We follow the energy sector very closely and have been bullish for some time. Of course as an active investor you need the tools and indicators to manage positions, etc.

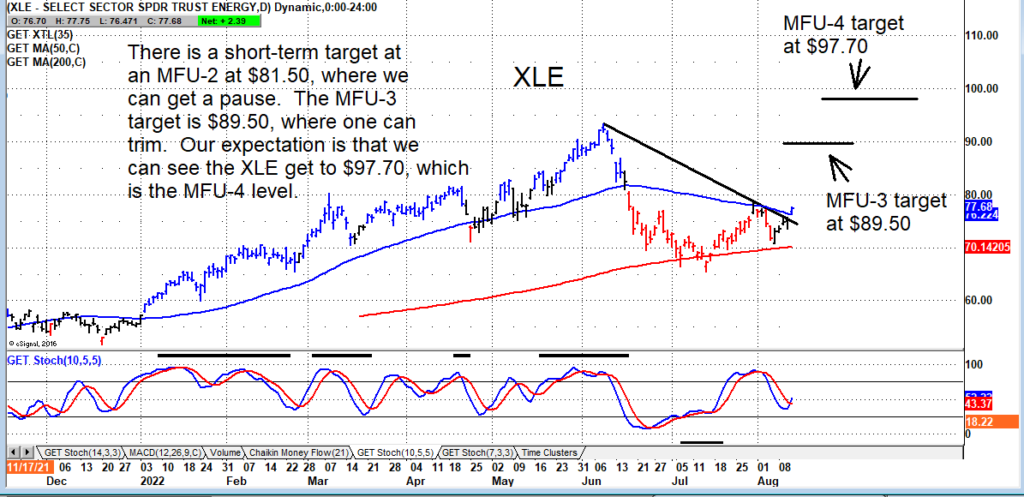

A few weeks ago, I turned bullish on a price reversal in XLE (energy sector etf). And now that we have both the XLE and XOP (oil and gas production etf) attempting to break out above their downtrend lines, I’m looking to add exposure here. I believe these ETFs are a good way to play the sector as a basket trade.

The bullish Money Flow Unit base which kicked this sector strength off back in late 2020 is still in control.

Some stock ideas that are on my radar include OXY, CVX, XOM, FANG, COP, MPC, DVN, and AR.

$XLE Energy Sector ETF Chart

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.