The big focus this week is on whether the Fed will either hike rates, announce Quantitative Tighening (QT) aka balance sheet normalization, do both, or do nothing…. but a bigger set of trends are playing out at a global level in the monetary policy space.

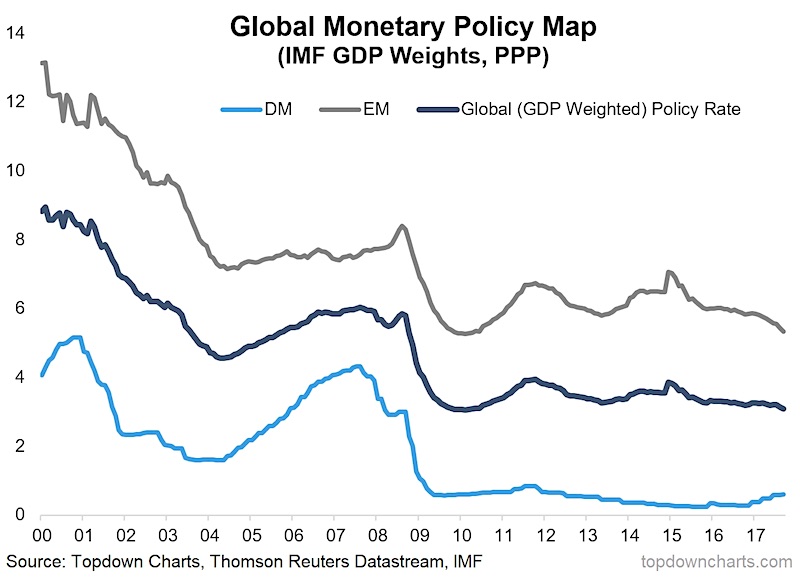

The key chart in this article came from a previous edition of the Weekly Macro Themes report, and shows the trend toward global monetary policy convergence.

At a global GDP weighted level, the composite monetary policy rate has been drifting steadily downwards as easing in emerging markets has offset nascent policy normalization in developed economies.

But there’s more going on under the surface…

Within emerging markets the first wave of easing was the Asian economies such as China, and more recently it’s the commodity producers such as Brazil, Russia, and South Africa – who’ve experienced more stable currencies and thus have had less of an imperative to defend their currencies with high interest rates.

But the main point is that at an aggregate level emerging market economies are net-cutting interest rates, and historically this has had a stimulatory effect on growth in emerging market economies.

At the same time the monetary tides are turning in developed economies: monetary policy normalization is now well underway in America, and Canada is now also hiking rates, and the ECB has probably reached a turning point in its easing program.

The result is convergence in global monetary policy rates, and on balance actually a lower global GDP weighted policy rate as the easing in emerging markets offsets the tightening in developed economies. At a global level this should mean a net-positive impulse to growth but it also may create some divergences in economic performance and is sure to result in more differentiated opportunities across global markets. So this is likely to be a key theme for investors.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.