The US Dollar is trading at elevated levels, even accelerating as Gold and Crude Oil trade lower (which is positive for the USD).

A stronger Dollar will likely have implications on precious metals gold and silver. And this could be why we are seeing Elliott wave point to additional downside.

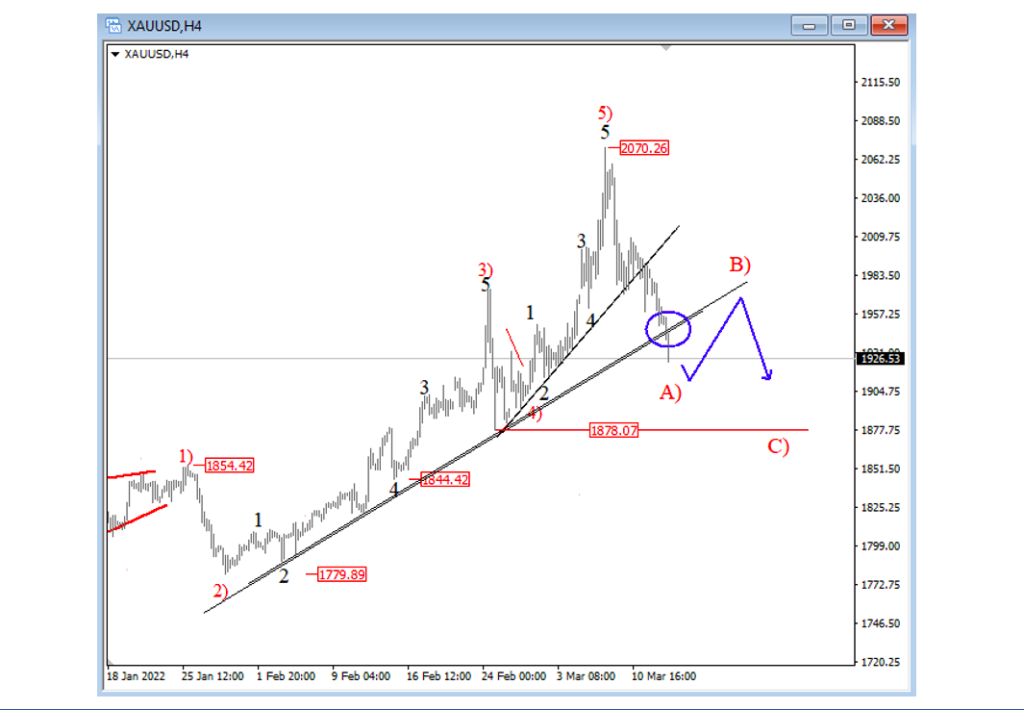

GOLD (XAUUSD) Elliott Wave Analysis

Gold came sharply to the upside as a “safe haven” asset based on the latest events in Ukraine. Higher inflation is also one of the reasons for higher metals, however the FED may try to limit the strength this week if the rate hike will be above expectations.

We have seen Gold coming above 1916, so this can be a break towards a new ATH. In the short term, however, we should be aware of an even deeper pullback as we see the price coming down from the highs with one leg. Currently, the broken trend line support from 1880 area can make a room for a retracement back to 1900-1880 area.

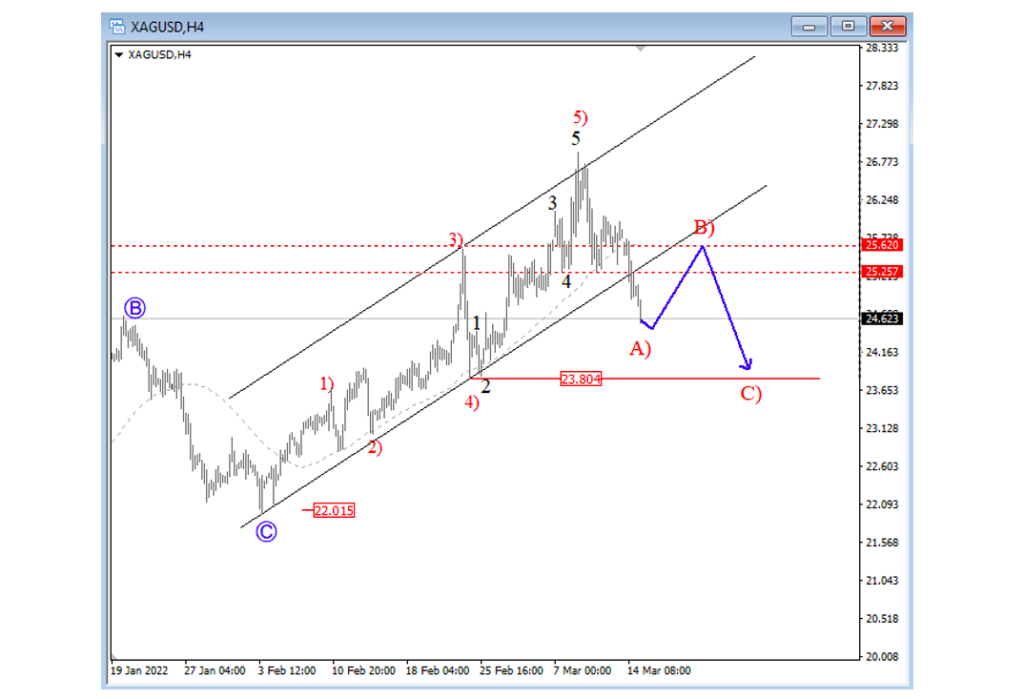

Silver (XAGUSD) Elliott Wave Analysis

Silver is coming down in the 4-hour chart after we noticed five waves up, so with broken channel support line, seems like it’s slowing down now within a higher degree A)-B)-C) correction, where first support could be at the former wave 4) and 23.80 level. Any bigger decline back below 22 region would be a serious signal that bears are back in the game.

If you like our work, you can check out our Elliott wave services.

Twitter: @GregaHorvatFX

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.