While December 1st brought out the bulls in nearly EVERYTHING, one area caught our attention.

In December 2019 I saw a similar chart showing an unsustainable ratio between equities and commodities which started me on the notion that something had to give.

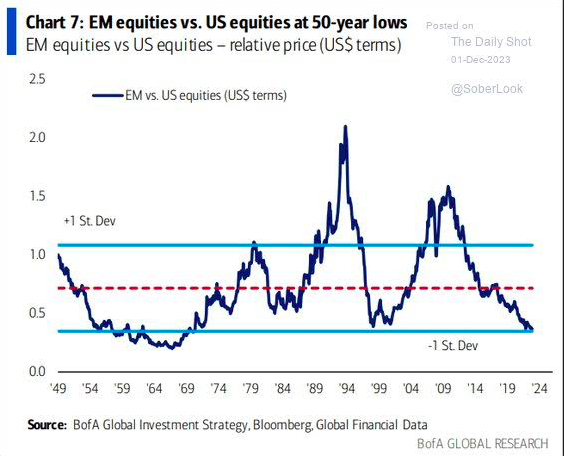

Now that I see this chart, with emerging markets at 50-year lows versus the U.S. markets, that does not necessarily mean the ratio will unravel in a month, or 2 or even more.

However, it does give us a focus for 2024 at least to watch emerging markets for signs that the ratio could narrow.

In 2020, after Covid, the equities to commodities ratio moved a lot.

It did not sustain though as many commodities peaked by June 2022.

But it was a great 2-year run.

Now in 2023, there is another ratio many are watching-growth and mega cap stocks versus value and small cap stocks.

Friday, we saw that ratio come in a bit with NASDAQ up .32% and the Russell 2000 up 3.09%.

Historical distortions of relationships can offer investors great opportunities in all trading timeframes.

With emerging markets, China has been under tremendous pressure while country funds like Brazil have done well (although still not keeping up with SPY.

The monthly chart of EEM is elucidating.

EEM iShares MSCI Emerging Market ETF ended November and began December very close to the 23-month moving average. (Compare this to SPY which started December about 3-4% lower than its all-time highs.)

So, for timing, we love these monthly charts.

Should EEM clear the 23-month MA that is a start. The risk would be clear, under the low of the month EEM close over the 23-month MA. Then, we would look to see if EEM can clear what appears to be the scene of the breakdown crime or at 42-43.00.

And that’s how you play ratios-you wait for price.

I will be away until December 14th. Look for my Outlook 2024 “If You Can’t Stand the Heat, Don’t Tickle the Dragon,’ to be out very soon. It is packed with ideas for the new year. Have a great couple of weeks!

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.