European stocks closed lower as fears of slowing growth and deflation continued to mount. A poor day for US equities also added pressure to the major European Equity Indexes. Perhaps of greater interest was that an aide to the European Union’s top court said a bond-buying program by the ECB is “in principle” in line with the EU’s treaty. This gave stocks a boost, but it would prove to be fleeting.

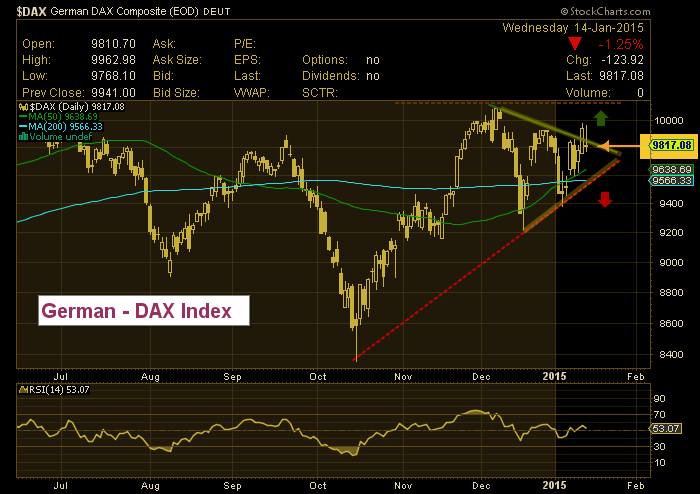

On Monday, I wrote about the ECB bond buying debate and how the German DAX had formed a symmetrical triangle pattern waiting on potential news. Perhaps this wasn’t “THE” news, but either way, it sure didn’t seem to reassure investors. One day after breaking higher out of the symmetrical triangle, the DAX slipped 1.25% today, closing on the upper edge of the triangle. Should the index continue lower tomorrow it would be a failed breakout. Investors remain uncertain and are likely hoping for a Draghi “whatever it takes” moment.

German DAX Chart

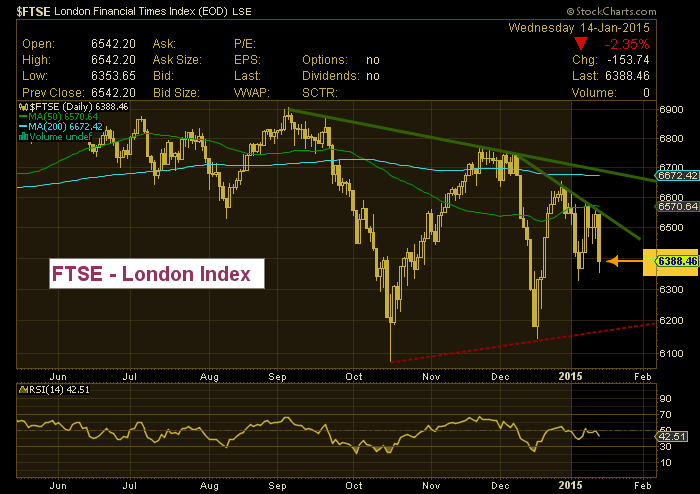

The DAX wasn’t the only major index of European stocks to close lower. Across the pond, the London Index (FTSE) was hit even harder falling 2.35% as the UK housing market continued to weigh on stocks. Technically speaking, investors also failed to push the index through downtrend resistance.

London FTSE Index

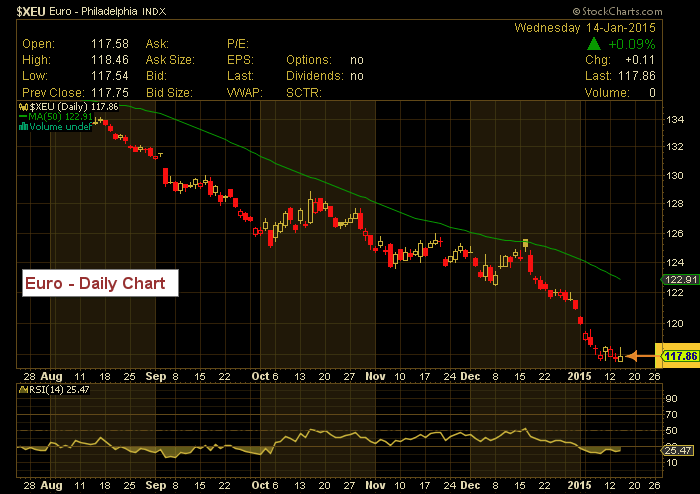

European investors likely won’t find solid footing until the situation with the ECB shakes out and economic numbers improve. Both of these concerns continue to hit the Euro. Should the Euro fall through the recent low, it could test 1.1521 according to Tom Pizzuti and Kurt Hulse of Trading On The Mark.

Euro Currency Chart

Will Mr. Draghi make an appearance soon? Perhaps that question in and of itself says a lot about investors addiction to central banks… but that’s a conversation for another day. For now, investors will continue to tip-toe around European stocks until the major indexes start to show more strength.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.