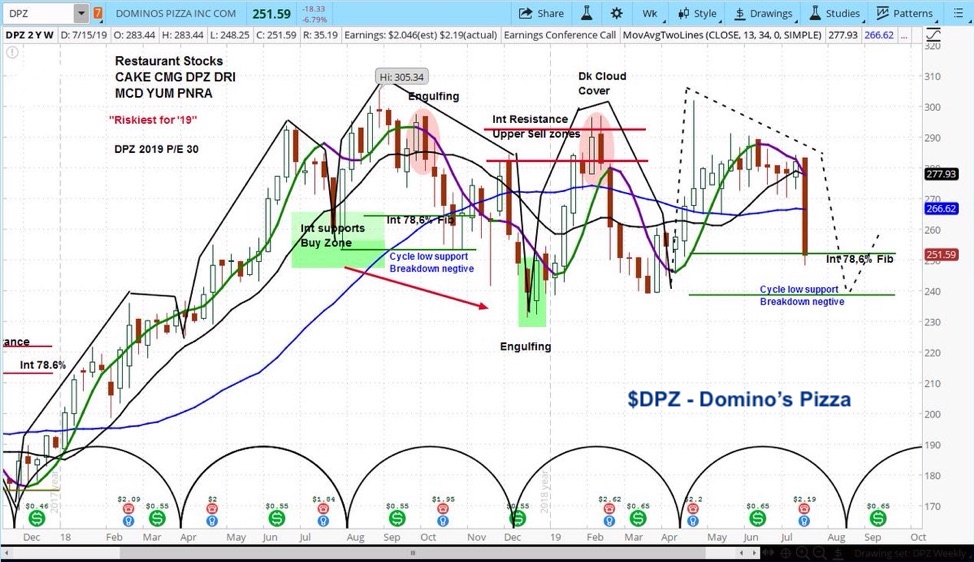

Domino’s Pizza (NYSE: DPZ) Stock Weekly Chart

Domino’s Pizza (DPZ) fell by 8% on Tuesday after the company posted earnings that beat Wall Street expectations – but missed on sales.

Based on its market cycles, we believe the stock has more downside risk in the coming weeks.

Domino’s Pizza reported earnings per share of $2.19 and total revenue of $812 million, compared to analyst estimates of $2.02 and $837 million. The company’s same store sales rose by only 3% compared to the expectation of 4.6%.

Nonetheless Domino’s CEO Ritch Allison insisted that, “It was a good quarter, particularly for global unit growth, as we continue to seek balanced retail sales growth through the blend of same store sales and store growth.”

Our approach to stock analysis uses market cycles to project price action.

We believe that DPZ is in the declining phase of its current cycle. Our near-term target is $238.

This stock is on our “Riskiest” list for 2019. We have continued to warn, as patterns were negative and it’s been weak in comparison to the overall market.

For a more detailed analysis of both of these charts, check out the latest episode of the askSlim Market Week show.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.