- Last year’s final quarter featured a record increase in the number of ETF splits

- Reverse splits dominated, along with a high volume of leveraged and inverse funds splitting

- Schwab and ProShares were active in managing the share prices of some of its index ETFs

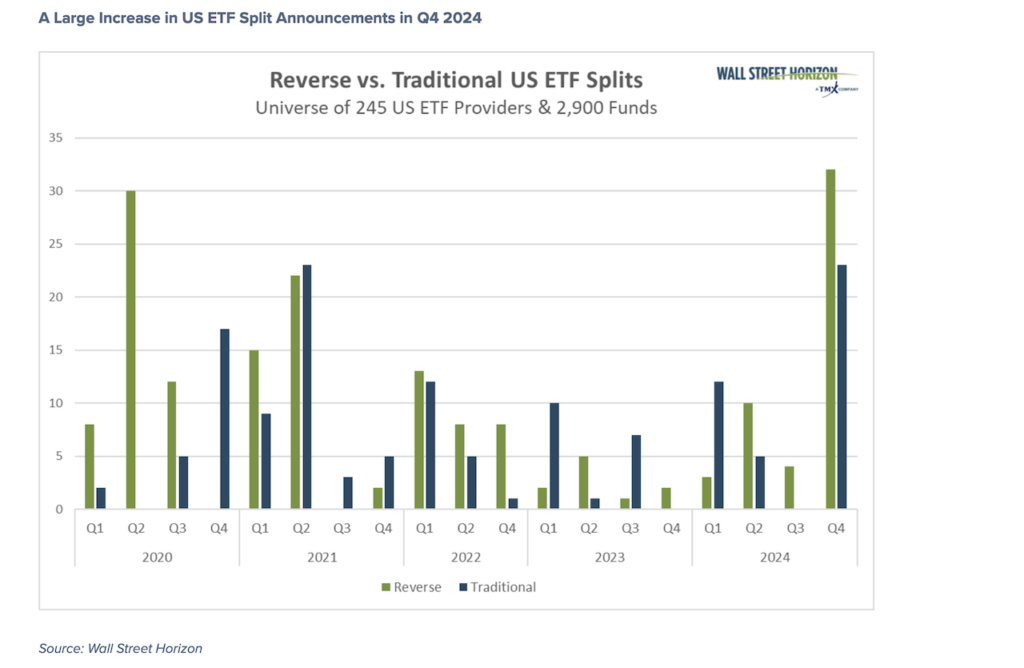

Something unusual came down the chimney late last year. During the holidays and the preceding weeks, there were a slew of splits among US ETFs – the most in the past four years, according to Wall Street Horizon’s data.

It’s nothing to be overly worried about if you take an asset-allocation approach to portfolio management, but it underscores key trends in today’s universe of investment options.

In all, there were 55 fund splits, a mix of traditional and reverse. Our team took a closer look at the numbers, and we found that 20 splits were from Schwab’s lineup. Often, issuers will wait until year-end to perform housekeeping activities, including splits, along with distributing dividends and issuing capital gains to shareholders.

Index ETF investors generally face a lower risk of the former distribution type, but splits remain common. Of course, a split (be it with a stock, mutual fund, or ETF) is merely a bookkeeping move; it’s like exchanging a dime for two nickels.

A Large Increase in US ETF Split Announcements in Q4 2024

For equities, some research points to potential alpha among shares of companies that announce a traditional, say a “2-for-1″ stock split.1 That trend was particularly prevalent in the 1980s and ‘90s, but recent cycles appear to show that stock-split outperformance is less of a trend. According to Goldman Sachs, stock splitters have shown just modestly better returns compared with the overall market when scanning split announcements since 2019, according to a 2024 research note.2

Reverse splits, perhaps a “1-for-10,” have still pointed to downside risk possibility in recent years, which makes sense as the corporate event action is usually only done when a stock has underperformed. Studies show that negative abnormal returns have occurred, on average, with reverse-split stocks.3

US ETF Trends

But let’s circle back to ETFs. What we picked up on regarding the split binge in the last few months is that the bulk of the announcements were on funds that were either inverse or leveraged products. Outside of the 20 Schwab broad index ETFs, 24 of the remaining 35 funds were inverse ETFs while 28 of the remaining 35 were leveraged products; (20 were inverse AND leveraged funds). Stick with us – we’ll tell you what all these numbers mean!

Leveraged ETFs are seen to be particularly risky because they generally reset daily, leading to “the negative compounding effect.” Here’s the potential danger – suppose an S&P 500® index fund is priced at 100. If the underlying index rises 10%, a 3x leveraged ETF would hypothetically rally to 130 while the index reaches 110. The next day, we’ll say the market drops 10%; the S&P 500 declines to 99 but the 3x long fund craters to 91, leading to material underperformance with the leveraged long ETF compared to the index.

Over time, particularly during volatile periods, this sort of leveraged ETF share-price decay may persist, which can lead to a very low ETF NAV over many years. Moreover, for weak-performing areas like the natural gas energy commodity, among others, a leveraged long ETF’s price per share can reach unattractive levels in the eyes of an issuer. Hence, a reverse split may be announced.

Few Traditional Splits

There were just three non-Schwab traditional ETF splits in Q4. After a two-year bull market for many sectors, geographies, and asset classes, it would make sense that issuers may want to bring the market price to a lower level, but why so few? Well, it used to be that brokers would only allow stocks and ETFs to be traded in whole, not fractional, shares. Now, though, many sites and apps allow retail traders to do fractional trading, so traditional splits are not as important in the industry. Still, we saw ProShares put through traditional splits on three of its funds – leveraged Health Care, semiconductors, and yen products.

The standout trend last quarter was the rash of reverse ETF splits. Thirty-two of the 35 non-Schwab splits were of the reverse variety, with the bulk of them being on leveraged ETFs. The ProShares UltraShort series of bearish leveraged funds littered our list. We can infer that the negative compounding effect that comes with leveraged products, along with them being inverse to an index, can lead to very low share prices. UltraShort Oil & Gas, MSCI EAFE, Utilities, Real Estate, and Russell 2000 are just a handful of such ETFs.

Enter: Single-Stock ETFs

Two companies appeared on our Q4 2024 list of ETF splits. How could that be? The proliferation of single-stock ETFs was a big story last year, and high volatility among AI and crypto-related equities drove investor interest in new ways to play those themes.

Specifically, there are ETFs linked to Super Micro Computer (SMCI) and MicroStrategy (MSTR). The Defiance Daily Target 2X Long SMCI ETF (SMCX) performed a reverse split while two leveraged inverse funds tied to MSTR reverse split. We could see more single-stock ETF splits this year, particularly if volatility increases.

The Bottom Line

There was a notable surge in US ETF splits as we called it curtains on 2024. While Schwab brought share prices down on some of its index funds via traditional splits, many leveraged and inverse funds likely had share prices too low for their respective issuer’s preference; most of the bearish-equity funds out there have probably tapered since the S&P 500’s low in October 2022. Finally, a few single-stock ETFs splitting late last year underscores the expanse of new investment choices for today’s traders.

Sources:

1 BofA Global Research, BofA Securities, January 14, 2025, https://business.bofa.com

2 US Weekly Kickstart, Goldman Sachs, June 7, 2024, https://www.gspublishing.com

3 Return Performance Surrounding Reverse Stock Splits: Can Investors Profit?, Seoyoung Kim, April Klein, and James Rosenfeld, 2008, https://citeseerx.ist.psu.edu

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.