Yesterday we tried to make it easy for you.

The Retail Sector ETF (XRT) told us a lot after the economic data already out earlier in the week (CPI PPI), and then the retail sales and earnings reports that came out today.

We wrote, “For those playing along, the number (to watch as pivotal) is 73.50-write it on a post it and paste it to your computer screen.”

Then, Warren Buffett posted his most recent holdings.

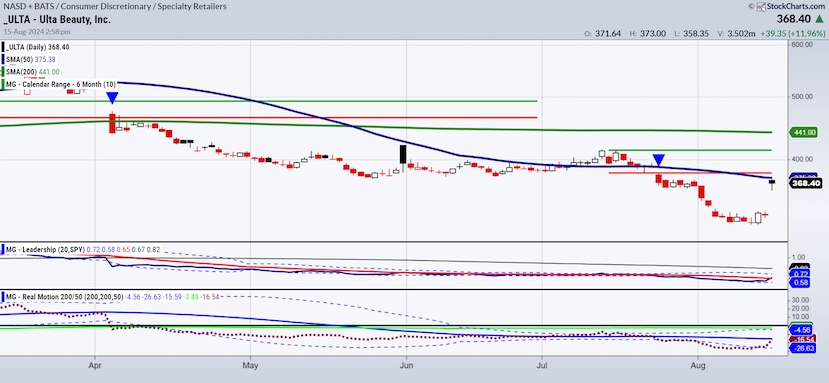

His biggest addition to his portfolio is the 680,000 shares of Ulta Beauty (ULTA) he bought. This came on the heels of my video (posted below). I recorded the video this past Monday on how to buy that stock.

Plus, I have been keen on the “vanity” trade, of which Ulta fits right in.

So, not only did the Retail Sector ETF (XRT) soar, but the whole market also perked up.

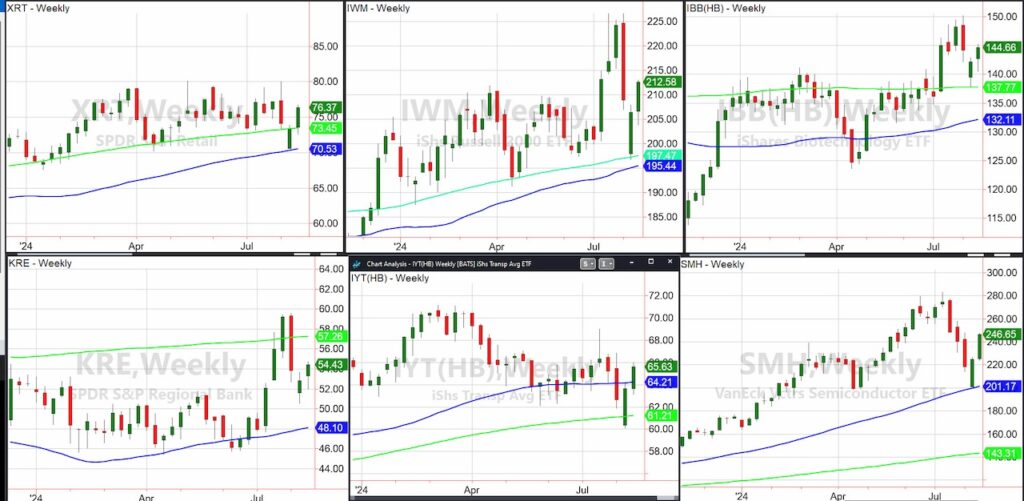

This is a great time to reexamine the Economic Modern Family and their weekly charts.

XRT handily cleared the 200-week moving average. Now, the overhead resistance is key, as well as the importance that the 200-WMA holds as support.

Note that ULTA Daily chart (not weekly) also rallied right into resistance. Hence, that stock needs to clear both the 50-DMA and the July 6-month calendar range low (red horizontal line).

Moving on to the Russell 2000 IWM, Gramps was already in better shape even on the huge down day, as it never failed the 200-WMA.

Now, IWM has to clear 215 and then 227. And IWM must now hold around 205 or this week’s lows.

Biotechnology IBB was the one I mentioned on Fox as significant because it well represents speculative cash flow.

No surprise that IBB held the 200-WMA last week. This week and into next week, we will watch 150 resistance.

Of course, it’s our Sister Semiconductors sector SMH that has the most cultish following. SMH not only held the 50-WMA last week, but now this week cleared 240, a very pivotal area. Can SMH keep going? Maybe.

If SMH fails 240, I would not get too excited about new highs anytime soon.

Transportation has been our sticky family member all year.

IYT directly ties in with retail-if people are buying, goods are moving. Hence, today’s exuberance around retail certainly spilled over to Tran.

Now, the 50-WMA must hold up. And, before anyone gets too excited about a huge economic growth spurt, there is a long way for IYT to go to get anywhere near its 2024 highs!

Regional Banks KRE rose in price some but not enough to be trade worthy.

KRE is stuck between the 2 weekly moving averages. The best takeaway in this sector is that all it needs to do is hold up over the 50-WMA. Any break would be a warning that something is up in the banking area.

And if KRE gets happy, you will see it clear back over the 200-WMA.

Finally, to answer the title question-did Retail and Warren Buffett save the market?

Nothing about our areas to watch has changed.

- Long bonds TLT over 100 is a warning

- Junk Bonds strong, but must stay that way

- Stagflation is still a theme especially with oil, gold, silver and copper acting well.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.