While Canadian energy companies have proven resilient, the recent divergence between commodity prices and energy stock performance warrants closer scrutiny. Despite a notable decline in commodity prices since the quarter’s inception, energy stocks have exhibited unexpected relative strength.

This disparity could indicate a potential overvaluation in the sector, driven by factors such as investor sentiment and heightened geopolitical tensions.

As such, we believe it prudent to reassess the energy sector, considering the potential risks associated with a prolonged disconnect between underlying fundamentals and stock prices.

Snapshot of Canadian energy

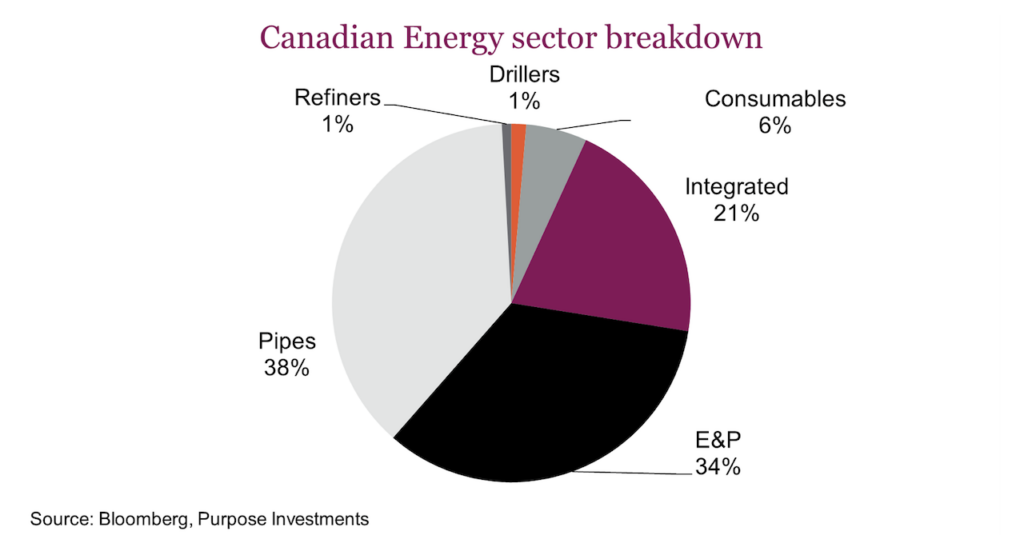

The Energy sector’s weight within the TSX has experienced significant fluctuations over the past 15 years. After reaching a peak of 33.5% in 2008, the sector’s influence waned, plummeting to a low of 10% in September 2020. However, a resurgence has seen the Energy sector’s weight climb back to 18% of the index.

While this increase may seem moderate compared to prior levels, its size does carry strong implications for portfolio risk. Given the Energy sector’s historically higher beta, even a market-weight allocation can amplify portfolio volatility. Within the sector, E&Ps have grown to 34%, nearly eclipsing pipelines and increasing the overall risk profile of the sector.

Fundamentals and oil markets

Oil has shed nearly all its year-to-date gains, with WTI again trading in the low 70s. There is no trend, and the chart is especially ugly relative to equity markets. The choppy price action is a sign of a fragile market, which has us concerned. Throughout the energy complex, we’re seeing the same story. Natural gas prices have plummeted 35% from their June high, and the outlook remains concerning, with lots of supply following an unseasonably warm winter and a cooler summer. Gasoline futures are back to the year’s lows, and diesel – a workhorse industrial fuel – has retreated to the lowest level in 14 months. On aggregate, the market is expressing a negative view of prices.

What commodity markets are telling us is that the demand outlook for commodities, especially oil, is not that strong. A lot of that stems from China, but we also see slowing growth rates across developed countries that have hampered demand. Chinese crude imports have been declining as we see further signs of demand peaking.

One of the big drivers is the rollout of EVs and hybrids, which are starting to have an impact. On top of that, you have the Sword of Damocleshanging over the energy market in the form of OPEC’s self-imposed production cuts. These cuts pose a looming threat in the form of rising spare capacity. However, the real danger might lie in their abrupt removal. Should OPEC decide to flood the market with excess supply, it could send prices plummeting, catching investors off guard and causing significant disruption to the energy complex. Of course, this isn’t our base case, but it is an ever-looming risk.

The market moves in cycles, especially commodity markets. You must be aggressive when the cycle dips and you have to be defensive when the market peaks. To do this effectively, you need to gauge where we are in the cycle. It’s not always easy to do. But from what we’re seeing, it does not appear that energy markets are setting up for their next big run. For energy stocks, the key driver is, of course, oil prices and without a strong trend, we’d expect choppy conditions.

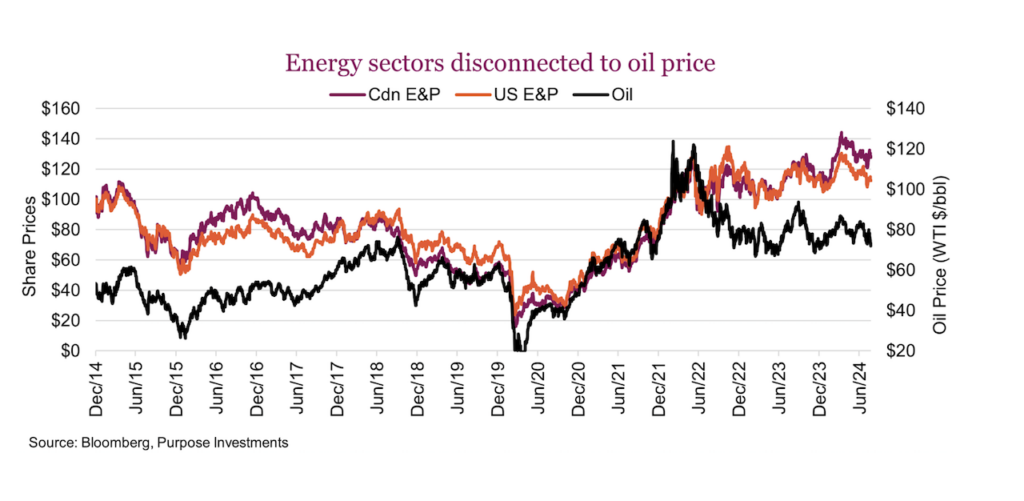

Energy sector performance disconnect

Given the rather uninviting commodity picture, the disconnect between the oil market and stock prices has been a bit of a head-scratcher. The chart below shows both Canadian and U.S. energy sectors, along with crude prices. Canadian stocks have held up better than U.S. peers, but both have been extremely resilient to weaker energy markets, which is slightly concerning. Considering producers are trading at levels that previously corresponded with higher oil prices, we believe there is risk in this gap. As such, we’ve grown wearier on producers. While there are still some great operators who are very shareholder-friendly with solid dividends and buybacks, valuations are not a screaming buy as they once were. We still like the space but simply believe less exposure is warranted.

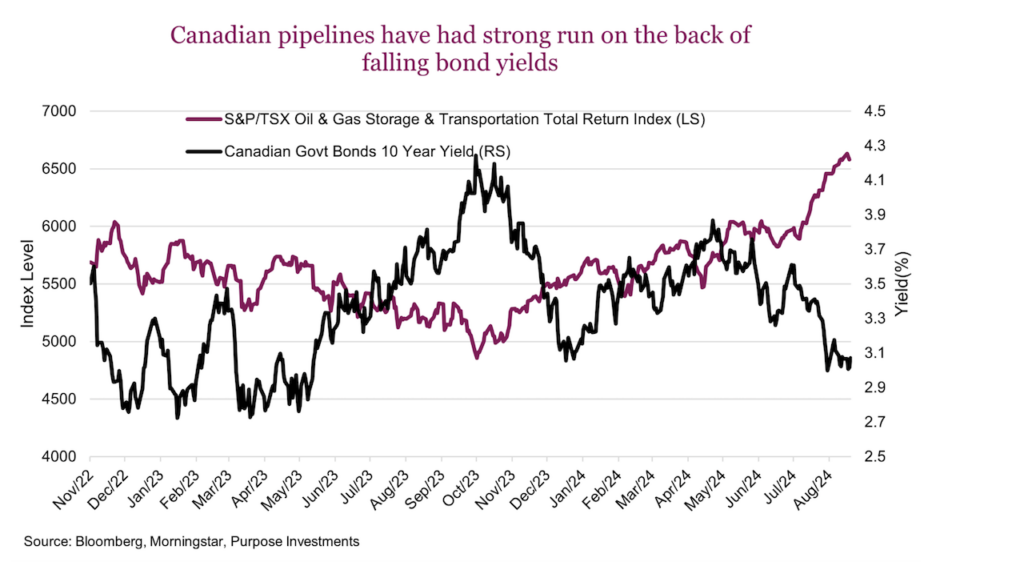

Pipelines: great run thanks to falling yields

Since the beginning of the year, Canadian pipeline stocks have been up over 20%. Most of that move has occurred since the beginning of the third quarter, with pipes rising nearly 15%. It was an incredible run, but momentum measures such as RSI are screaming overbought conditions. Peaking at over 90, RSI measures are currently 75 and falling. From a technical perspective, these stocks are overbought, and we expect further weakness. Pipelines rank very highly on our scale of interest rate sensitivity.

So, it’s unsurprising that this move coincided with plummeting bond yields. The Canadian 10-year yield is now 3% after falling 60bps since early July. Rates are now at the lower end of their multiyear trading range, and we believe it’s a good time to reduce rate sensitivity within portfolios. One of the easiest ways to do this is by reducing pipeline exposure.

Final thoughts

The energy sector is highly cyclical, often mirroring broader economic fluctuations. During economic downturns, demand for energy products can decrease, leading to lower prices and lower stock performance. Oil and gas companies have done a superb job of deleveraging and being very shareholder-friendly with increased dividends and buybacks. We still like the sector, but less so than previously. Raising some cash and diversifying away from energy should help spread risk across the portfolio as we head into a seasonally weak period for markets ahead of the U.S. election.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.