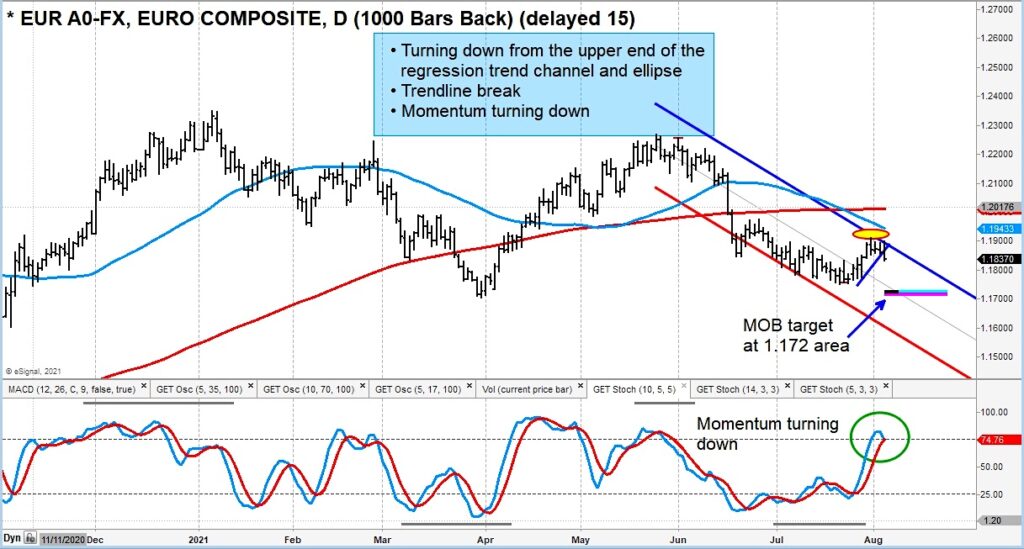

Earlier this week, the U.S. Dollar Index (DXY) turned higher as indicators flashed bullish signals. And by mid-week, the Euro (EURUSD) has triggered sell signals after turning lower.

The Euro currency has a strong trading setup for a short-term move lower.

This reversal pattern has a trading trigger on a break below 1.1825. Given the structure of both the US Dollar DXY and Euro EURUSD, I believe this will be confirmed and see further bearish price action on the Euro (and bullish on the US Dollar). But patience is required for traders and a watchful eye for inter-market analysts.

If confirmed, the initial trading target is 1.172 (a MOB band). But the Euro could fall to 1.16 if selling picks up steam. A weaker Euro and stronger US Dollar should impact select commodities adversely.

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.