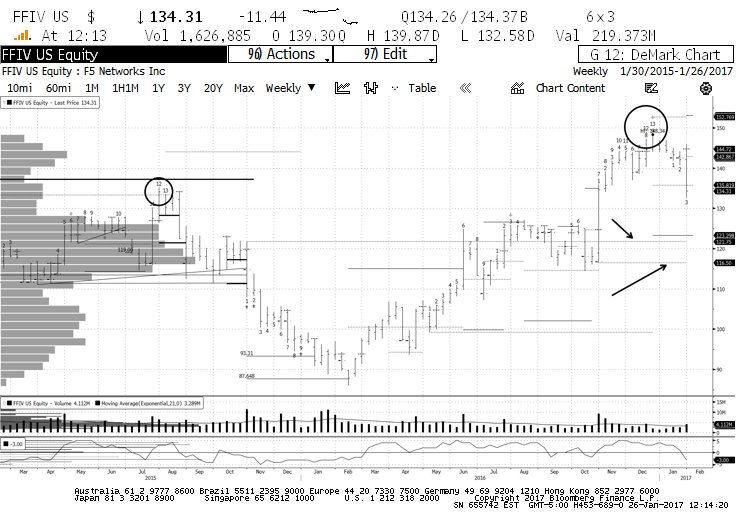

Going as far back as four years, the weekly DeMark Sequential Setup and Sequential Countdown counts have worked remarkably well in spotting good entry/exit areas. The chart below shows that the last two completed Countdown Sell signals (white and red circles), marked significant tradable highs.

If history repeats, the active TD Buy Setup count (currently on Bar 3) should go to completion. It doesn’t tell us how far down the price may go, but there is scant support until the TDST Level Up line (Green Arrow – $121.75) and the active TDST Level Down line (Red Arrow – $116.50).

If the price sinks to near $116.50, traditional technical analysis might suggest that FFIV’s uptrend is broken. However, in DeMark analysis, as long as the stock remains above TDST Level Down (or the TDST Level Down line is not broken on a “qualified” basis – depending on how one chooses to read the indicators) the weekly trend would still be considered bullish.

As is often the case, the stock price may not oblige my preferred “buy zone”, but in my opinion the risk/reward profile of this chart argues for patience. Thanks for reading.

Twitter: @FZucchi

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.