After a nice run higher during the middle of 2014, several emerging markets ETFs have stumbled into 2015, falling or underperforming other markets for the better part of the past 5 months.

After a nice run higher during the middle of 2014, several emerging markets ETFs have stumbled into 2015, falling or underperforming other markets for the better part of the past 5 months.

That said, the EM complex is starting to perk up with several individual country ETFs at important near-term levels.

So as we continue to monitor the Emerging Markets ETF (EEM) for clues over the coming days, we will also want to keep our eyes focused on some of the underlying emerging markets ETFs.

Emerging Markets ETFs Performance – A look under the EEM hood

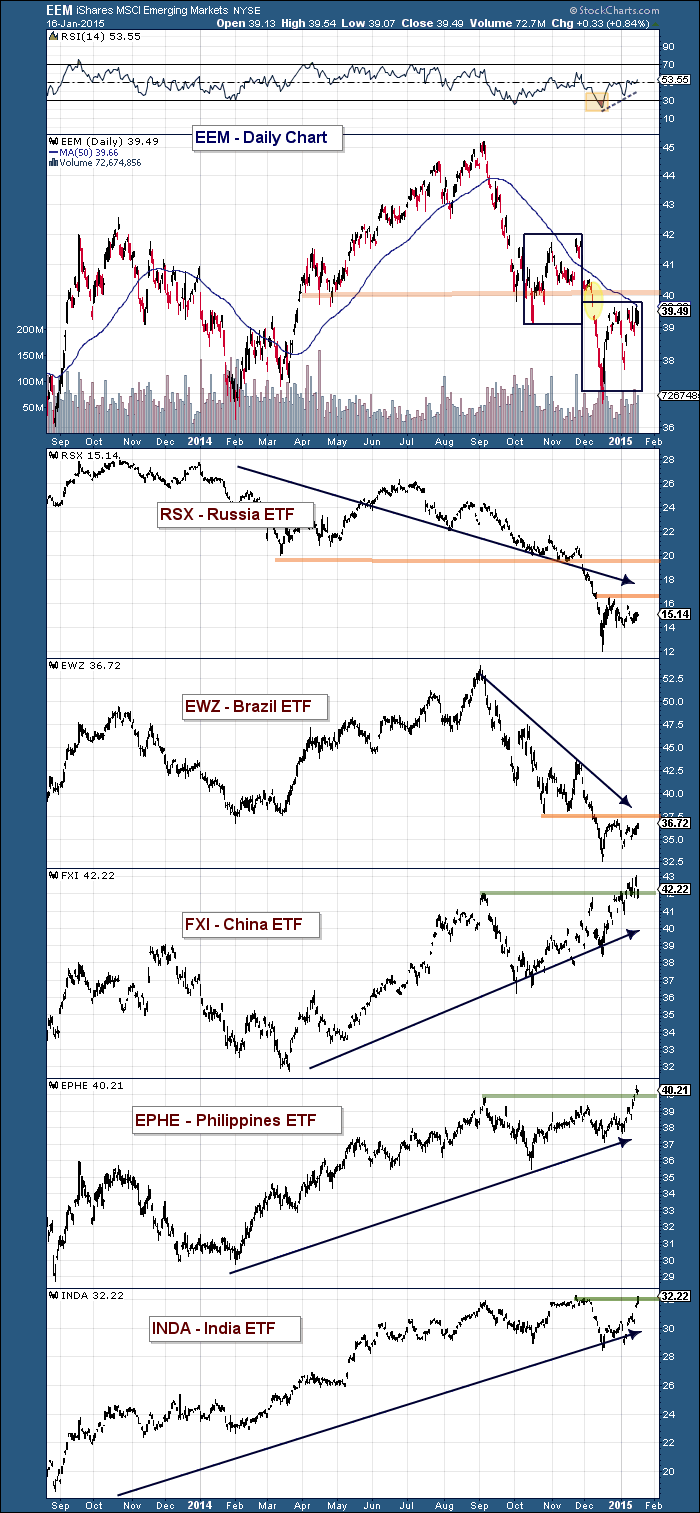

- EEM – Similar price pattern to October-November. Will this time be different? A breakout above the original December disconnect ($40.88) would bode well for the emerging markets complex. But with the ECB up next week, all bets are off. Patience and discipline will rule the day.

- Russia (RSX) – Russia played a big part in leading the markets lower. I wrote a piece on the Russian ETF last week, pointing out that a move above the December highs (16.53), could signal a trip back to $20.

- Brazil (EWZ) – Brazil is another laggard. Same chart setup as Russia… needs to crack the December highs ($37.20) to neutralize the situation. And considering the downtrend line, it may be better to wait for a move above $38).

- China (FXI) – China has been an out-performer. It’s no longer a true emerging market, but still a breakout on the EEM would likely do wonders for FXI as well. Note the chart below – it’s trying to break out above its December highs.

- Philippines (EPHE) – Another out-performer. Also attempting to breakout above its December highs. Fellow SIM contributor Mike Zaccardi wrote about the Philippines outperformance last week – it’s a great read for emerging markets investors.

- India (INDA) – The Indian ETF has been on fire, and is one to watch should EEM continue its bounce. It is testing its November highs ($32.38). That is the level to watch.

As mentioned previously, the ECB bond buying program (and details) will be something to watch in the days ahead. And with the financial markets attempting to digest a heavy load of volatility (and negative news cycle), it will be important to stay disciplined in regards to the emerging markets ETF complex. Have a great weekend.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.