After a sharp selloff last week, four key Technology ETFs all tested and held their rising 200-day moving averages, a very important long-term trend signal.

Nasdaq 100 ETF – Nasdaq: QQQ

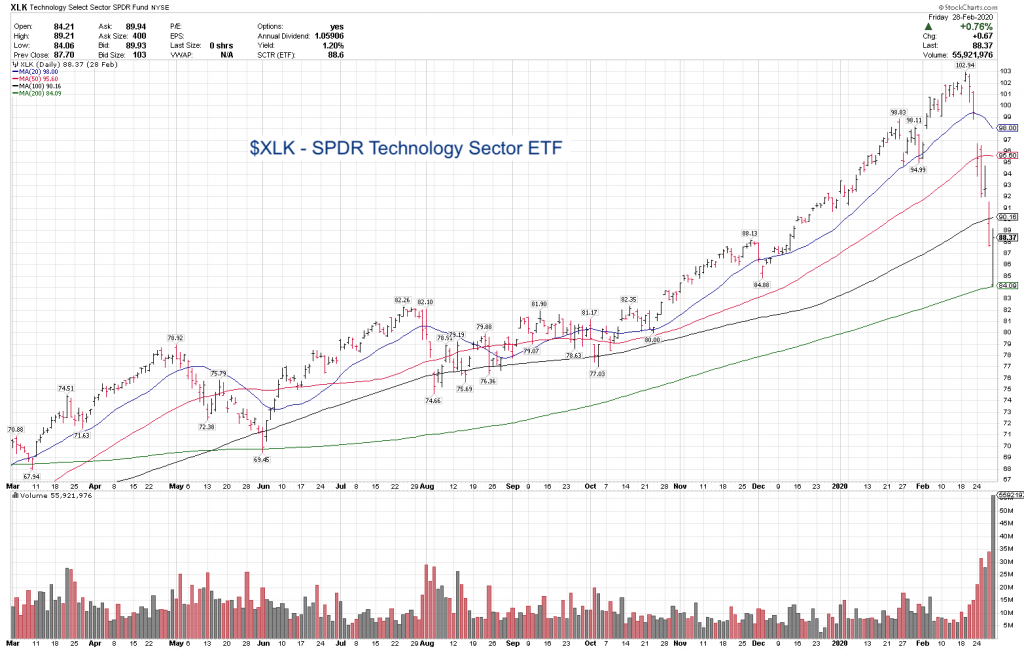

Technology Select SPDR – NYSEARCA: XLK

VanEck Semiconductors ETF – NASDAQ: SMH

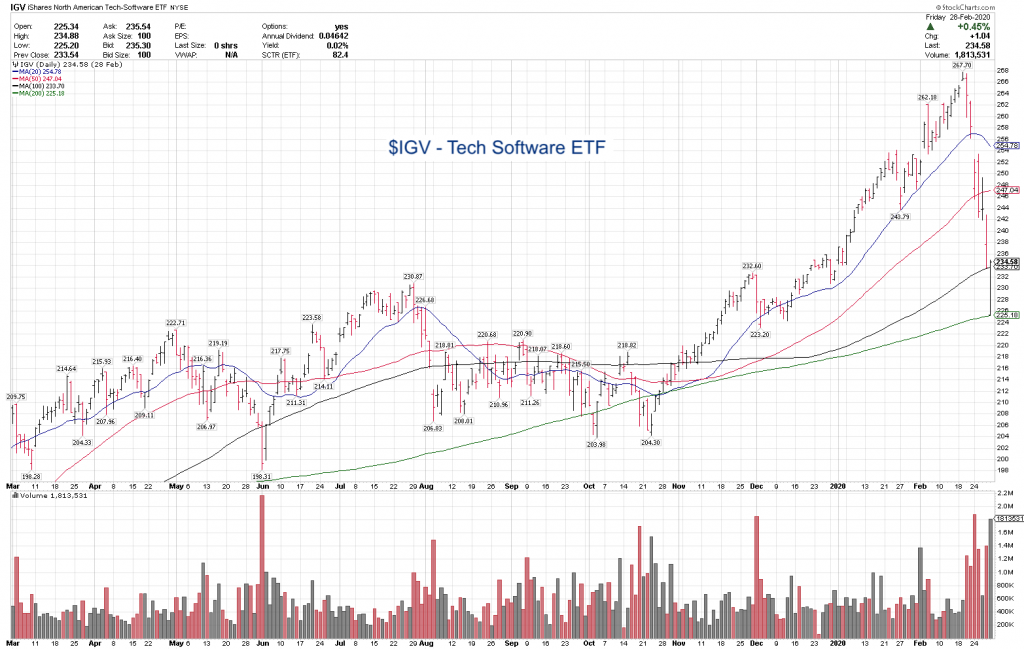

iShares Tech-Software ETF – NYSEARCA: IGV

For many trend followers and technical position traders like myself, the 200-day moving average is considered the most important final line of support, and key longer-term trend indicator.

The technical price action was bullish, a gap down to the 200-day, a rally, a few intraday pullbacks and then closing on the highs of the day, on very high volume.

These are all very strong key price signals. In a normal news flow environment, these would be considered major ‘all-in’ buy signals. The wild card here is the uncertain news flow of the Coronavirus. Healthcare news flow creates a different level of uncertainty than regular financial market news like trade tariffs and recessions, which are easier to quantify.

With healthcare news, we don’t know what we don’t know yet.

From a purely technical perspective, last week’s 200-day test and hold, on massive volume is very bullish on it’s own for now. As long as last week’s lows hold, this 200-day MA signal offers high potential reward vs defined risk.

Larry is the publisher of the Blue Chip Daily Trend Report.

Twitter: @LMT978

The author has a long position in ticker QQQ at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.