Chinese stocks have effectively crashed and, given the laughable reliability of the underlying companies’ financials, it shouldn’t surprise anyone if the Chinese market crash continues lower after a brief pause.

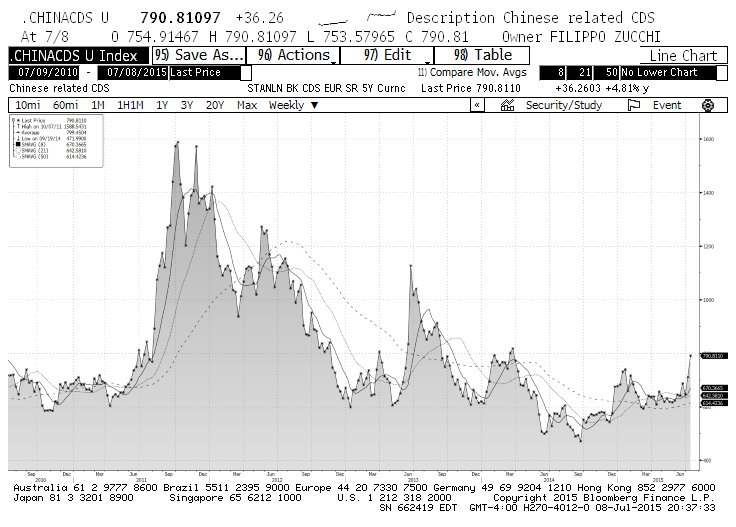

That said, Credit Default Swaps highly sensitive to Chinese-related credit so far have yawned over all the equity commotion. As you can see from the chart below, spreads on those CDS are still nowhere close to spike levels reached several times over the last 5 years, which ultimately resolved themselves without any systemic issues.

It’s still early on in evaluating the Chinese market crash, so I’ll continue to monitor the Chinese credit markets and provide updates accordingly on CDS / China credit.

As I suggested last year in this article there’s an abyss between the consequences of stock crashes due to equity-specific problems (over-leverage, speculation, etc), and stock crashes due to widespread credit problems. So far all indications are that the China stock wreck falls into the first category. And except for those entangled in such a deeper credit mess, the Chinese market crash is not likely to have lasting / systemic consequences. That time will come, just not now.

Thanks for reading.

Twitter: @FZucchi

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.