Friday the market woke up to great news.

Mission accomplished on inflation.

Yahoo Finance reported: “The Fed’s preferred inflation measure — a “core” Personal Consumption Expenditures index that excludes volatile food and energy prices — clocked in at 2.9% for the month of December, beating estimates.”

Furthermore, the core PCE inflation rate fell to 1.5% on a three-month annualized basis, its lowest since late 2020. On a six-month basis it was 1.9% for the second month in a row.

Both of those marks are below the Fed’s 2% target.

Except, the PCE does not include food and energy.

Another headline that hit the news Friday: “Yemeni Houthis hit with a missile a tanker operated on behalf of commodity trading giant Trafigura. The tanker is on fire.”

Oil traded over $78 a barrel. The price cleared the 200-daily moving average and confirmed an accumulation phase. Should oil remain above $78, the next level to watch is $80. Over $80, an emotional trip to $100 is not out of the question.

More importantly, that could trigger a bigger move in gold and silver.

Of course, the Fed cannot dot plot war and geopolitical stress- but shouldn’t they?

Remember this?

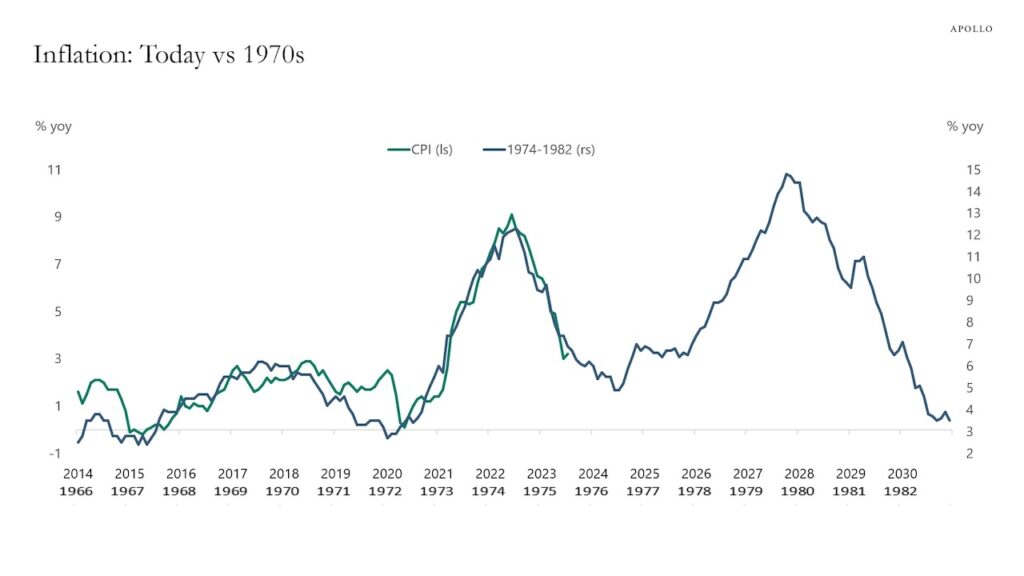

If you do not, this is the chart from Apollo that overlays CPI from the 1970’s with CPI from 2014 until the end of 2023.

CPI fell to under 2% in 1976-1977, then turned right back around and screamed. Oil had a lot to do with that. Here we are. CPI is not quite at 2% but core PCE is.

Should oil continue its run and become more parabolic in nature, then this chart is eerily prescient.

Super cycle of commodities?

Not all commodities have to run in a super cycle like the one that began in 1977 until the peak in 1980. But if oil and metals take charge, along with certain food commodities, then the FED will be stuck.

As for the market that has been counting on rate cuts to keep the equities moving higher? That will present a newer and bigger worry.

Stagflation.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.