European stocks and ETFs have experienced a difficult summer amid a faltering currency and European Central Bank that has been scrambling to implement looser monetary policies. On the surface, the recent announcement of further rate cuts and asset purchases seems like a step in the right direction by the ECB to stimulate growth. However, reaction to the accumulation of news this year by European stocks has been less than stellar.

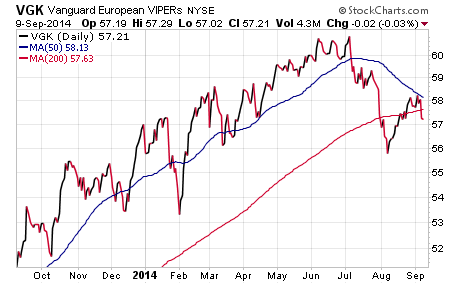

The Vanguard European ETF (VGK) recently fell back below its 200-day moving average and is now nearly 6% off its high established in July. Despite a brief rally attempt in August, this index of over 500 European stocks is now fighting to regain its uptrend.

It may face additional technical damage if the 50-day moving average crosses below the 200-day moving average. This is technically known as the “death cross” and appears to be a potential near-term event on the horizon.

Vanguard European VIPERS Daily Chart

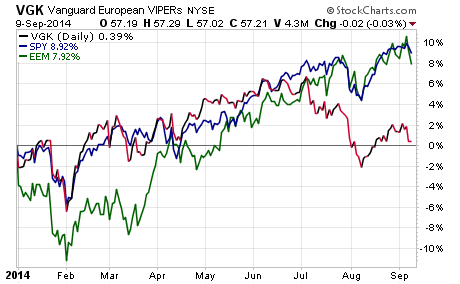

That stands in sharp contrast to major equity indices of domestic and emerging market countries that are within 1% of their 2014 highs. The SPDR S&P 500 ETF (SPY) and iShares MSCI Emerging Market ETF (EEM) are showing much greater relative strength than fellow European indices. In fact, VGK is clinging to the flat line this year while SPY and EEM are diverging upward.

Vanguard European VIPERS Performance Chart (vs SPY and EEM)

Another consideration is the sharp decline in the CurrencyShares Euro Trust (FXE), which has fallen more than 7% since hitting a high in May. This devaluation of the euro is not surprising considering the long standing expectation of further quantitative easing. However, it may be adding to the anxiety of international investors and globally-based companies that would like to see more stabilization in the Euro zone and European stocks.

So what does this mean for your portfolio and allocations? Well, the easy move is to sell European stocks and indices and move to the safety of cash or reallocate those proceeds to other regions that are showing better relative strength. However, I would caution against a complete abandonment of European equities without doing your due diligence, which includes taking several factors into account.

Ultimately, the ECB is committed to implementing measures to counteract deflationary forces throughout the Euro-zone region. As the asset purchase strategy begins to take shape and additional data is accounted for, we may reach an inflection point that morphs into a counter-trend rally.

In addition, the recent drop in the Euro may be stretched to the point of short-term exhaustion. Conversely, the rally in the US Dollar may be ready for a breather as well. If that takes place, it should play a role in steadying European markets.

Lastly, chasing performance in domestic stocks and abandoning international diversification this late in the game may have its own set of consequences. Selling one investment low and buying another near the highs is not a successful strategy to generate wealth.

While there is certainly a case to be made for rotating assets to undervalued emerging market nations, many European regions are becoming more attractive as well: France, Germany, Italy, and Spain have fallen 10 percent individually from their highs.

One potential investment alternative to consider if you are focused on further devaluation of the Euro is the WisdomTree Europe Hedged Equity Fund (HEDJ). This ETF invests in a diversified basket of 125 European stocks and equities, while simultaneously shorting the Euro. The goal is to increase returns versus a basket of non-hedged stocks when the U.S. dollar is rising relative to the Euro.

So far this year, HEDJ has gained 5.79% and recently picked up steam as a result of the Euro’s weakness. This ETF has now accumulated more than $2.5 Billion in total assets, with more than $1.7 Billion of inflows this year alone. Clearly larger and sophisticated investors are implementing strategies to hedge currency risks, while still remaining allocated to liquid overseas equities.

No matter how you ultimately play the European theme, remember that implementing proper risk management measures is key to protecting capital. If the Euro-zone slips into a deflationary environment, it will be imperative that a disciplined approach overrules personal convictions. Remaining nimble and alert to these developing themes will allow investors to traverse the stormy seas and emerge in a better position.

Get more insights from Dave’s FMD Capital Blog.

Follow Dave on Twitter: @fabiancapital

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.