Long-term chart resistance may slow the pace of the European stock rally.

We have been noting of late the relative improvement among international equity markets. This even includes a recent pickup in the perpetual laggard, Europe. Now, there are several markets in Europe that, in our view, actually look very attractive, as members of The Lyons Share know. However, the broad European measures (that are heavily weighted toward core countries) have, for the most part, lagged for many years, if not decades. That has not been the case since December, however, as the continent has been on a solid run. That run may at least see the pace of its advance slow down here, though, based on the charts.

A couple weeks ago, we suggested that the rally in the Dow Jones Industrial Average (INDEXDJX:.DJI) may have “Reached Its Speed Limit”. Our reasoning was that the index was hitting the upper bound of its post-2009 rising trend channel. And while not a roadblock to further gains, we surmised that it may serve to limit the pace of advance. As it turns out, its progress has slowed in recent weeks as the DJIA has actually drifted lower since that post. We see a potentially similar limiter in the European stock rally as well.

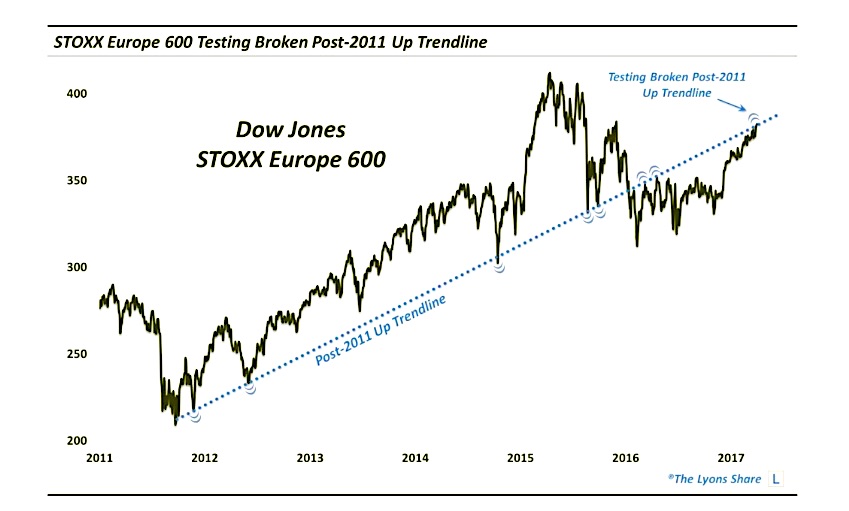

From Fall 2011 through 2015, the Dow Jones STOXX Europe 600 Index was supported by a well-defined Up trendline, with no fewer than a half a dozen nearly-precise touches. These included October and November 2011, June 2012, October 2014 and August and September 2015. At the beginning of 2016, the trendline was finally broken. Subsequently, the former support began to serve as resistance, repelling prices in March and April 2016. One year later, the STOXX 600 has again returned to challenge the underside of this broken post-2011 Up trendline.

Will this trendline pump the brakes on the STOXX 600 rally as a similar line did for the DJIA? That remains to be seen. The rally in Europe still has some decent momentum behind it so it very well may continue its upward trajectory. However, again, the rally may see its speed limited by this trendline.

That is, of course, unless the index can accelerate its ascent and reclaim the top side of the trendline. In that case, the European rally may well be merging onto the Autobahn. Get more charts and insights over at our new site, The Lyons Share.

READ: Tech Leaders Pass Key Trend Test: AMZN & GOOG

Twitter: @JLyonsFundMgmt

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.