The stock market continues to trade near all time highs as investors climb the wall of worry.

Yes, the there are plenty of worries: the presidential election, war abroad, government debt, the economy, interest rates…

BUT, the most important thing is the price action. And this has been bullish on the broader stock market indices but neutral to bearish on several underlying sectors.

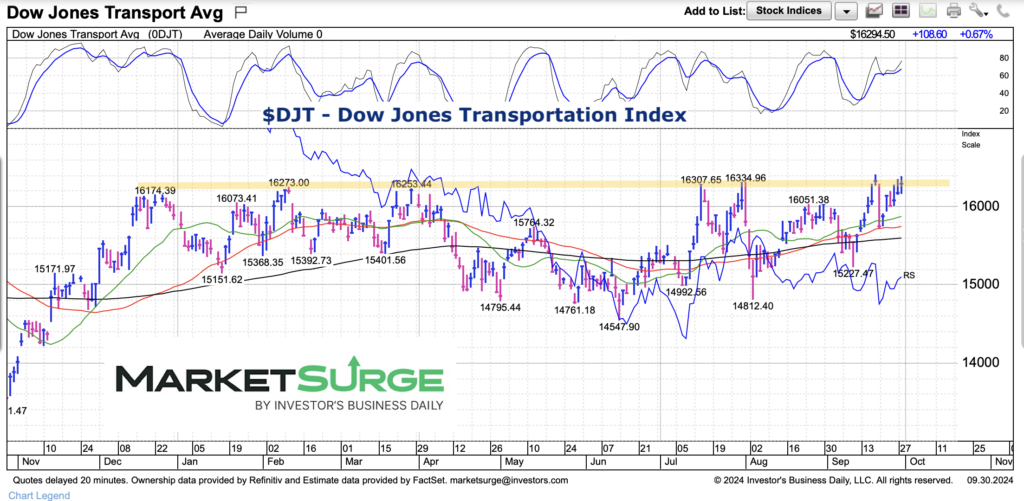

And one of those sectors is the transportation sector… in stock market purposes, the Transportation Sector ETF (IYT). Today we highlight the under-performance as well as critical price resistance.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$DJT Dow Transportation Index Chart

The Transportation Sector ETF (IYT) has traded sideways for the past 10 months. And, as you can see, the price action has created very strong resistance level around 16200-16400. Bulls are hoping for the breakout… but it’s wise to be patient.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.