The KBW bank index is a popular benchmark for the performance of domestic regional banks. Unlike the major national banks, such as J.P. Morgan and Bank of America, these banks are smaller in size, have less global exposure, and do a majority of their business in specific regions of the country.

The largest banks in the index are household names such as KeyCorp, M&T Bank and BB&T Corporation. Some of the lesser-known banks are Berkshire Hills Bancorp, Hanmi Financial Corporation, and Cardinal Financial Corporation. Nearly 65% of the stocks in the KBW index are included in the R2K index.

Passive investors could have extracted a large portion of the fundamental benefits of owning the R2K by purchasing the KBW index. In substituting KBW for R2K, they would have retained similar exposure to financials while avoiding a portfolio of additional stocks trading at extreme valuations. The financial stocks within the R2K currently have a market cap to income ratio of 22.2, well below the 237.4 ratio of the entire index.

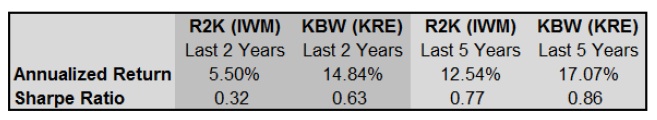

The table below compares the results of R2K and KBW. We used popular ETF’s to replicate investor performance of the two indices – IWM (R2K) and KRE (KBW).

KBW outperformed the R2K on an annualized return basis over the last two and five year periods and provided better risk-adjusted returns.

Having identified a meaningful anomaly, the next question is how can an investor or portfolio manager capitalize on it? For those who already own the R2K and are comfortable with market valuations, the recommendation would be to replace the R2K with a combination of the S&P 500, Wilshire 5000 and the KBW banking index. The Wilshire 5000 also provides some small cap exposure, but at comparatively reasonable valuations. For those looking to exploit what seems like a mispricing of the R2K, we recommend a paired trade approach whereby one shorts the R2K and goes long the KBW and the S&P 500.

Summary

Much of the recent post-election price appreciation in the R2K has been based on the performance of financial stocks. The KBW index, again solely a financial stock portfolio, is up approximately 25% since the election, compared with 15% for the broader R2K. The recent appreciation in financials is apparently a response to the new administration’s planned policies that are generally viewed as beneficial for the financial sector. Given the regulatory oppression of the past eight years, this may very well be a sound reason to own bank stocks. However, the R2K index is trading at grossly elevated levels. Owning the index for anything other than pure speculative trading is ridiculous. Owning the index for its bank exposure is insane.

Active investment may not be in style, but that is certainly no reason to ignore sound analytical rigor and proper logic in making prudent investment allocation decisions.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.