An Attractively Valued Small Cap Software Growth Stocks that Benefits from Bad News

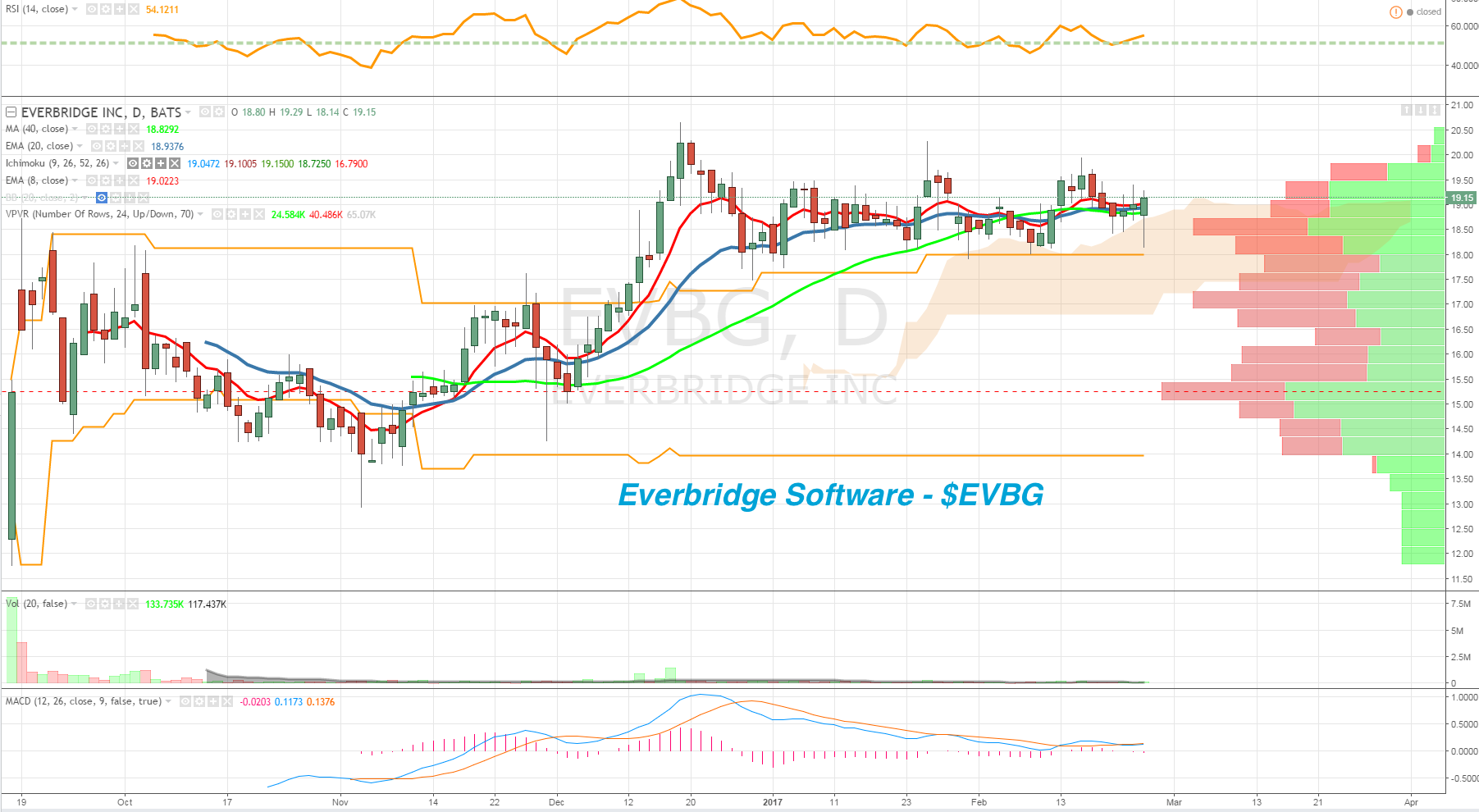

Everbridge Software (NASDAQ:EVBG) will report earnings after the close on February 27 and on its initial earnings report in November shares fell as much as 10.4% before closing down just 2.84%. Shares of Everbridge Software (EVBG) have consolidated the last few months with $18 acting as support and resistance near $20 – this chart caught my eye into their upcoming report.

Note that Everbridge Software priced its 7.5M share IPO at $12/share in September 2016.

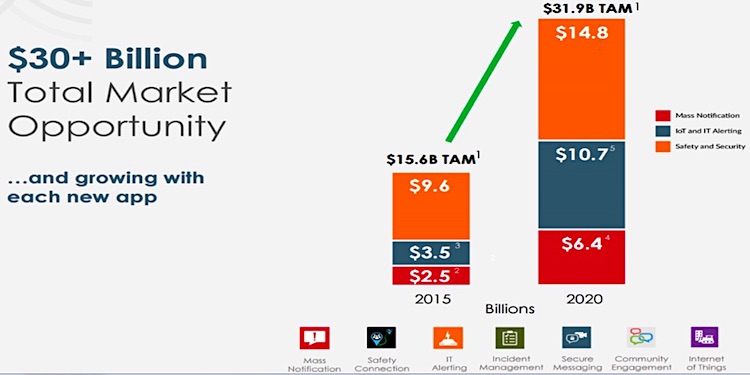

The $517M company provides critical communications and enterprise safety applications enabling customers to automate and accelerate processes keeping people sage and businesses running during critical events such as active shooter, terrorist attacks, severe weather, cyber hacking, and more. EVBG shares are trading 4.8X EV/Sales FY17 which is fairly cheap for a company that grew revenues 38% in 2015, set to grow 30% in 2016, and targeting 25% revenue growth in both 2017 & 2018. EVBG is not currently profitable, but has 3,500 enterprise customers spending on its platform that hots seven different applications and is addressing a $30B market. Everbridge Software notes that an important driver for its business is more people are mobile spending time out of office with IDC saying by 2020 70% of the US workforce will spend three days or more outside the office. Its core market is mass notifications and automation. The long term model calls for adjusted gross margins of 77% to 82% and EBITDA margins of 23% to 25%. Its customers include 8 of the 10 largest investment banks, 6 of the 10 largest global auto makers, 8 of the 10 largest US cities, 24 of the 25 busiest North American airports, and 4 of the 10 largest healthcare providers. As an example, one of its large Pharmaceutical customers has increased annual spend at EVBG by 190% from 2015 to 2016, and a Software customer by 182%.

Everbridge Software paid $18.7M for IDV Solutions in late January, a company providing risk intelligence and response software to command centers. In its first earnings report, EVBG beat estimates and provided upside to guidance with 48% billings growth, 3.2% Q/Q customer growth, strong cross-selling, and strong ASP.

Analysts were mostly positive in October when initiating coverage, CSFB at Outperform with a $21 target and BAML at Buy with a $22 target.

EVBG is already Adjusted EBITDA positive, has a large TAM, and is generating impressive revenue growth with potential to enter new verticals, an early-stage growth company that can scale and trades at attractive valuation. I think it is fair to value shares at 6X FY18 sales, or $750M, a 45% premium to the current market cap, while in a M&A scenario it could fetch 8X sales, so even more upside.

You can get more of my research and options trading ideas over at OptionsHawk. Thanks for reading and have a great week!

Twitter: @OptionsHawk

The author currently owns EVBG at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.