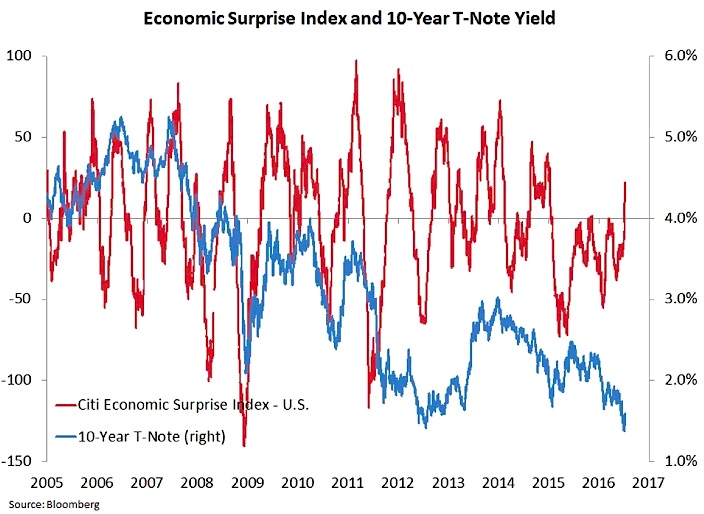

The equity markets traded higher for the third week in a row, as the stock market rally continued in earnest last week. The Dow Jones Industrials (INDEXDJX:.DJI) and S&P 500 Index (INDEXSP:.INX) hit new all-time record highs. Stocks were supported by the first net inflow into equity mutual funds since April. Investors poured $11 billion into stock funds reversing a nearly year-long trend out of equity funds.

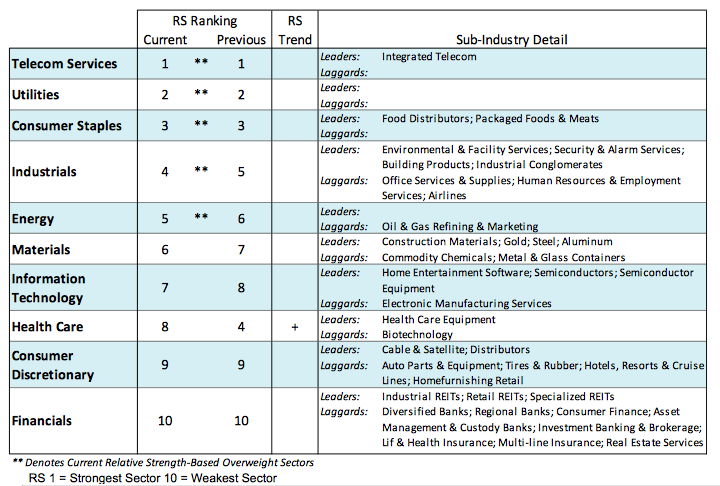

Additional support for the recent surge in stocks can be found in the improving economic growth data. It is now estimated that second-quarter GDP climbed to nearly 2.5%, from 1.1% in the first quarter.

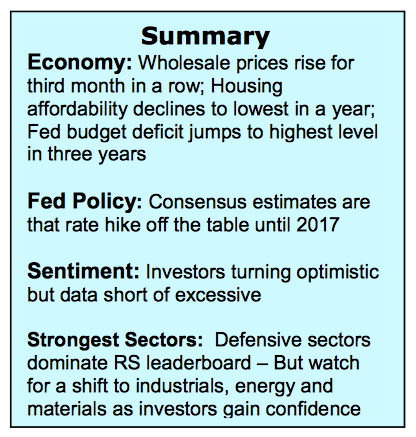

As a result, stocks are enjoying the best of all worlds with economic growth returning, albeit modest growth, and near record-low interest rates. The surge to new highs has prompted investors to become more optimistic, but the uncertainty surrounding global prospects and political events continues to anchor sentiment. This is readily seen in the latest report from Reuters/University of Michigan Consumer Sentiment Index which plunged to a three-month low.

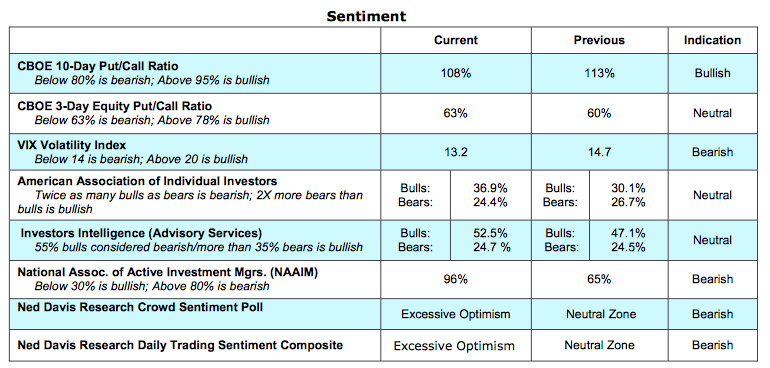

Stocks enter the new week overbought, which could lead to a period of weakness. But any pull-back in stock prices is expected to be limited in both time and price given the favorable technical support and the likelihood of improved earnings in the second part of the year. New funds should concentrate efforts in mid-cap stocks focusing on the industrial, materials and energy sectors.

Technically, there has been significant improvement in the broad market in 2016 suggesting the current stock market rally has room on the upside. Since the February 11 low, industry group trends have turned higher with the process accelerating this month. Additionally, the number of stocks making new highs has expanded in recent weeks and the number of issues making new lows has fallen off the cliff. On a short-term basis the largest negative is the increase in investor optimism. The Chicago Board of Options Exchange (CBOE) reports a plunge in the demand for put options last week (investors buy puts in anticipation of a decline in stock prices). The CBOE Volatility Index (VIX) dropped 50% the past three weeks indicating fear has left the building. More worrisome, the National Association of Active Money Managers shows an unusually big jump in the allocation toward stocks by this group of professional investors to a level last seen at the May 2015 peak. The change in the mood of investors and an overbought condition could lead to some near-term weakness. But in an environment of record- low interest rates, investor optimism would likely need to become deeply seated (not easily dislodged) and more widespread before presenting a risk to the bullish trend and momentum now in place.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.