The Emerging Markets sector has been a tricky play for active investors. 3 failed rallies in 3 years has left many with a poor taste in their mouths. And once again, the rally is on. Is it for real this time?

The Emerging Markets sector has been a tricky play for active investors. 3 failed rallies in 3 years has left many with a poor taste in their mouths. And once again, the rally is on. Is it for real this time?

The Emerging Markets ETF (EEM) has put together a strong rally out of the February bottom and is currently attempting to breakout above key resistance. But EEM has a few issues to mend before going primetime.

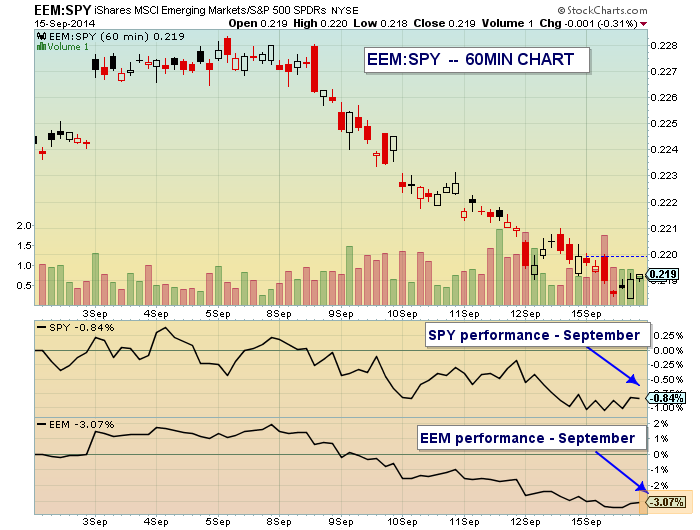

As Chris Burba pointed out in late August, the Emerging Markets have not performed well (generally) when the S&P 500 has gone limp. And with the S&P 500 currently in consolidation mode, EEM is quietly underperforming the SPDR S&P 500 (SPY) in September. This underperformance will need to give way to another strong move higher if EEM is going confirm a breakout. Check out the chart below.

EEM:SPY Performance 60MIN Chart

EEM currently finds itself caught in a swift pullback that has pushed the index back below its 50 day moving average. This will need to be regained, but before that can happen, the RSI indicator will need to bottom out. The RSI is currently at 36 and may need to push below 30 to trigger a strong oversold reading/opportunity.

As well, the Emerging Markets ETF is nearing a key support level around $43. This level represents lateral support, as well as a fast approaching uptrend line.

EEM Daily Chart

The $43 support level seems to be confirmed by the weekly chart as well. So if this breakout is for real, $43 should hold (give or take a percent). But, it’s worth noting that the long red weekly bar lower to start September is a bit ominous and will likely be tough to overcome near-term.

EEM Weekly Chart

Perhaps the US Dollar strength is finally is getting to the Emerging Markets. Or perhaps the Russian-Ukraine conflict is nearing a head. Either way, the technical battleground for EEM is at $43. Thanks for reading.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.