Summary: After a few years of really lagging the broader market, dividends have enjoyed a strong catch-up trade since the end of June. Lower bond yields appear to be the primary driver, helped by cooling inflation and slowing economic activity.

Now with dividends somewhat overbought in the short term, where do we go from here?

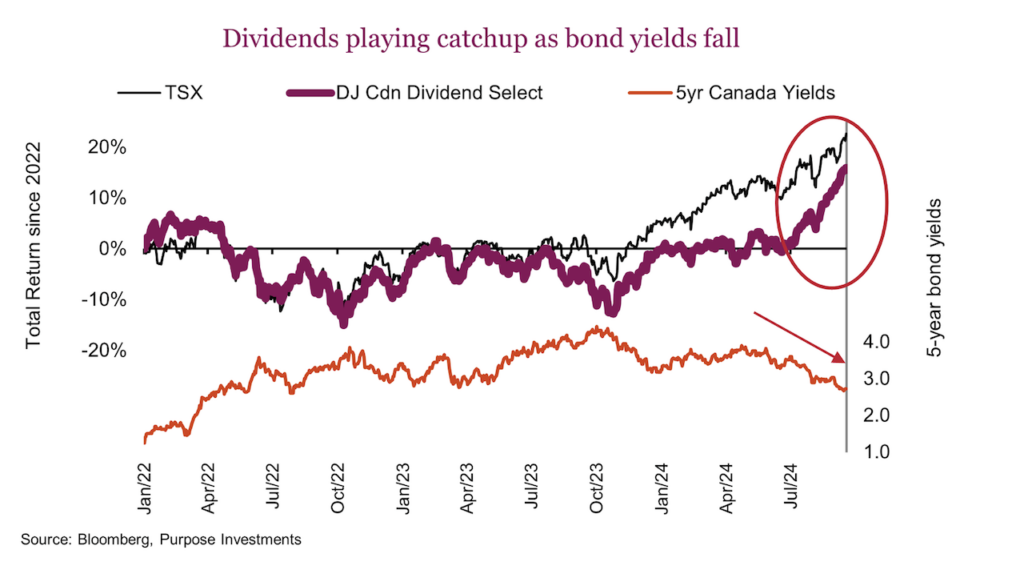

As of June 30th, the halfway point of the year, the TSX was up about +6%. Meanwhile, dividend stocks, as measured by the DJ Canadian Dividend Select index, were marginally better than flat (+0.9%). Even worse, dividend stocks were actually flat over a 2½ year long period, measuring back to the start of 2022, as the TSX rose +12%.

Dividend stocks were in the dumps or lagging the broader market for so long for a number of reasons –the biggest being bond yields.

As bond yields moved higher, there were simply many choices for yield that didn’t exist in previous years. Cash was paid decently, and bonds from governments with high yields offered yields not seen in many years. Preferred shares were up there, too. Higher bond yields created attractive yielding options across many asset classes. All of a sudden, those dividend stocks had some serious competition.

So, the prices of dividend stocks ground lower due to increased competition, and as a result, the dividend yield kept climbing higher. Pipelines touched a yield of 8%, banks 5.5%, utilities over 5% earlier this year, and telcos reached 7.2% a couple of months ago.

But then bond yields started to fall on the back of slowing economic activity and confidence that the pace of overnight rate cuts would accelerate. Dividend stocks started to fly. Since the end of June, banks have gained 16%, pipelines have gained 14%, telcos have gained 11%, and utilities have gained 13%. In fact, gyrations in bond yields are driving both the relative and absolute performance of dividend stocks of late.

Of course, this now begs the question: Was it too far, too fast? There is no denying that many dividend stocks are in overbought territory on a technical basis. We looked at 14-day relative strength across the constituents of the Dow Jones Select Dividend index, and the average today is 64. That is at or near the highest level over the past 25 years, so certainly a bit cautionary.

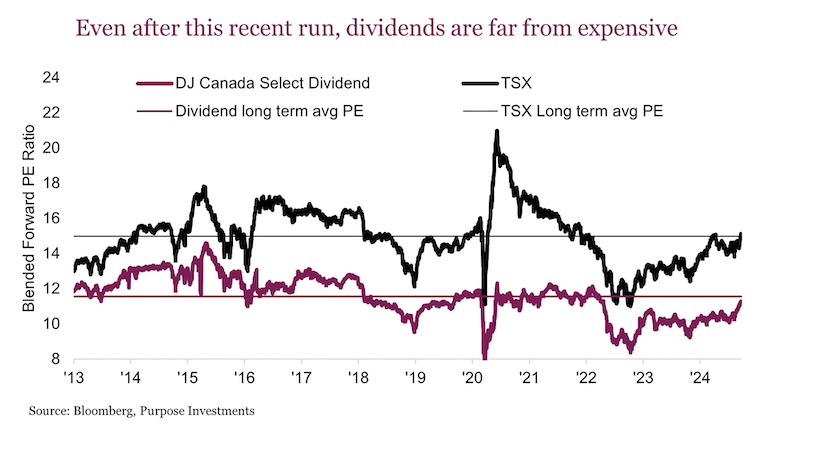

But after so many years of lagging, it certainly could have a longer run to go. Let’s talk valuations. The Dividend index, even after this partial catchup run, is trading 11.3x forward estimated earnings. That is getting close to the long-term average of 11.5x, certainly not overvalued. Plus, the spread to the broader market is currently 3.8, which is still pretty wide.

The BIG question is, where do bond yields go from here? Everyone knows, including the market, that central bank overnight rates are on the way back down. Still, for dividend stocks, bond yields are a bit further out and have a bigger impact on prices. So, 5-year Canada yields rose to about 4.3% in late 2023 and have since decreased to 2.75%. That is down 150bps, 90bps of which occurred since the end of June when dividend stocks started their catch-up run. There is no denying economic data has been weak in Canada during this time, and CPI inflation has been low. This has all helped.

We are not convinced bond yields will go much lower. This lever to help dividend stocks may be near the end of its positive price influence. That applies to inflation, too. There was lots of celebration around the year-over-year number coming down, but it just rolled off back-to-back 0.6% from last summer. The headline was going to come down unless we matched those huge inflation months. But now, it is all small numbers falling off, so for the headline to come down, we would need actual disinflation.

If the Canadian recession risk continues to rise, it will certainly put more downward pressure on bond yields. However, this is not a linear relationship between bond yields and dividend stocks, it is more quadratic. The further down bond yields move, the more the positive yield competition factor fades and the higher the recession risk. The more bond proxy utilities, staples, and pipes may still do well, but others like banks, telcos and real estate will not. Still, it’s pretty early to get recession excited. Yes, the data is softer, but not many recession alarm bells are ringing just yet.

Final thoughts

The dividend factor has been in the dumps for the past few years, and this recent catch-up is encouraging. It’s clearly not early innings, but it’s likely not late in the game, either. Valuations are still favourable, and bond yields could tick a bit lower.

But don’t forget why so many Canadians have a decent tilt towards the dividend factor: 1) The dividend yield is attractive, more so these days, 2) some decent tax treatment helps, 3) they are defensive, which does have them lag in big up markets but retain value better in downswings, 4) dividends grow over time, historically faster than inflation, providing valuable portfolio purchasing power protection.

We are probably missing some points, but generally, dividends are cool again.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.