With concerns over China and global growth, the Federal Reserve took a dovish stance in today’s released FOMC minutes.

They want to exercise patience to see what the U.S. economy has in store for the second half of 2019.

Furthermore, they will consider an interest rate hike if the economy stays on track.

One could interpret the Fed’s minutes as proof that they have little idea as to exactly what monetary policy should be for 2019.

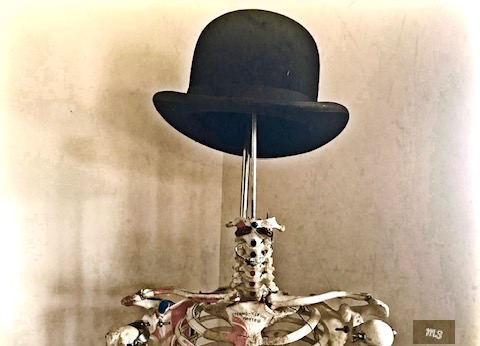

I chose this photo today (part of the Arnold Lieberman Private Collection), as it seems that for the Federal Reserve and both the global and U.S. economies, this latest rally could be as thin as a skeleton.

A skeleton that dons a bowler hat.

Why a bowler hat?

These hats, also known as “billycocks”, were created for gamekeepers so when they were out riding, they could protect their heads from low-hanging branches.

These hats, also known as “billycocks”, were created for gamekeepers so when they were out riding, they could protect their heads from low-hanging branches.

Does the FOMC’s hesitation on further balance sheet reductions protect investor’s heads from low-hanging resistance?

I realize I have been a bit repetitive concerning recent levels in both the Russell 2000 (IWM) and the Transportation Sector (IYT) over the past week.

From Tuesday:

“If IWM does clear 157, what’s next? Last week, we surmised that if IYT stays robust and IWM clears 157, we could see 200 and 160 respectively. The 200-DMA is above at 157.97 (now 157.88 since slope is negative). Furthermore, the November 8thswing high was 157.90.”

Today, after the announcement, IWM held 157. IYT remains roboust.

Yet, IWM has yet to visit the overhead 200 DMA or the November 8thswing high.

Plus, IYT, after all is said and done, had an inside trading day. (traded inside yesterday’s trading range.)

Regardless of what the S&P 500 and the Dow do, the levels in IWM and IYT are still most compelling.

With IYT’s inside day, watch which way that range breaks tomorrow. Additionally, watch to see if IWM can close above 157 or not.

Bowler hats were worn by Churchill, Oddjob, the evil henchman in “Goldfinger,” Charlie Chaplin, Laurel and Hardy, Lou Costello and Alex Delarge from Clockwork Orange.

In other words, the hat makes a wide-range of statements.

Kind of like the Fed has done since 2018.

Is this rally becoming as thin as a skeleton?

Watch who’s image appears under the bowler hat.

S&P 500 (SPY) – 280.40 the last December swing high before the crash. 276.00 is the important support to hold on a closing basis

Russell 2000 (IWM) – 157.03 is the 50-WMA and 157.88 the 200-DMA. November 8thhigh 157.90. There’s your resistance. And under 157, especially on a closing basis a sell signal.

Dow Jones Industrials (DIA) – 258.00 support. With 260.30 the last swing high in December before the crash.

Nasdaq (QQQ) – 171.99 the 200-DMA now the level to hold.

KRE (Regional Banks) – 58.18 the 200 DMA overhead with 56 the best underlying support

SMH (Semiconductors) – 104-105 resistance with 102 is the immediate area to hold.

IYT (Transportation) – Inside day making the range 189.20-192.27 the range to watch break one way or another.

IBB (Biotechnology) – 109.92 the pivotal point. 112.60 resistance

XRT (Retail) – 44.67 pivotal for the week. 46 resistance

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.