The S&P 500 Index INDEXSP: INX finished higher last week offsetting the previous week’s decline of nearly 3%.

The stock market continues to move up on good economic data and then re-traces its steps on bad news regarding the COVID-19 virus.

The Labor Department reported a record 4.8 million new jobs added in June on top of the 2 l/2 million added in May. The unemployment rate fell to 11.1%, down from 13.3% in May.

These numbers are mainly a result of states beginning to open up their economies.

We also saw good news on manufacturing, home sales and consumer confidence.

The bad news is that at least twenty states have paused their re-opening plans as COVID-19 cases have risen. Yet we have not seen an increase in death numbers and hospitals seem to be getting better at treating the virus.

I expect the good news/bad news scenario will continue to play out in the stock market as we work to overcome the obstacles created by the virus.

We still have a massive number of the population unemployed. The economy may not fully recover for several years and the path of the virus and the availability of a vaccine remains uncertain. Consumer spending may be slow as some job losses become permanent and people may be hesitant to fully engage in their previous habits.

The Federal Reserve has pledged to do whatever it takes to support the markets and the economy. Congress is working on a Phase Four stimulus package which will place an emphasis on bringing American manufacturing jobs back home from overseas, incudes funding for states, expanded support for small businesses and a possible payroll tax cut. Pent-up demand should spur economic growth in the second half of the year. Corporate profits are expected to rebound in the 3rd and 4th quarters of this year and into 2021.

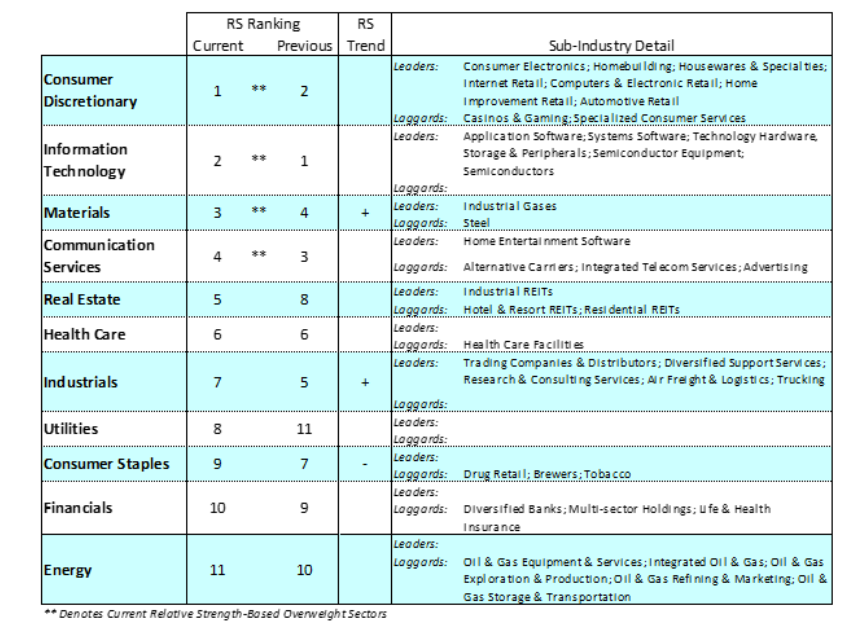

At the end of March as investors began to see signs of an economic recovery, the cyclical sectors (materials, consumer discretionary, industrials, financials) led the market. But by the end of June when the virus cases began to increase and the recovery looked to be in jeopardy, investors shifted to large cap growth and defensive areas that are more insulated from the COVID-19 virus.

The U.S. economy is now back in a recovery mode and as things improve, the cyclicals historically lead the stock market higher. Our government continues to apply monetary and fiscal stimulus to support small businesses through low interest rates and forgivable loans which should benefit the small cap and cyclical sectors. We also like gold or gold mining stocks which tend to be a resilient asset and will provide diversification in periods of uncertainty.

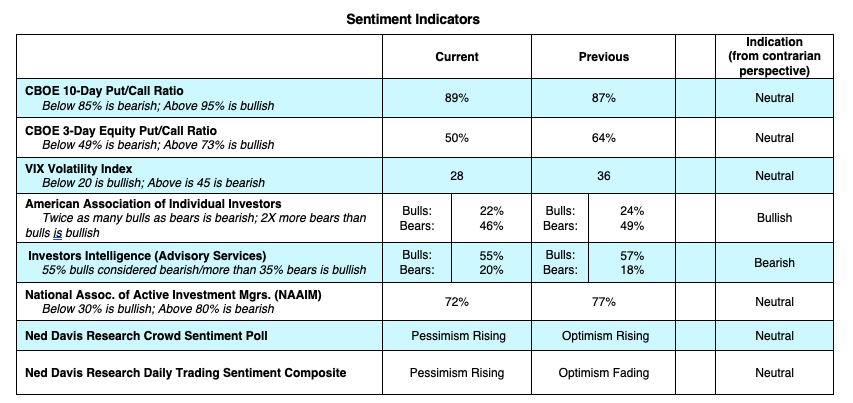

There is currently about $1.5 trillion of investable cash on the sidelines. This money will likely go back into the stock and bond markets once investors believe that the virus outbreaks have stabilized and feel confident the economy is on a solid growth track. The Baird Weight of the Evidence Indicators which take into account technical data, investor sentiment, valuations, seasonal trends and economic data, points to potentially a more back and forth trading range environment with a positive bias to the upside.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.