Emerging market stocks appear to be in trouble as investors look to the new year and try to unveil potential themes for 2025.

Underscoring the downward price action are plummeting interest rates in China.

Economic issues in China would be troubling for emerging markets (and the global economy).

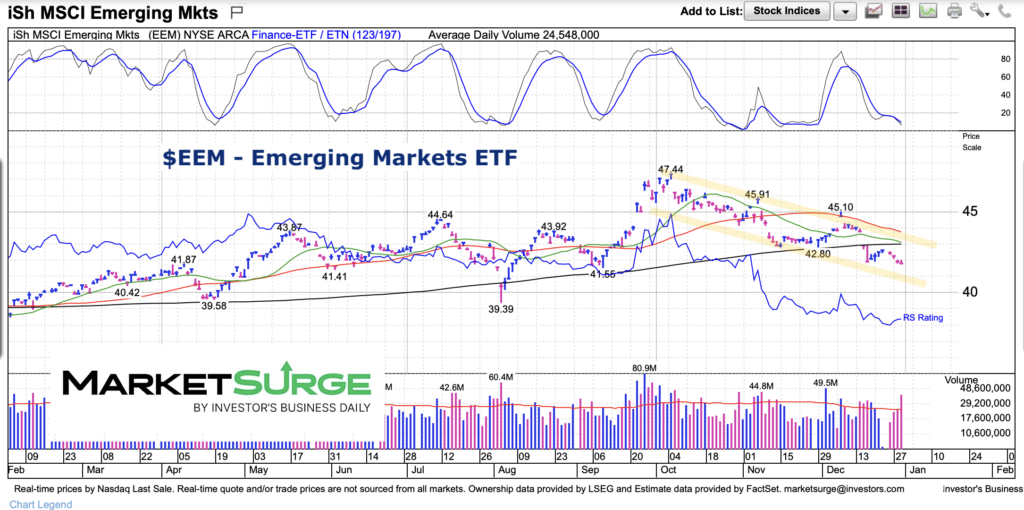

Today we look at a simple chart of the MSCI Emerging Markets ETF (EEM) to highlight the recent decline and concerns.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$EEM Emerging Markets ETF Chart

As you can see, the entire 4th quarter has seen EEM peak (47.44) before forming and trading within a falling price channel. EEM is currently trading below all 3 major moving averages an only a move back above them would neutralize sellers/bears. Keep an eye on economic data out of China… could become an early (bearish) theme in 2025.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.