By Sheldon McIntyre

By Sheldon McIntyre

As of Friday’s closing price, the S&P 500 was 24% above it’s 200 week moving average. This caught my attention, as it comes at the same time that I am seeing extreme market readings on the Nasdaq Composite Index (25% above), the S&P 400 Mid-Cap Index (30% above), and the Russell 2000 Index (27% above). See chart below.

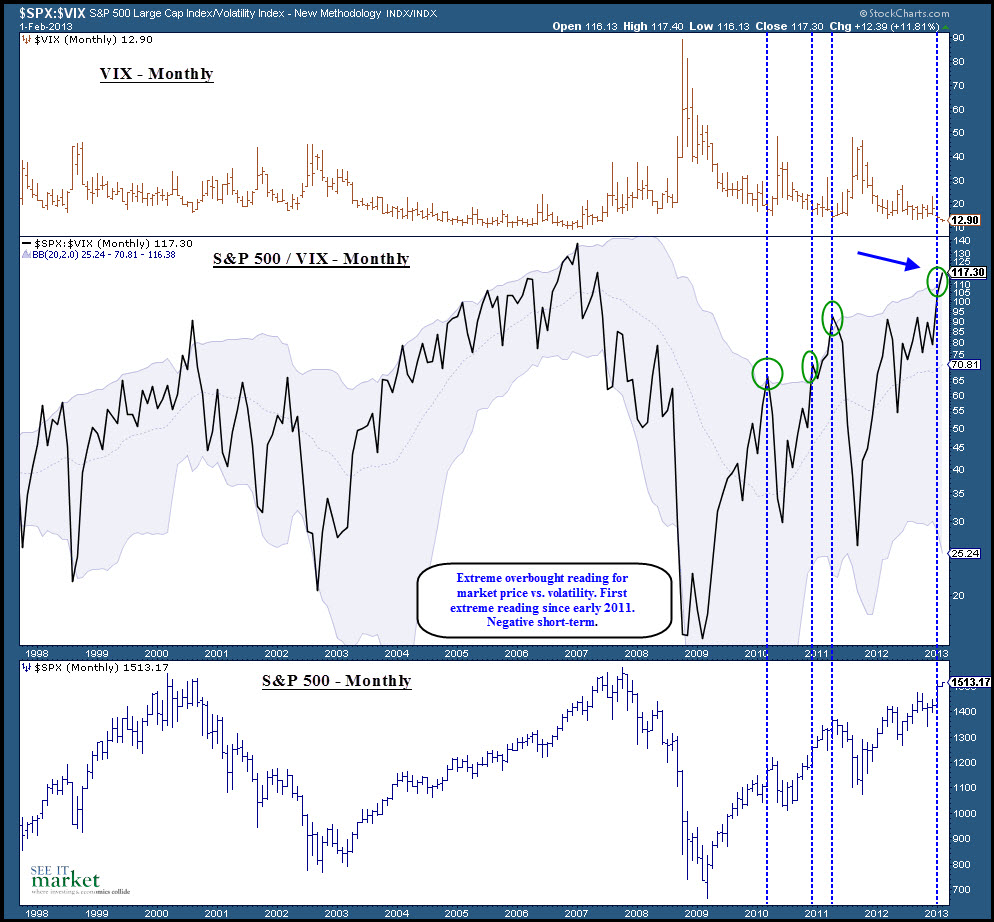

As well, the S&P 500 to VIX (Volatility Index) ratio is registering its first extreme overbought signal since early 2011 (chart 2), and market price, breadth, and volume are all in sync for the first time since mid-2011 (chart 3).

Taking these three charts into consideration tells me that a cautious approach is advised over the near-term.

Trade safe, trade disciplined.

Index Deviation from 200 week MA Charts:

Market Price, Breadth, and Volume Charts:

S&P 500 to VIX Monthly Charts:

Charts showing extreme market readings for February 2013.

Twitter: @hertcapital @seeitmarket

No position in any of the securities mentioned at the time of publication.