The latest decline in crude oil prices may be offering another “trading” opportunity on the long side.

We are getting long WTI based on the research below (and comments on today’s chart).

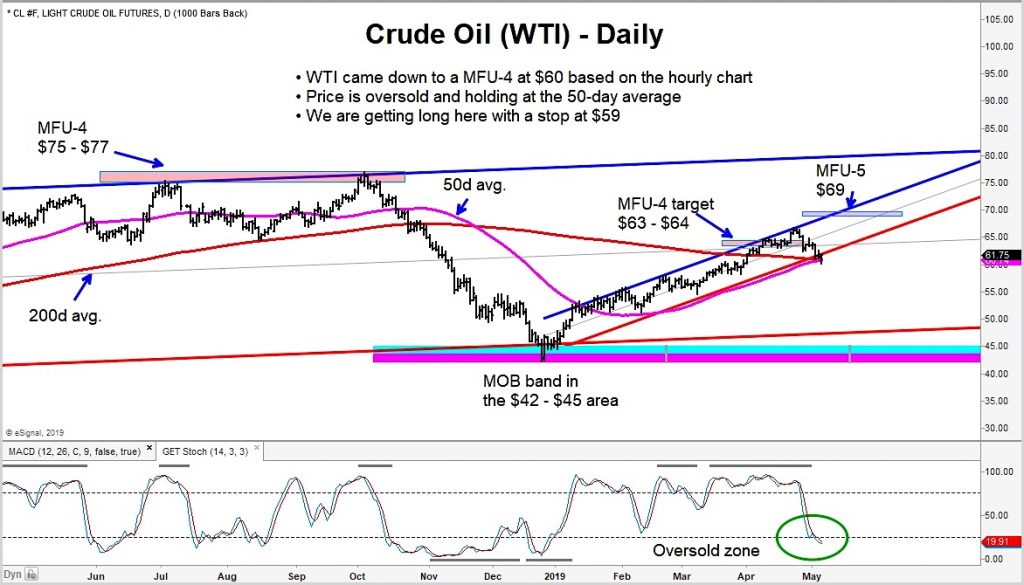

Crude oil came down and touched $60 price support yesterday.

Price is attempting to stabilize above support, including the 50 day moving average.

Note that we are using a tight stop at $59 and have an upside target as high as our MFU-5 price target $69.

Should crude oil bounce higher, traders can take profits along the way, raising stops. Should crude oil break lower, your $59 stop loss should limit downside.

Crude Oil Futures “daily” Price Chart

The author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.