On May 4th, CBOE Global Markets (CBOE) reported better than expected results, topping expectations for EPS and revenue for the first quarter.

Despite the positive results, the stock is down over 14% year to date.

Whether it is warranted or not, Volatility Index (VIX) and other tracking ETF’s and ETN’s have been partially blamed for underperformance in the equity markets earlier in the year.

As investors reevaluate valuations of the $12B options exchange, CBOE currently trades at a P/E ratio of 23x (2018 estimates), 4.52x sales, and 3.86x book value. Options and futures average trading volume for the month of April weren’t promising either, dropping 7.8% and 7.2% year over year, respectively.

Technical Analysis

$CBOE Weekly Chart

The 2 year weekly chart of CBOE shows the massive run from the low $60’s into the $130’s in less than a year and a half. As all good things must come to an end, the uptrend ended in February. Shares continue to print lower lows and lower highs, now pushing back towards the $100 level.

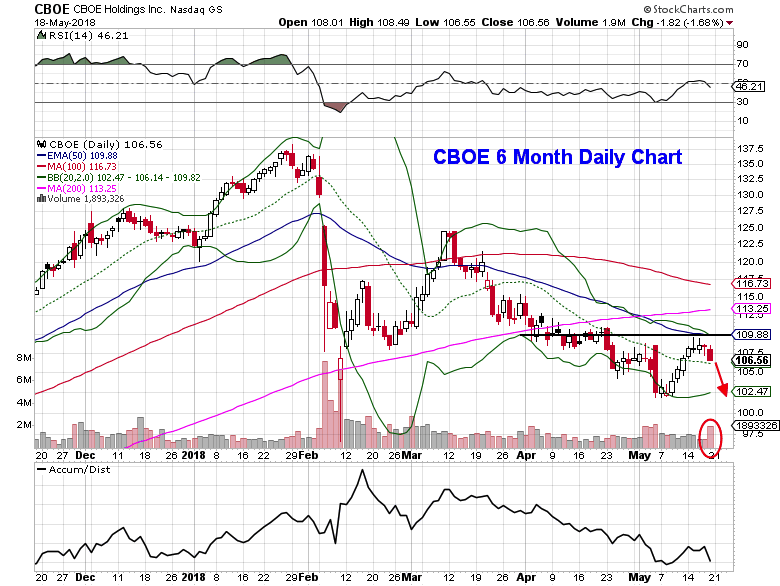

$CBOE Daily Chart

Zooming into the daily chart, last week’s price action gives traders a chance to short CBOE with a buy stop loss above the $110 resistance level (near the 50-day moving average). The first level of support to watch for is near the May low’s ($101-$102). Below there the 2018 low beneath $97 is likely to be revisited in the coming months.

CBOE Options Trade Ideas

I am looking at the June 18 $100/$105 bear put spreads for a $1.20 debit or better

1st upside target would be $2.00

2nd upside target would be $3.00

OR

Consider the June 18 $110/$115 bear call spreads for a $0.70 credit or better

Stop loss reference: a close above $110 in the stock

Depending on style of trading, both options strategies are a way to position for a move lower in the intermediate-term. The first trade offers a clear defined amount of risk with the potential to make $3.80 per spread. The second spread is a neutral to bearish trade that is profitable as long as the stock doesn’t move above the short strike ($110). Shorter term credit spreads put time on ones side, but they do require discipline. As a rule of thumb it is best to consider cutting losses if the underlying moves above the $110 level.

Twitter: @MitchellKWarren

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.