eBay Inc. (EBAY) reports 2Q earnings on Thursday morning. There’s been a lot of chatter around the upcoming eBay spinoff of PayPal and how the company will fare without its payment division. That spinoff is set for Friday, making this the last quarter that Paypal will be a part of eBay earnings.

According to Estimize, analysts are expecting eBay earnings to come in at .72c EPS on 4.48B in revenue. Note that the company tends to lowball EPS guidance – They’ve beaten on EPS for at least the last 8 quarters per Estimize.

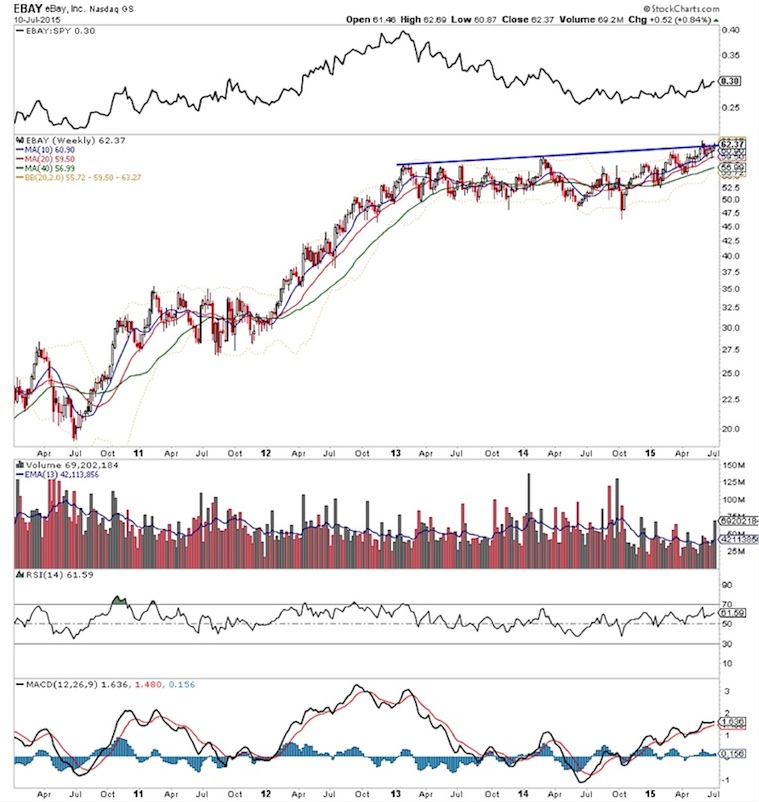

Looking out longer term, we see a multi-year trading range break with a rally capping resistance line in play. This line holding into earnings isn’t what bulls want to see. The question now is: Can eBay’s stock price successfully break out above this price resistance?

eBay Weekly Stock Chart

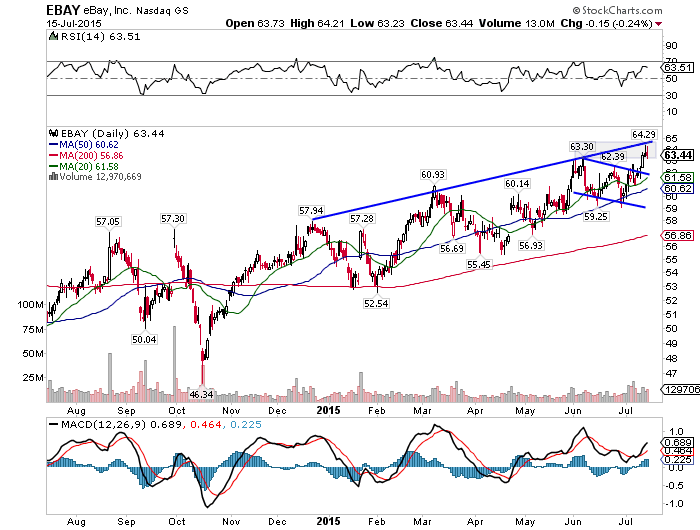

Zooming in on the daily chart, we can see that the near-term trend is young, but still pointing higher. The 63.00+ level is proving important as price has traded in a 5 point range for the past 2 months (and the level coincides with resistance on the weekly chart as well).

The 59.00-60.00 level is a key price support area. Depending on eBay earnings and guidance, perhaps this level will be a ‘buy on weakness’ area. The next support/pivot level for the stock resides at 57.00.

Right now, though, eBay stock bulls are watching (and waiting) for a convincing breakout above the rising weekly and daily resistance line.

eBay Daily Stock Chart

Thanks for reading, trade ‘em well!

Twitter: @ATMcharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.