The character of oil and energy stocks has completely changed in May.

After a rough start and a full blown liquidation of an energy trading firm, stocks have stabilized along with oil. In fact oil, has had a persistent bid of late.

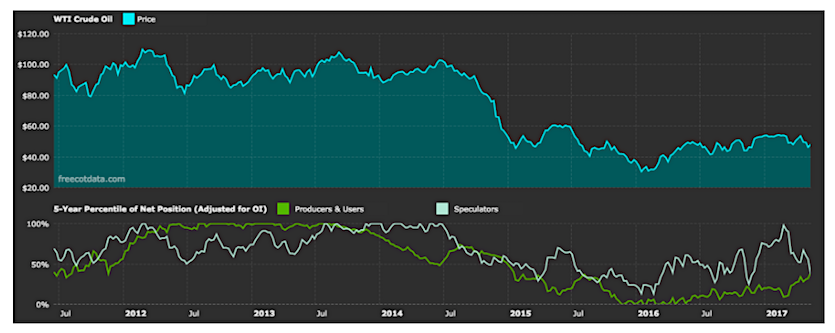

One huge reason to be bearish oil prices early in 2017 was the Commitment of Traders Data. Since then, the extremes have significantly moderated. Oil speculators have backed off the pedal in a big way after extreme bullishness to start the year. At the same time Hedgers are closing out their shorts.

The SPDR S&P Oil & Gas Exploration ETF (NYSEARCA:XOP) has formed a bullish divergence as it broke below and recovered this support area.

Shale stocks like CLR are trying to find support at key levels. You can see momentum stabilizing as well via RSI and MACD.

Fracking Stocks like EMES have shown explosive moves off of lows. In fact this just reached its highest RSI since February.

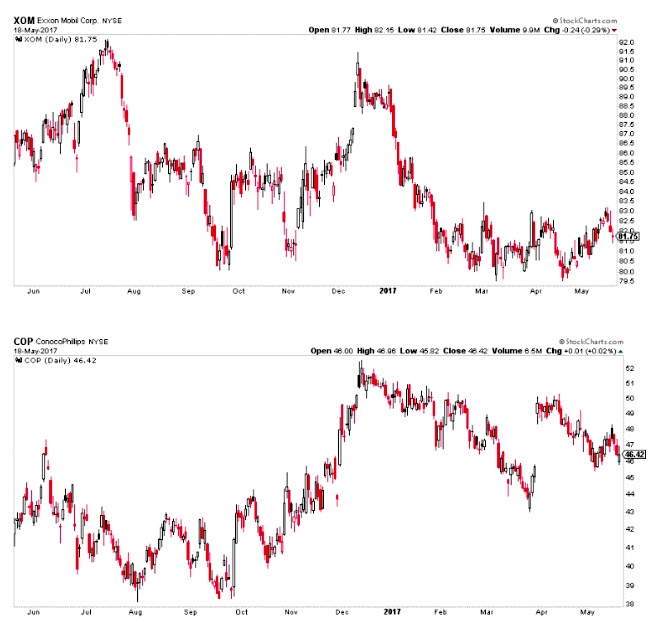

Energy Majors like Exxon Mobil (NYSE:XOM) and Conoco Phillips (NYSE:COP) have been basing at support.

It’s worth noting the Dollar Index has recently broken down in a big way. Perhaps that’s all that is going on here. Then again, a further fall would obviously be a net positive for commodities.

We’ll see if or how long it can continue, but this change of character has been the most notable development in energy price action in months. If you’re a tactical asset allocator, this is a low risk opportunity with obvious exit areas to buy energy stocks while nobody is talking about them.

Catch more of my analysis over at North Star TA. Thanks for reading.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.